The incident involving SCB Bank and Vạn Thịnh Phát Group at the end of 2022 has continued to pose challenges to the corporate bond market in the first three months of 2023. However, after the government issued Decree No. 08 in March 2023, the market has shown signs of recovery and regained investor confidence.

Mr. Hồ Đức Phớc, Minister of Finance. Photo: Ngọc Thành |

Sharing with the press earlier this week, Minister of Finance Hồ Đức Phớc stated that corporate bonds are still a good source of capital mobilization and have a lot of potential for development.

The minister revealed that, according to the strategy, individual corporate bond issuance will account for about 25% of GDP. Currently, the outstanding debt of corporate bonds is only about 1,000 trillion VND, equivalent to 10% of GDP, mainly issued by commercial banks. “This is a low level,” Phớc commented.

Phớc stated that there is still about 15-16% of GDP, equivalent to about 1,500-1,600 trillion VND, of potential capital that can be mobilized through individual corporate bonds. This capital source will address capital difficulties and help develop businesses.

In agreement with the view that bonds are still an important capital-raising channel, Nguyễn Tùng Anh, Research Director of FiinRatings Joint Stock Company, said that in recent years, if it was not for the issuance of bonds, many businesses and the banking system would have faced heavy burdens and capital pressure.

Transaction at a bank branch in Hanoi, April 2020. Photo: Giang Huy |

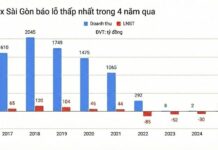

Anh cited data showing that before the decline, the corporate bond market experienced strong growth from 2018 to 2021, with an average annual growth rate of about 45%. At its peak in mid-2022, the total outstanding debt of corporate bonds reached nearly 1,500 trillion VND, equivalent to about 14% of GDP in 2021 and 12% of the total credit debt of the entire banking system.

According to a report by the Ministry of Finance, in 2023, thanks to the regulation to postpone the credit rating of enterprises under Decree No. 08, 78 companies successfully issued individual corporate bonds, raising about 237.4 trillion VND. Of this, about 236.5 trillion VND of bonds were issued after the effective date of Decree No. 08.

Some notable cases include Capitaland Tower Co., Ltd. issuing 4 tranches of bonds, raising about 12.24 trillion VND; Nam An Investment and Business Joint Stock Company raising 4.7 trillion VND; Hưng Yên Urban Development and Investment Co., Ltd. raising 7.2 trillion VND; Saigon Capital Joint Stock Company raising 3 trillion VND; Southern Star Urban Investment and Business Joint Stock Company raising nearly 4.7 trillion VND; and Tân Cảng Logistics and Real Estate Joint Stock Company raising 4 trillion VND…

In other sectors, Phương Đông Bank issued 2 tranches of corporate bonds, raising 1.8 trillion VND; Tien Phong Securities raised 1 trillion VND; Rồng Việt Securities raised nearly 1.5 trillion VND; and Vietjet raised 600 billion VND.

Although the issuance volume has increased and the market has become more active, analysts have also raised concerns about the ability to repay bonds at maturity. This year, the total volume of individual corporate bonds maturing is about 310 trillion VND. Real estate businesses and credit institutions have the largest maturity ratios, accounting for 34.9% and 29.7% respectively.

To address the cash flow for bond repayment, experts from FiinRatings believe that in normal conditions, businesses will seek new sources of capital through bond issuance, bank loans, stock issuance, etc. to refinance and maintain and develop their production and business activities.

However, they forecast that the capital calling ability of businesses in the coming time will be challenging due to the market needing time to adjust and restore confidence, especially for professional investors and mandatory credit ratings for some cases that have not yet been implemented. Additionally, credit funding for this target audience is limited due to prioritizing production and business activities and with a credit growth rate of about 14% to control inflation.

The Minister also pointed out that raising capital through the stock market is difficult because the market is no longer vibrant, and selling assets to repay debts is not easy due to the sluggish real estate market and slow recovery. Therefore, there is a risk for some enterprises, especially in the real estate sector, of delayed bond repayment.

Although the volume of bonds maturing is high, the Minister of Finance believes that the current macroeconomic and credit contexts are more stable than during the SCB Bank incident. These are favorable conditions for businesses to stabilize their production and business activities, have cash flows to pay principal and interest to investors.

He stated that for each industry and sector with its own operational characteristics, the recovery and development levels will vary. For the real estate sector, the market has shown signs of recovery, with legal obstacles being gradually resolved, creating conditions for businesses to complete projects promptly and have adequate funds to fulfill their obligations to investors.

However, to avoid risks, the head of the finance industry said that businesses issuing bonds must borrow and repay on time to the public. He urged companies issuing bonds to use the funds raised for their intended purposes, and not to use these funds to repay other debts, which would result in the failure to repay debts, eroding the trust of the public and investors and affecting the corporate bond market.

In addition, the Ministry of Finance will establish a separate bond market, strengthen inspections and examinations, both facilitating businesses to raise capital and establishing order and regulations to make the financial market transparent.

Phương Dung