Below are the most notable events in the world during the week of 12-16/2:

1/ US inflation data – the focus of attention this week

For traders trying to determine when the US will cut interest rates for the first time after a long period of tightening, the task is not easy as the US economy continues to perform well and this could revive inflation, which is very worrying.

The number of jobs in January reached a high level, which is a sign that the US economy is growing faster than expected. This sudden strength has made the Federal Reserve increase caution and forced them to “pour cold water” on those who expect interest rates to be cut in March, while pushing the USD and bond yields sharply.

Therefore, all attention in the market is now focused on the US inflation data for January, which will be released on Tuesday (13/2). Any signs of returning price pressure could discourage the market from betting on an early interest rate cut.

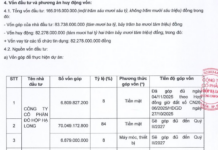

Reuters survey results showed that economists estimated US consumer prices in January 2024 increased by 0.2% compared to the previous month, after increasing by 0.3% in December 2023.

US CPI for January is expected to decrease slightly

2/ USD stronger against all other G10 currencies

The US economy is very special so their currency – the USD – is also special.

As 2023 ended, market watchers were sure that the US currency would go in a negative direction in 2024 as traders expected the Fed to cut interest rates up to 6 times this year.

But now, the USD is at its highest level in 3 months, supported by booming employment growth, a strong services sector, cooled-off inflation, bottomed-out lending conditions, and a booming stock market, with only 4 markets being fully priced.

The strengthening of the USD is making the currencies of its competitive rivals, places where central banks are struggling to tame inflation and slow down growth, fall into difficulties.

No other currency in the G10 group has risen against the USD this year. However, investors are still not holding a net long position on the USD. This shows that if the gap between the US economy and the rest of the world continues to widen, the greenback may receive “a breath of fresh air” in the coming time.

USD is the only currency in the G10 group that has increased

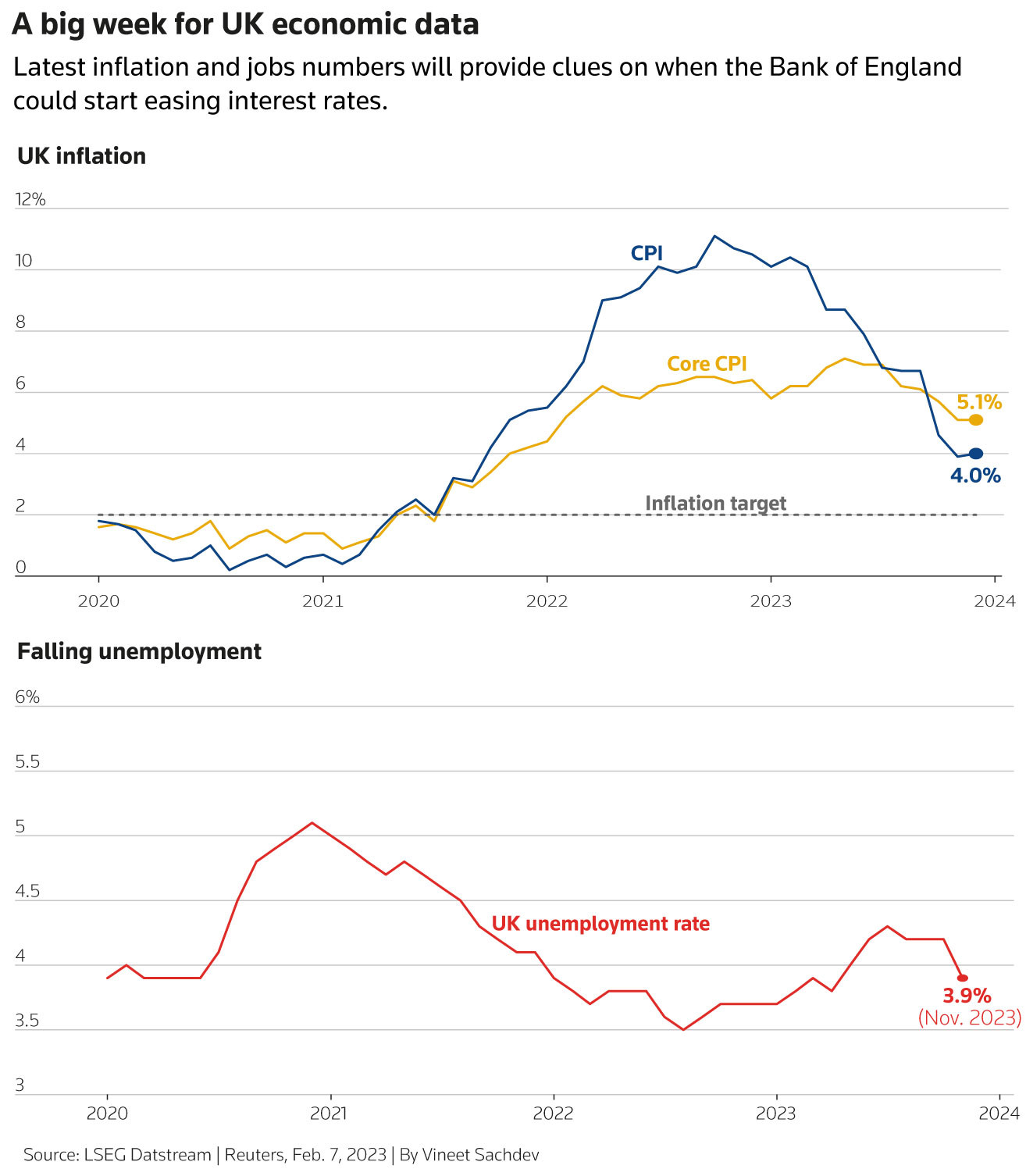

3/ Uncertainty about the timing of the UK interest rate cut

The Bank of England (BoE) has not been able to set a date for changing its high interest rate policy. The upcoming release of the UK employment data may push the country further behind the Fed and the European Central Bank (ECB) – places that are sending more accommodating signals.

Recent revisions to labor market data from November to the present have shown that the unemployment rate in the UK is lower than previously estimated. According to researchers at Pantheon Macro Economics, this means that the unemployment figure to be announced on Tuesday (13/2) may be lower than the BoE’s estimated 4.3%.

UK inflation data, which will be released on February 14, may complicate the prospects for monetary policy. The BoE believes that inflation will return to its 2% target this year but warns that inflation could rise again in the third quarter.

Market participants are now pushing back their forecast for the time BoE will cut interest rates for the first time to June instead of May. Pantheon predicts that the UK’s interest rate will be 4.5% in December 2024, from the current 5.25%, but warns of “increasing uncertainty about the timing of the first interest rate cut.”

UK inflation and unemployment rates.

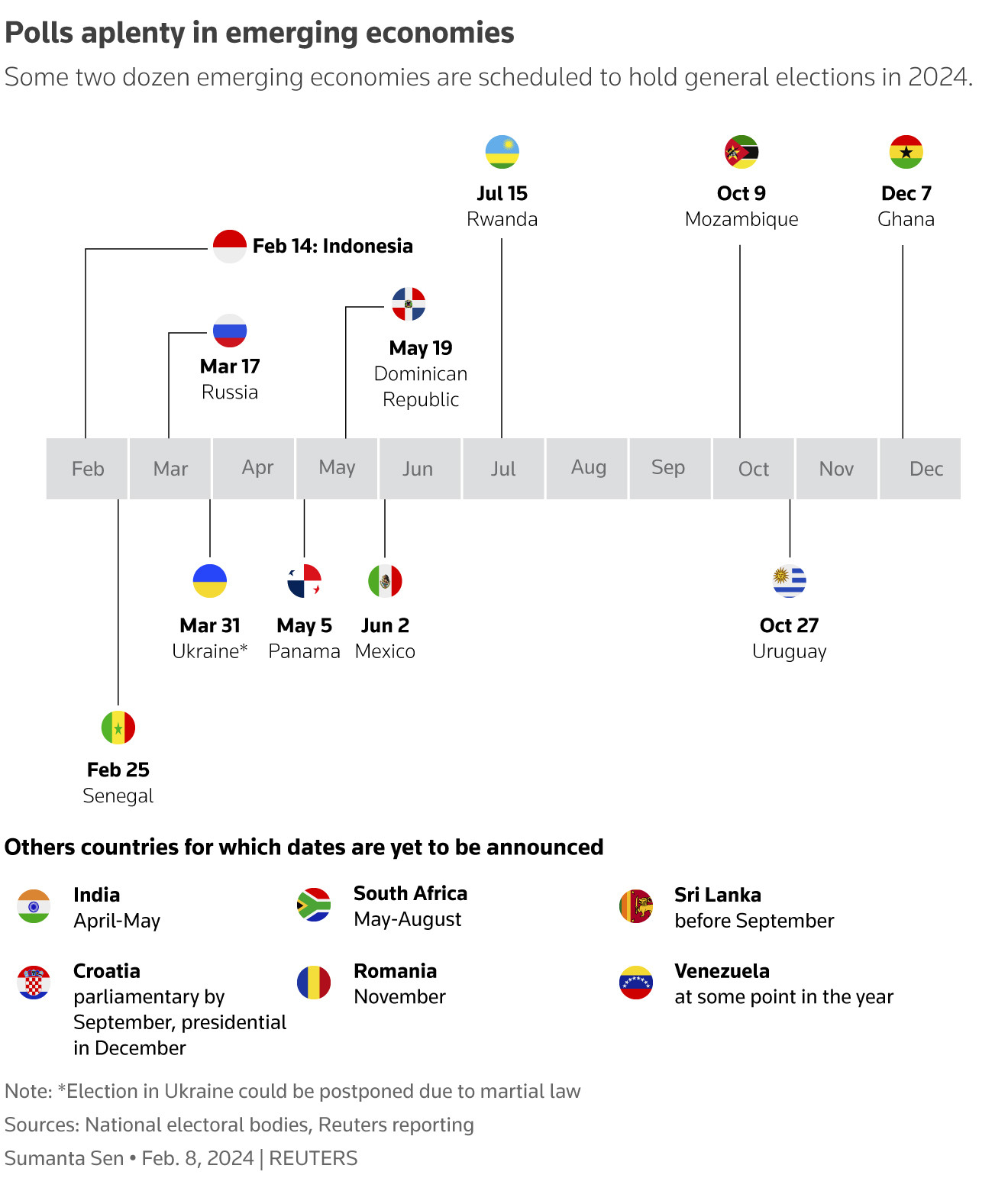

4/ Indonesia’s election

Indonesian citizens will cast their votes on Wednesday (14/2) to elect the next leader of the third-largest democratic country in the world as President Joko Widodo is ready to step down after a decade in office.

Three candidates are in the race to succeed Jokowi, a well-known President, and polls show that Defense Minister Prabowo Subianto is the most viable candidate.

Reuters reported that according to a survey by the Indonesian Survey Institute (LSI), Mr. Prabowo is expected to win 51.9% of the votes, followed by former Jakarta Governor Anies Baswedan with 23.3% support and 20.3% for Mr. Ganjar Pranowo, former leader of Central Java province, while 4.4% of respondents are undecided.

Jokowi, not allowed to run for re-election after two terms, has left a legacy of policies that have helped the $1 trillion economy in the G20 group, from large-scale infrastructure projects to social welfare programs.

However, not everything is going smoothly, with changes in regulations allowing Jokowi’s son to run against Prabowo.

The Indonesian market, which has already been resilient to global interest rate hikes, is being disrupted. The rupiah has lost nearly 2% of its value this year.

Election schedule in some countries in 2024.

5/ Russia with monetary policy meeting

It may be time for the Russian central bank to take a break at the meeting on February 16. Policy makers in this country have raised interest rates by an additional 850 basis points since July 2023 to the current 16% to address inflation caused by labor shortages, a weak ruble, and high budget spending.

With President Vladimir Putin seeking reelection in March, just over two years after the Russia-Ukraine conflict led to sanctions and cut Russia off from the global financial structure, the central bank is faced with the difficult task of reducing inflation without further increasing borrowing costs for consumers and businesses.

This also contradicts the Kremlin’s goal of expanding capital controls – which has supported the ruble since October.

Russia’s interest rate reaches double digits

Reference: Reuters