Illustrative image

In its latest macro report, Dragon Securities (VDSC) stated that in January 2024, the USD/VND exchange rate fluctuated sharply but within the allowed range. On January 25, 2024, the Vietnamese dong depreciated by 1.4% compared to the beginning of the year and then cooled down, only increasing by 0.6% compared to the beginning of the year for the official exchange rate and 0.1% for the free market exchange rate.

VDSC believes that the main reason for the depreciation of the Vietnamese dong in the first month of the year is the recovery of the USD, arising from investors reducing their expectations of a Fed interest rate cut. According to FedWatch, the probability of an interest rate cut in the March 2024 meeting of the Fed decreased from 70% at the beginning of the year to 34.5% after the Fed’s announcement in the January 31, 2024 meeting. Meanwhile, the market’s expectation of a cut throughout 2024 remains at 150 basis points with a probability of 42.8%. Accordingly, the DXY index recovered to 103 in January 2024, an increase of 1.7% compared to the beginning of the year.

Furthermore, the positive spread of the USD-VND interest rate still remained high in the first month of the year (~4.85 percentage points), which also put pressure on the movement of the Vietnamese dong.

However, compared to other currencies, the Vietnamese dong is one of the currencies that depreciated the least against the USD in January 2024. In the context of the People’s Bank of China continuing to implement additional monetary easing measures to support growth, the unfavorable economic situation in the first month of the year caused the Chinese yuan to depreciate by about 1.1%. Meanwhile, the Japanese yen depreciated the most (~3.8%) as investors continue to wait for signals of a change in Japan’s negative interest rate policy. Other ASEAN currencies (except for Vietnam) depreciated by 1-3% in January 2024.

“Placed in the context of the economic prospects and monetary policies of various countries, the USD has a clear advantage in the early months of 2024,” VDSC evaluates.

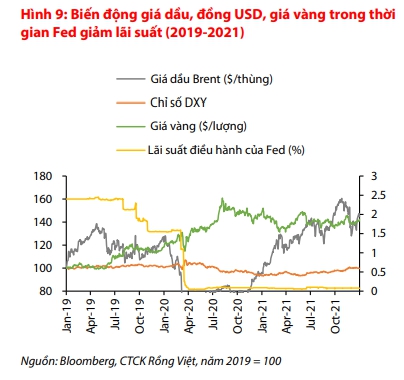

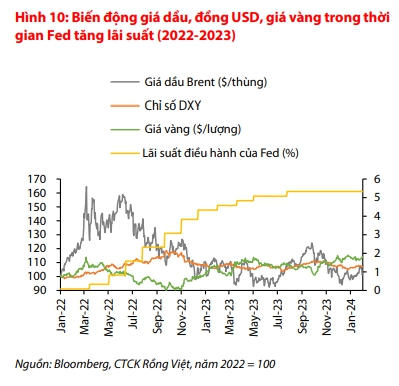

According to VDSC, although the economic situation in 2024 is different, a comparison of the fluctuations in oil prices, USD, and gold prices during the period of Fed easing (2019-2021) and monetary policy tightening (2022-2023) yields some implications.

First, during the period when the Fed tightened monetary policy, the USD fluctuated significantly and remained strong for a period of time as interest rates were high.

Second, during the period of Fed interest rate cuts, the first cuts did not create much change in the trend of the USD, and the decline of the USD only occurred afterward when the rate cut cycle reached its conclusion.

Third, the fluctuations in oil prices and gold prices during the period of Fed easing and tightening policies are quite interesting. Specifically, crude oil experienced significant fluctuations but the overall trend was an increase during the period of Fed easing and a decrease during the period of Fed tightening. Meanwhile, gold prices increased in both periods.

VDSC believes that looking back at history can help predict part of the exchange rate fluctuations in the near future, and the high peg of the USD during the early period of monetary easing may put pressure on the USD/VND exchange rate, and this trend may last at least in the first half of the year 2024.