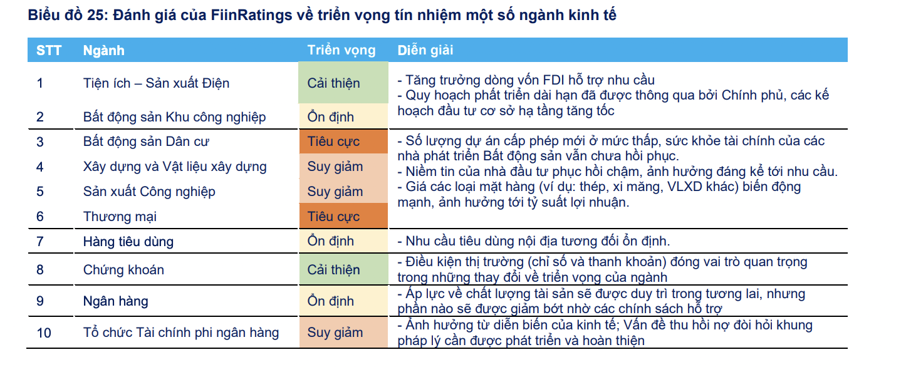

FiinRatings recently released credit ratings and prospects by industry for 2024. In this ranking system, residential real estate is assessed with a negative outlook; Construction and Building Materials are rated as declining, and Non-bank financial institutions are also rated as declining.

On the other hand, Industrial real estate and banking are rated as stable, while securities are rated as improving.

NEGATIVE OUTLOOK FOR RESIDENTIAL REAL ESTATE

For the residential real estate industry, in 2023, changes in the legal framework have not been approved, and inspections and investigations are still major obstacles to market recovery. According to statistics from the Ministry of Construction, the number of newly licensed commercial housing projects in 2023 is very limited, but the number of ongoing projects is at a record high.

This reflects the general market apprehension, with a decrease in transactions in both finished housing and land, as well as a suspension of ongoing projects.

Most developers are currently facing pressure to mobilize capital for project implementation on accumulated land plots from before the pandemic. At the same time, finding options to refinance old debts will increase risks related to capital structure and liquidity condition.

For the outlook in 2024, FiinRatings assesses that residential real estate developers will continue to face pressures in terms of liquidity, access to capital, and interest rate risks, as well as economic recession affecting the demand and ability to pay of the population.

Overall, with a large amount of real estate bonds due (estimated at around 120 trillion VND – the highest level in the past 5 years), FiinRatings assesses that the risk of recapitalization remains high for residential real estate developers.

However, there will be a strong differentiation in the ability to maintain business operations among businesses in the industry in the face of prolonged market difficulties from 2022 to now. Companies with good brand reputation, quality assured projects with diverse product lines, and clean land reserves accumulated through many years of operations, along with expected project deployment and execution capabilities, are expected to have access to diverse capital mobilization channels and better resilience against adverse market developments.

For the Industrial real estate industry, the industrial land supply in Vietnam is expected to increase by an additional 44,760 hectares in the period of 2022-2025 to meet the increasing demand for industrial land leasing in Vietnam, particularly expanding new supply sources in the Red River Delta, North Central Coast, and South Central Coast.

The slower approval of industrial real estate policies in Vietnam is a timing issue when many cities have planned to expand new land funds for industrial parks.

FiinRatings believes that the prospects for the Industrial real estate industry in Vietnam will still be maintained at a stable level through the following factors: high demand due to the expansion of both FDI companies and domestic companies’ production; the encouraged new supply by the Government to meet the increasing demand; promoting investment in infrastructure.

The expected wave of shifting and diversifying production chains from China will continue to stimulate investment demand from foreign enterprises, thereby further improving the efficiency of the industry’s operation.

BANKING AND SECURITIES STABLE

For the banking industry, in 2023, besides difficulties in disbursing loans, the profits of some banks are also affected by incidents related to insurance business or underwriting advice.

The decrease in profits also makes banks face difficulties in balancing between profit and risk management of the asset quality portfolio. In 2024, although asset quality pressure still exists, FiinRatings assesses that the earnings potential of banks will have certain improvements due to the expected economic recovery, along with credit solutions and policies implemented by the Government and the State Bank to achieve the goal of promoting economic growth, somewhat removing difficulties in credit growth.

In addition, a trend in 2024 of the banking industry that FiinRatings believes may affect credit growth and the creditworthiness of banks is the promotion of tier 2 capital mobilization to supplement capital sources, support growth. With the current capital adequacy ratio of domestic banks lower than banks in the same region, FiinRatings expects this trend to help banks improve capital buffers and maintain relatively stable capital sources with appropriate costs, thereby reinforcing the creditworthiness of banks.

For the securities industry, in the context of relatively low-interest rates and market expectations for economic recovery in 2024, increasing margin lending activities may have positive impacts on market liquidity, which will help securities companies strengthen their revenue and profit margins.

In terms of the profitability of securities companies, the expectation is that 2024 will be a year of significant differentiation due to the differences in business models, as reflected in the revenue structure of securities companies, but fundamentally it will be relatively positive, with the main driving force being proprietary trading activities and margin lending activities.

However, the monitoring factor for the securities industry will still be activities related to margin lending and with the corporate bond market; this will significantly impact the liquidity position of securities companies.