In 2023, many businesses continue to struggle due to the heavy burden of debt left behind by the Covid-19 pandemic. As businesses are still recovering, some choose to sell their assets in order to have money to repay their debts.

Hoang Anh Gia Lai sells assets to repay bond debt

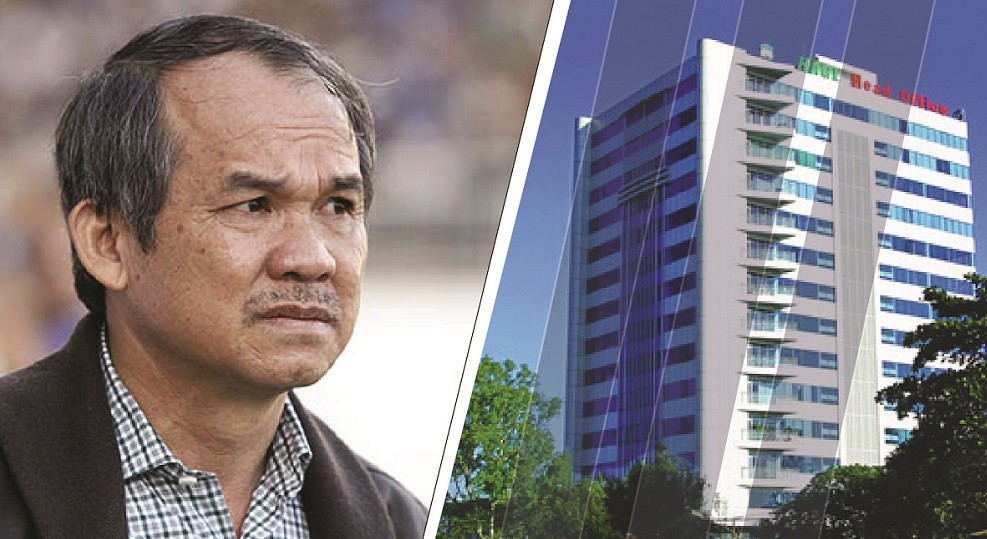

Last year, Hoang Anh Gia Lai Joint Stock Company (HAGL, code: HAG, HoSE) continuously liquidated assets to generate money for debt repayment. Specifically, in September 2023, HAGL sold Hoang Anh Gia Lai Hotel, earning 180 billion dong, to repay the bond debt series HAGLBOND16.26 issued in 2016 at the Vietnam Joint Stock Commercial Bank for Investment and Development (BIDV).

The buyer of Hoang Anh Gia Lai Hotel is Hoan Sinh Gia Lai Investment Limited Liability Company. HAGL Hotel has been operating since December 2005, with 117 rooms, being the first 4-star hotel in the Central Highlands region.

In December 2023, HAGL continued to transfer is entire capital contribution of 9.9 million shares (equivalent to 99% charter capital) to Hoang Anh Gia Lai University Hospital Joint Stock Company to repay the above-mentioned bond debt.

Hoang Anh Gia Lai University Hospital was established in 2011 in Pleiku city, Gia Lai province, with an initial investment of 250 billion dong. This is a multi-disciplinary hospital established based on the cooperation of the Ho Chi Minh City University Medical Center and HAGL Corporation.

Hoang Anh Gia Lai, owned by Mr. Duc, has continuously liquidated assets to repay debts over the past year.

In early 2024, HAGL announced its intention to transfer its entire ownership stake in BAPI Hoang Anh Gia Lai Joint Stock Company (BAPIHAGL). After completing the transaction, BAPIHAGL will no longer be an affiliate of HAG.

It is known that the company was established in early 2022 with an initial charter capital of 50 billion dong. This is a joint venture between HAG and Dong A Pharmaceutical Trading Limited Liability Company. HAGL contributed 27.5 billion dong to hold 55% of the charter capital. HAGL’s ownership stake has been reduced to 44.5% as of the end of the second quarter of 2023.

Thanks to active liquidation of assets for debt repayment, by the end of 2023, HAGL’s long-term bond debt had significantly decreased from 3,681 billion dong to approximately 2,900 billion dong.

R&H Corporation sells assets to repay bond debt

According to periodic financial information for the first 6 months of 2023, R&H Corporation recorded a net loss of 296.5 billion dong, while the previous reporting period had a profit of over 11 billion dong. Notably, despite the business losses, the company’s bond debt decreased by 2,500 billion dong compared to the beginning of the year, down to 5,000 billion dong.

In the period 2021 and early 2022, R&H Corporation issued 7 bond series with a total value of over 8,000 billion dong. These bond series have terms of 12, 18, and 36 months. In April and May 2023, R&H Corporation had 3 bond series due with a total value of 2,500 billion dong.

However, at the beginning of 2023, R&H Corporation established a series of new subsidiaries with charter capital of hundreds of billion dong. These subsidiaries were then quickly transferred to new owners who had close ties with R&H Corporation and Mr. Truong Quang Minh.

The first company to mention is Mê Linh Thịnh Vượng Investment Limited Liability Company, newly established in March 2023 with a charter capital of 659.6 billion dong. The General Director and legal representative of Mê Linh Thịnh Vượng is Mr. Nguyen Minh Tuan – the General Director of Vinahud Real Estate Development Investment Corporation (code: VHD, UpCoM).

At the 2023 Annual General Meeting of Shareholders, Vinahud passed a resolution to transfer the capital contribution in Mê Linh Thịnh Vượng. Accordingly, Vinahud will repurchase the entire capital contribution of 659.6 billion dong, accounting for 100% of the charter capital in Mê Linh Thịnh Vượng from R&H Corporation at a transfer value of 950 billion dong. As of May 5, 2023, Mê Linh Thịnh Vượng officially became a subsidiary of Vinahud.

Another subsidiary sold by R&H Corporation is Bến Bình Thanh Investment Limited Liability Company. This company was also newly established in January 2023 with a charter capital of over 221 billion dong, and its legal representative is also Mr. Nguyen Minh Tuan.

15 days after its establishment, the position of General Director of Mr. Nguyen Minh Tuan at Bến Bình Thanh was transferred to Mr. Ngo Minh Tam – Head of Internal Audit of Vinahud. Concurrently, the legal representative with 100% ownership in the company at this time is Mr. Nguyen Anh Tuan (born in 1983).

These are two of several subsidiary sales that helped R&H Corporation have abundant funds to repay bond debt in the first half of 2023.

Phat Dat Corporation escapes losses by selling subsidiaries

In the consolidated financial statement for the fourth quarter of 2023, Phat Dat Real Estate Development Corporation (code: PDR, HoSE) reported nearly 422 billion dong of financial revenue, a significant increase compared to over 16 billion dong in the same period last year.

PDR stated that this sudden increase came from selling subsidiaries, specifically, on November 3, 2023, PDR approved the transfer of the entire capital contribution in Phat Dat Industrial Park Development and Investment Joint Stock Company (Phat Dat Industrial Park), equivalent to 99.8% of the charter capital.

Phat Dat escapes losses in the fourth quarter of 2023 by selling subsidiaries.

The buyer of the transfer is Phat Dat Holdings Limited Liability Company. The transfer price is not lower than 130% of face value, equivalent to a minimum value of over 1,297 billion dong.

Previously, in the second quarter of 2023, Phat Dat also completed the sale of the entire stake in Saigon-KL Real Estate Joint Stock Company (the investor of Astral City project in Binh Duong province) to Danh Khoi Holdings Joint Stock Company. As a result, PDR recorded financial revenue of 532 billion dong in the second quarter of 2023, a sharp increase compared to over 829 million dong in the same period.

In the context of business revenue from core activities decreasing by 99.4% compared to the same period, the proceeds from this asset transfer helped PDR escape losses in the second quarter of 2023.

Hai Phat Investment Corporation sells ownership in prime land in Nha Trang

Similarly to PDR, the consolidated financial report for the fourth quarter of 2023 of Hai Phat Investment Joint Stock Company (code: HPX, HoSE) also recorded a significant financial revenue of nearly 251 billion dong, an increase of 73% thanks to increased profit from investment sales.

According to the disclosure, HPX transferred the majority of its equity in HP Hospitality Nha Trang Limited Liability Company, reducing the ownership percentage from 78% (equivalent to a recorded value of nearly 526 billion dong) to 4.5% (equivalent to a recorded value of over 30 billion dong). This conversion turned the subsidiary into another investment.

It is known that HPX officially owned 78% of the capital at HP Hospitality Nha Trang through acquisitions in September 2017 and September 2019 from two founding shareholders, namely Song Da Nha Trang Joint Stock Company and Song Da Thang Long Joint Stock Company (code: STL).

HP Hospitality Nha Trang is the investor of the TM1 project in the residential area of Con Tan Lap, located at the mouth of the Cai River to the sea in Nha Trang, adjacent to Tran Phu Bridge, a position considered “prime land” in the coastal city. The TM1 project has a total floor area of 311,239 square meters, including 2 basement floors, 3 commercial floors, 27 residential floors, and 10 hotel floors. HPX transferred the TM1 project amidst its slow progress in recent years.