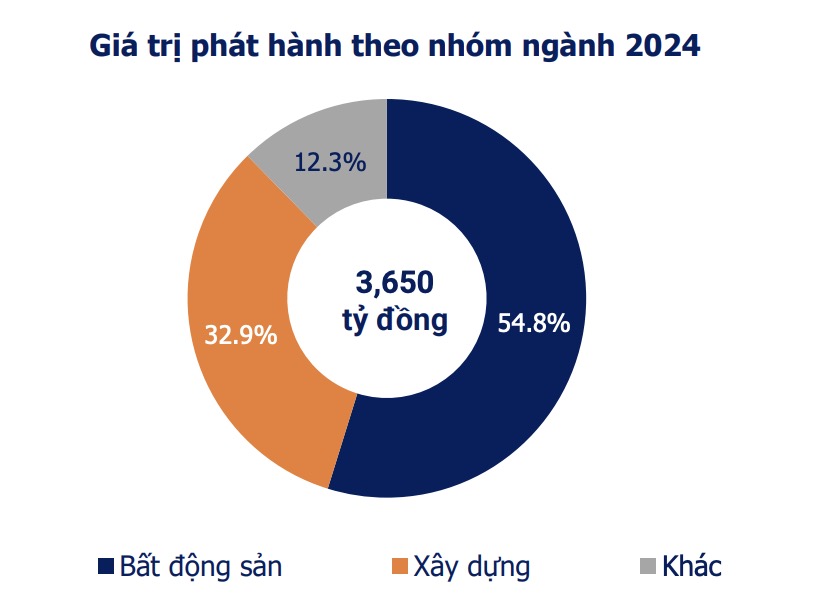

In comparison to previous months, the value of issuances has decreased significantly from an average of around 43 trillion VND, equivalent to a 91% decrease. The issuances had an average interest rate of 10.7% per year and an average term of 5.25 years.

Source: VBMA

|

Source: VBMA

|

In January, there was also a public bond issuance worth over 2.8 trillion VND by Infrastructure Investment Corporation – Ho Chi Minh City (HOSE: CII). The bond lot with the code CII42301 was issued in December 2023 (completed in January 2024), it is a convertible bond with a total offering quantity of over 28.4 million bonds, a 10-year term and a face value of 100,000 VND. The applicable interest rate is 10.5% per year for the first 4 periods, and floating interest rate for the subsequent periods.

The bonds of CII are convertible into common shares, without any collateral or warrants. The bonds can be converted into common shares every 12 months, at a conversion rate of 1:10, meaning each bond can be converted into 10 common shares.

In total, 22.8 million bonds (80.14% of the offering quantity) were purchased by 4,033 domestic individual investors; 70,734 bonds (0.25%) were purchased by 73 foreign individual investors; and finally, 5.3 million bonds (18.66%) were purchased by 24 foreign institutional investors. In total, over 28.1 million bonds were issued, equivalent to 99.05% of the total offering quantity.

CII netted more than 2.8 trillion VND after this offering. The raised funds, as stated in the resolution of May 2023, will be used to contribute capital or invest in bonds of two companies, Ninh Thuan BOT Infrastructure Co., Ltd (1,200 billion VND) and Investment and Construction of Hanoi Highway Joint Stock Company (1,640 billion VND). However, due to some arising factors, CII is expected to propose adjustments to this purpose at the General Shareholders’ Meeting.

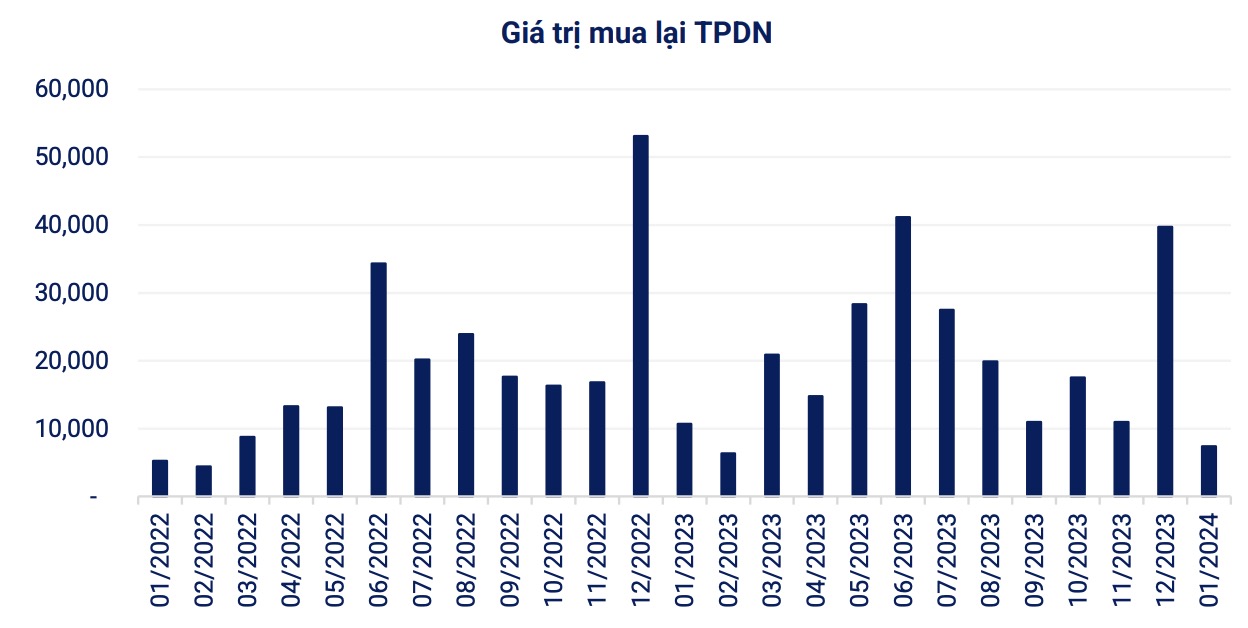

In terms of repurchases, nearly 7.4 trillion VND of corporate bonds were repurchased in January 2024, a 31.1% decrease compared to the same period. In 2024, there is an estimated total of over 279 trillion VND of bonds due, with the majority being in the real estate sector with nearly 116 trillion VND, accounting for 41.4%.

Source: VBMA

|

There were 7 issuers that delayed principal and interest payments in the month, with a total value of over 8.8 trillion VND (including interest and remaining outstanding balance of the bonds), and 5 bond codes had their interest and principal payment periods extended.

Upcoming, there will be 2 notable issuances. Firstly, from Thanh Thanh Cong – Bien Hoa Joint Stock Company (HOSE: SBT), where the Board of Directors has approved a bond issuance plan in the first quarter of 2024 with a maximum total value of 500 billion VND. This is a non-convertible bond without warrants, with collateral, and a face value of 100 million VND/bond (equivalent to a total issuance of 5,000 bonds).

The bond lot has a maximum term of 3 years, applies a fixed interest rate of 11% per year for the first 2 periods, and for the remaining periods, the interest rate is calculated based on the reference interest rate plus a margin of 3.85% per year.

Secondly, from Ban Viet Joint Stock Commercial Bank (UPCoM: BVB). The Board of Directors of BVB has approved a private bond issuance plan for 2024 with a maximum total value of 5,600 billion VND, divided into 6 issuances. This is a non-convertible bond without warrants, with collateral, a face value of 100,000 VND/bond, a maximum term of 8 years, and a fixed interest rate of 8% per year.