Banking stocks continued to lead the market in the opening trading session, pushing the VN-Index up 0.59% or +7.1 points to the level of 1,205.63 points. The total trading value on the two listed exchanges reached nearly 10 trillion VND, the highest in the past 6 sessions.

The market had a good start to the first trading day after the Lunar New Year holiday, which is a normal tradition. Although losing the boost of the largest pillar stock VCB, which decreased by 0.44%, the banking sector still performed well. Among the 27 banking stocks on the exchanges, only VCB was in the red, while the other 20 stocks increased by more than 1%, with 13 stocks increasing by more than 2%.

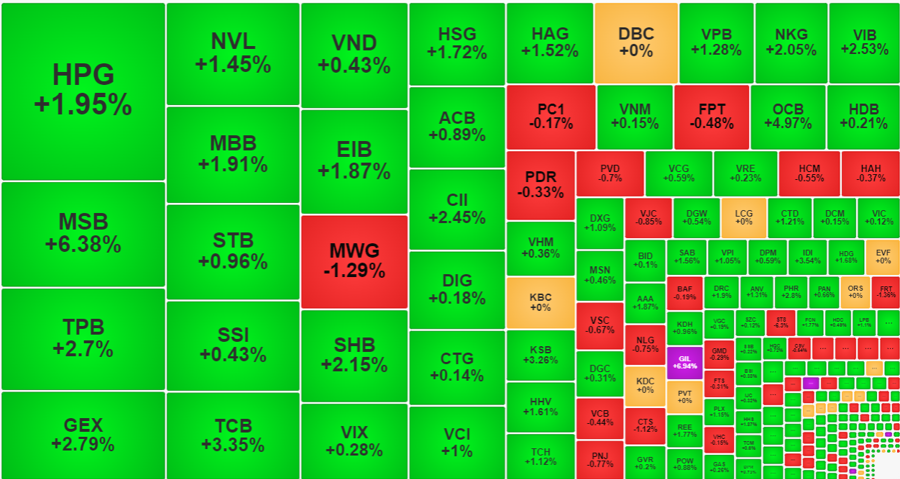

Leading in terms of increase amplitude are MSB, increasing by 6.38%, NVB increasing by 5.56%, VAB increasing by 5.26%, and OCB increasing by 4.97%. However, leading the group pushing up the VN-Index were TCB, increasing by 3.35%, MBB, increasing by 1.91%, and VPB, increasing by 1.28%. In the top 10 strongest stocks of this index, there are also MSB, OCB, VIB, TPB, and ACB. Therefore, banking stocks accounted for 8 out of 10 leading stocks.

The VN30-Index also gained 0.81% in the morning session, outperforming the main index thanks to the momentum of the banking sector. The blue-chip range had 26 stocks up and 4 stocks down. The only decrease, aside from VCB, was MWG down 1.29%, VJC down 0.85%, and FPT down 0.48%. The increases included 9 stocks with an increase of over 1%, and in terms of amplitude, there were also 4 banking stocks leading TCB, TPB, VIB, and SHB. Only HPG made it into the strong group with an increase of 1.95%.

The strength of blue-chips is an important driving force pushing the VN-Index to surpass the psychological level of 1,200 points, and the increase could have been even better if there was clearer synergy from the remaining pillar stocks. Apart from the decrease in VCB, BID’s increase was too weak at 0.1%, CTG increased by 0.14%, VHM increased by 0.36%, and GAS increased by 0.26%. These are the 5 largest-cap stocks in the current market.

Although not yet having comprehensive strength in the blue-chip group, the market overall had active and enthusiastic trading in the opening spring session. The dominance was completely on the increase side from the beginning of the session, and by the end of the morning session, the VN-Index recorded 329 gainers and 134 decliners. The number of stocks with an increase of over 1% reached 118, and the liquidity accounted for 53.5% of the total trading value on the HoSE. In contrast, the decreasing group had only 25 stocks, with more than 1% decrease, and accounted for only 3.5% of the exchange’s liquidity. Even this group had only MWG with high liquidity at 22.03 billion VND, CTG at 34.4 billion VND with a decrease of 1.12%, ST8 at 18.1 billion VND with a decrease of 6.3%, FRT at 22 billion VND with a decrease of 1.36%, and BMP at 11.4 billion VND with a decrease of 1.04%.

Funds are currently strongly focused on the financial sector, especially the banking stocks. The total trading value of banking stocks in the VN-Index accounts for about 32% of the total trading value on the HoSE. In the entire market, there are 13 stocks with trading value exceeding 200 billion VND this morning, including 7 banking stocks and 2 securities stocks, SSI and VND.

Today is the derivatives expiration date, but the market is still witnessing significant enthusiasm, not only in terms of price increase and breadth, but also in overall liquidity. The total trading value on the HoSE and HNX increased by over 51%, reaching nearly 10 trillion VND, compared to the previous session. Large liquidity accompanied by positive breadth is a clear indication of active buying pushing prices up. On the HoSE, out of the 31 stocks traded at 100 billion VND or more, only 4 stocks were in the red, MWG, PC1, FPT, and PDR.

The VN-Index is currently closing near the highest level in the session, with about 105 stocks declining by more than 1%, equivalent to about 30% of the stocks with trading activity this morning. The ability to maintain the high level of the index rests on the shoulders of blue-chips, and this group has also seen only a small price drop. Aside from the 4 stocks in the red, FPT, MWG, VCB, and VJC, the decrease amplitude of the remaining stocks is very small.