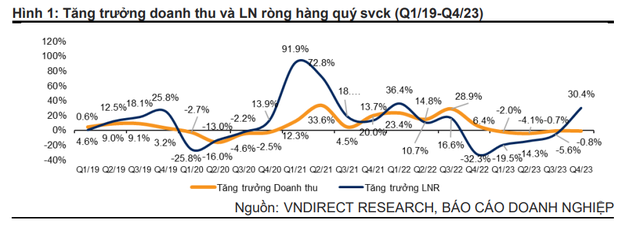

According to a recent report by VNDirect Securities, as of February 5, 1,128 listed companies and trading companies on HSX, HNX and UPCoM have announced their financial reports. Accordingly, net profit increased by more than 30% compared to the same period, thanks to the strong business performance and the low base effect of the previous year.

In the fourth quarter of 2023, steel and banking were the leading sectors contributing to growth. Steel companies continue to have a positive business season as many companies have achieved positive results in the fourth quarter, while the same period last year recorded losses. Net profit of the Steel sector increased by 26.7% compared to the third quarter. This improvement comes from higher gross profit margins due to lower input costs, better inventory management, and improved consumption.

Net profit of the banking group in the last three months of the year increased by 22.5% compared to the same period, thanks to the acceleration of credit, strong growth in non-interest income (fee income, foreign exchange operations), and a 5% reduction in provisioning costs.

Notably, the real estate sector was not as negative as many predicted. The net profit in the fourth quarter of 2023 of this sector decreased by nearly 20% compared to the same period and more than 24% compared to the third quarter of 2023. However, according to VNDirect, the actual figures seem to be better than the statistics.

The decline mainly came from the revenue and profit of Vinhomes (VHM), which decreased by 72% and nearly 91% respectively compared to the same period, due to the high base effect of the previous year. The net profit of the industry leader in 2023 still grew by about 15%. If Vinhomes is excluded from the statistics, the net profit of the real estate industry of listed companies increased by nearly 132% compared to the same period.

Electricity and retail still face negative pressures. The profit of the electricity industry decreased by nearly 33% due to low output from hydropower plants due to the El Nino phenomenon, while coal-fired power plants did not achieve high efficiency due to incidents in many units. Retail companies also recorded a sharp decline due to fierce price competition among large companies. However, thanks to signs of recovery in demand, the profit of this sector increased by nearly 43% compared to the third quarter of 2023.

In addition, the cooling of loan interest costs is also a point worth noting in the fourth quarter of 2022. According to VNDirect, thanks to the policy interest rate cuts by the State Bank of Vietnam since March and continuous adjustments of deposit interest rates by commercial banks to lower levels than the pre-Covid-19 period, the loan interest costs gradually decreased when they turned around by 0.6 percentage points compared to the previous quarter to 6.2%. This brokerage firm continues to expect that loan interest costs will decrease in the coming quarters and boost the profits of the entire market.

Regarding the VN30 group

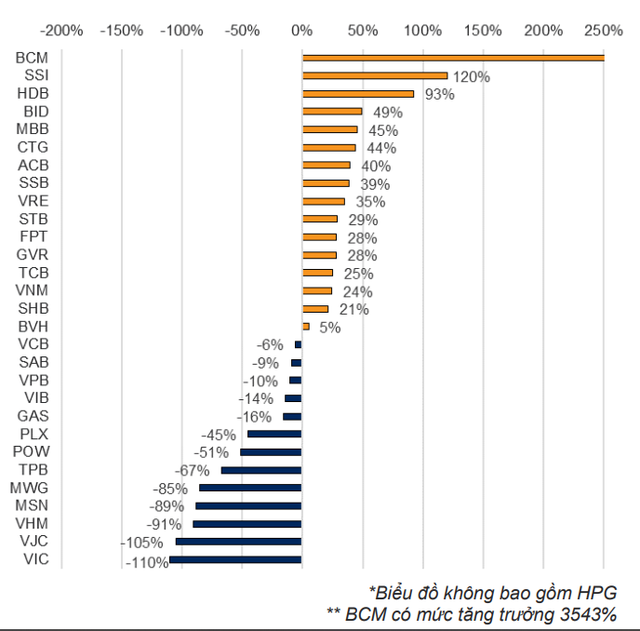

The net profit of VN30 in the fourth quarter of 2023 increased by 11.6% compared to the same period and 3.0% compared to the previous quarter. There are 17 companies that recorded net profit growth, leading by Becamex IDC (increase of 3,542%), SSI (increase of 120% YoY), HDBank (increase of 93%) and Hoa Phat (achieving a net profit of 2,972 billion VND compared to a loss of 1,991 billion VND in the same period).

On the contrary, the net profit of Masan Group (MSN) and Mobile World (MWG) in the fourth quarter of 2023 decreased by 89% and 85% respectively due to the overall prospects of the Retail industry not being able to return to the previous level and the strategy of reforming new business operations being in the early stages. However, compared to the third quarter of 2023, the net profit of MWG grew by 133%, indicating signs of gradual recovery in consumer demand.

Notably, the net profit of Vingroup and Vinhomes decreased by 110% and 91% YoY respectively due to the low profit margin of Ocean Park 2 and 3 projects under the BCC contract compared to wholesale and retail sales. In addition, these companies also adjusted costs once when settling the projects.