Savings Account: Low interest but safe

In 2023, after four adjustments to the central bank’s policy interest rate, banks entered a race to lower deposit interest rates. The 12-month term deposit rate dropped from an initial range of 10-12.5% at the beginning of the year to 5% at the end of the year.

The state-owned banks in the Big4 group set record low interest rates. Currently, Vietcombank’s 1-month deposit rate is only 1.7% per year, the lowest ever. Meanwhile, the average 12-month deposit rate across the entire banking system is currently 5% per year.

Despite the declining savings interest rates, people still deposit money in banks.

In the context of historically low deposit interest rates, KBSV Securities predicts that the deposit interest rate landscape will continue to range from 4.85% to 5.35% throughout most of 2024.

The key factors impacting the deposit interest rate environment are likely to experience a recovery in credit demand, although there may not be any drastic changes. The difficulties lingering from 2023 have yet to be fully resolved in the following year. Vietnam’s economy is predicted to grow by around 6%, with the real estate sector, which has a high contribution to credit growth, still unable to recover strongly.

According to the central bank, by the end of November 2023, deposits in the banking system reached a record high, despite the low interest rates. In October and November 2023 alone, individuals deposited an additional VND 21,847 billion (approximately $950 million) into the banking system. Financial experts believe that the savings channel will remain attractive in 2024.

Gold: Definite Profit!

In 2023, investors who held gold bars or gold rings earned returns of over 12% per year. SJC gold bars briefly reached VND 80 million ($3,500) per tael at the end of 2023 and are currently around VND 78 million ($3,400) per tael. Gold rings increased strongly from VND 55 million ($2,400) per tael at the beginning of the year to VND 65 million ($2,800) per tael.

Gold is forecasted to continue setting records in 2024.

Huynh Trung Khanh, an expert from the World Gold Council, said that gold has been attractive in the past two years, but over the past decade, the average increase for SJC gold has been only 4%, lower than the interest rate for savings deposits.

Previously, in the late months of 2023, SJC gold prices fluctuated wildly, reaching over VND 80 million ($3,500) per tael before quickly dropping to around VND 77-78 million ($3,300) per tael.

“Gold may be supported at good price levels in 2024, but in 2025, when the economy grows, gold may decrease or move sideways,” Khanh said.

Real Estate: Slow Recovery

The real estate landscape in 2023 ended with a sluggish performance in all segments, despite the government and ministries taking many measures to ease market difficulties. Many investment and speculative segments saw drastic price declines of 40-50%, while stable or high prices were observed in segments serving actual housing needs, such as apartments and detached houses.

Apartment segment continues to surge in 2024.

Assessing the real estate prospects in 2024, according to Market Analysis reports from MB Securities JSC (MBS), real estate will perform better this year due to factors such as interest rate stabilization and the land law (amendment) being passed. However, real estate companies still face issues such as stalled projects and difficulties in accessing bank capital.

According to Nguyen Van Dinh, Chairman of the Vietnam Real Estate Brokers Association, real estate can only recover in segments such as apartments, landed properties, or central areas. Speculative segments will recover more slowly, over a period of about one year.

Stocks: Ups and Downs

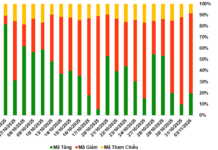

After a tumultuous year, the stock market closed 2023 with the VN-Index at around 1,130 points, up 12.2% compared to the beginning of the year. Some stocks performed exceptionally well, with increases of 35-78% from sectors such as steel, chemicals, and technology. In contrast, some stocks experienced sharp declines of around 80-90%, disappointing many investors.

However, given the low savings interest rates and reasonable market valuations, many experts have high expectations for the recovery of the stock market in 2024. MBS reports predict that the VN-Index will rise to the range of 1,250-1,280 points.

In line with this view, the analysis team at the Vietnam Joint Stock Commercial Bank for Industry and Trade (Vietcombank Securities – VCBS) forecasts that the VN-Index may reach its peak at around 1,300 points in 2024. However, the VN-Index may experience sharp declines interspersed with surges in point increase sessions. The securities company assesses that the continued low interest rates will remain the key supporting factor for market valuations in 2024.

Bonds : Many Opportunities

As of February 5, 2024, the corporate bond market recorded 4 issuances with a total value of VND 6,450 billion ($280 million) from 4 companies, according to the latest report from FiinRatings.

In forecasting the market prospect for 2024, although it is difficult to project the expected total value for the whole year, FiinRatings believes that prospects for the corporate bond market will be more active in 2024 for the following reasons.

Firstly, banks are ramping up bond issuances to improve capital capacity. Although this industry group has yet to announce all of its plans, most banks will have plans to mobilize funds through corporate bond issuances this year in order to supplement debt capital to meet the credit growth target for 2024 (expected to be 15% for the entire system for the year) as well as in subsequent years.

Furthermore, the addition of bond capital for banks will also increase Tier 2 capital and contribute to meeting the State Bank of Vietnam’s requirements for capital adequacy and risk management, such as the requirement for the proportion of short-term capital utilization for medium- and long-term loans.

Secondly, a low interest rate environment and favorable conditions for long-term capital mobilization: In order to attract investors, most current bond issuances have floating interest rate mechanisms tied to the reference interest rates of major banks.

In addition, the domestic interest rate environment is forecasted to remain low as it is today, while international interest rates are expected to decrease in the coming years.

“This will be a major catalyst for sectors and businesses with long-term capital needs to consider issuing bonds in preparation for expanding production and business, especially as the macroeconomy has shown strong recovery in the past few months of 2023,” FiinRatings assesses.