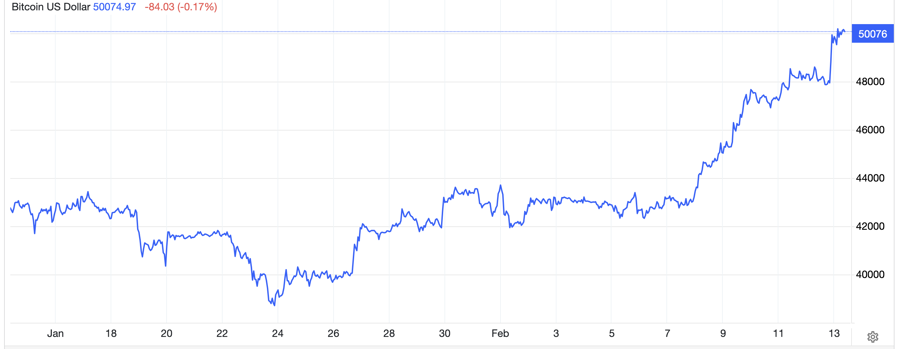

Bitcoin price surged above the $50,000 mark in Monday’s trading session, reaching its highest level in over 2 years. The inflow trend of bitcoin spot exchange-traded funds (ETFs) is one of the driving forces behind the surge of the world’s largest cryptocurrency.

According to data from Coinmarketcap.com, the price of bitcoin stood at $50,134 at around 9am this morning (February 13) Vietnam time, up 3.3% from 24 hours ago and up nearly 18% in a week. In the early week session, the price of bitcoin reached $50,334, the highest level since December 2021.

The price of the second-largest cryptocurrency in the world, ether, also saw a strong increase, reaching $2,679 at around 9am today, up 6.4% from 24 hours ago and up more than 16% in a week.

“$50,000 is an important milestone for bitcoin, as the launch of bitcoin spot ETFs last month failed to push the price above this mark, leading to a sell-off and skepticism about the new investment product,” said Antoni Trenchev, co-founder of the cryptocurrency service company Nexo, to CNBC.

Optimism has returned to the cryptocurrency market after a large capital outflow from investors from the Grayscale Bitcoin ETF fund led to pessimism over the past month. Recently, not only has the withdrawal activity decreased, but also the inflow of capital into bitcoin spot ETFs has increased.

In addition, the price of bitcoin has benefited from an increase in risk appetite amid the US stock market maintaining an upward trend. After the S&P 500 index surpassed 5,000 points for the first time in history last week, both the S&P 500 and the Dow Jones index set new records in Monday’s trading session.

“A number of factors are influencing market dynamics, including China pursuing loose monetary policies. This has led to an increase in the demand for assets, including bitcoin,” said James Butterfill, research head at the cryptocurrency management company CoinShares, to CNBC.

“Investor demand for bitcoin spot ETFs is still strong, with $1.1 billion of net inflow into these funds in the past week and $2.8 billion since their inception. In the Friday session alone, the ETFs bought 12,000 bitcoins, far exceeding the daily bitcoin mining output of about 900 bitcoins,” Butterfill added.

Investors consider the $48,600/oz level as a key resistance level for bitcoin. If this level is maintained, the price of bitcoin could break above the $50,000 mark and even set a new all-time high – according to technical analysts.

The record price of bitcoin was set on November 10, 2021, at nearly $69,000. This year, the price of bitcoin has increased more than 16%.

The US Securities and Exchange Commission (SEC) approved the establishment of the first bitcoin spot ETFs in the country on January 10 – a move seen as a milestone for bitcoin in particular and the cryptocurrency industry in general after 10 years of efforts to achieve this investment product.

Analysts at Bernstein predict that bitcoin spot ETFs will attract more than $10 billion in capital this year. Standard Chartered Bank predicts net inflows of $50-100 billion into these funds alone in 2024. Other forecasts range from $55 billion in 5 years.

In addition to the appeal of bitcoin spot ETFs, another driver of the bitcoin price increase comes from the upcoming halving event scheduled for April. This event occurs every 4 years to halve the rewards for bitcoin miners, thereby limiting the supply of this cryptocurrency to a maximum of 21 million. To date, 19 million bitcoins have been mined. The price of bitcoin has increased in all 3 previous halving periods, with the most recent one occurring in 2020.