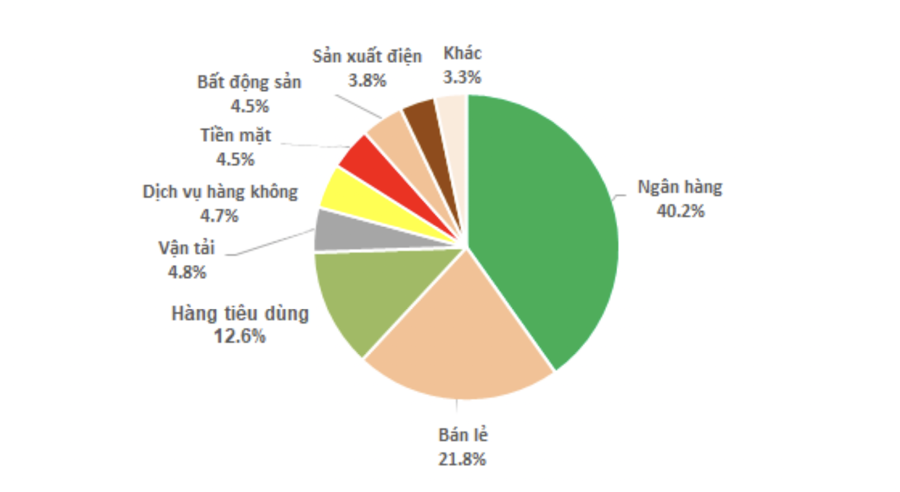

The Ballad Vietnam Growth Stock Fund of SGI Capital continued to reduce its cash position to its lowest level in January. Currently, the fund’s cash position is only 4.5%, compared to 7.5% in December 2023.

Meanwhile, the banking sector accounts for 40.2% of the portfolio structure, with stocks such as ACB, MBB, CTG, TPB, VIB. The retail sector accounts for 21.8%, with MWG being the largest holding, followed by PNJ; The consumer goods sector accounts for 12.6%, with VNM, TLG, FMC, and the remaining sectors include transportation, real estate, power production…

Prior to that, the fund’s performance in January recorded a return of 4.84%. Since its inception at the end of 2021, the fund’s performance has been negative at 15.94%.

Looking ahead to the Vietnamese stock market in the coming month, according to SGI Capital, the macroeconomic factors in early 2024 continue to follow the major trends of declining interest rates and stable exchange rates. The interest rate levels for deposits and borrowing have reached lower levels than the bottom of the Covid 2021 period, with Vietnamese deposit interest rates lowering rapidly and reaching a historically low level. This will definitely stimulate a large amount of matured money to look for investment opportunities in various asset classes.

The rapid decline in borrowing costs also reactivates the demand for loans for production, business activities, and consumption. The general message from global banks to customers this year is “Do not hold cash,” which is also applicable to Vietnam.

After cautious periods at the end of last year, the Vietnamese stock market in 2024 has shown signs of recovery, led by the banking sector. The fourth-quarter financial reports have shown that the banking industry is gradually overcoming its most difficult period with the bottoming out of the net interest margin, peak bad debts, and the establishment of provisions, as evidenced by state-owned banks and healthy commercial banks like ACB.

At historically low valuations at the end of 2023, it’s not difficult for stocks in this sector to be revalued for a more positive outlook in 2024.

Despite the favorable overall background for the stock market with low interest rates and rebounding growth in many industries due to the low comparison base of 2023, the valuations of many stocks have approached or even exceeded the long-term average valuations. The VN-Index itself, when surpassing 1,200 points, has returned to the vicinity of the historical average valuations with a P/E ratio of 14.x and a P/B ratio of 1.9 times. This level of valuation reflects the expectation of the recovery of growth in many stocks. The investment efficiency will only come true when these expectations become a reality.

Conversely, as valuations increase, overly optimistic and distorted expectations will become traps for investors this year. Therefore, the Vietnamese stock market in 2024 will be a highly differentiated environment.

For global stock markets, the theme throughout 2024 will still be the reduction of interest rates to support the economy. The timing and extent of the rate cuts will depend on the balance between inflation and unemployment. After a tight period of nearly 2 years, there is still considerable room for the Fed to loosen monetary policy as inflation has significantly decreased below the benchmark interest rate. Data from the past 60 years shows that Fed rate cuts have a very positive impact on the stock market in a soft landing scenario. Conversely, stock prices will decrease when profits decrease in the event of a recession and a bursting crisis.

Recent economic data is showing the feasibility of a soft landing for the US economy. SGI Capital continues to closely monitor leading indicators to try to foresee the possibility of a recession. Unemployment (currently at 3.7%) will be a very important signal if it increases to exceed 4.2%. In the current context, this is unlikely to happen in the first half of 2024, and if the Fed starts cutting interest rates in Q2, it will create a positive environment for the stock market.

However, other major economies worldwide, such as the EU and especially China, do not have such positive prospects. The real estate crisis along with the declining population growth rate is causing the Chinese economy to decline, similar to what happened in Japan in the lost decade of the 199x200x.

The collapse of major private enterprises in China such as Evergrande and Country Garden is a lesson to be noted for Vietnamese corporations in terms of debt management and accurate market assessment. What is happening in the Chinese real estate market could be repeated in Vietnam in the next 10-15 years as the population growth cycle ends.

In the near future, the continued decline in demand and excess supply from China will intensify export competition, putting pressure on price reductions and narrowing profit margins for companies in the construction material industry. On the other hand, ongoing construction and infrastructure projects will have low and stable input costs.