The National Citizen Bank (NCB) has officially adjusted its deposit interest rates on the first working day after the Lunar New Year holiday. This is the second time this bank has reduced deposit interest rates since the beginning of February. According to the traditional savings interest rate chart, the interest rates for various terms have decreased by an average of 0.1-0.3 percentage points. Specifically, the interest rate for a 1-month term is currently 3.6% per year. For a 2-month term, the deposit interest rate is 3.7% per year. The bank applies an interest rate of 3.8% per year for terms of 3-5 months. For the 6-8 month term, the current interest rate is 4.5% per year.

For the 10-12 month term, the interest rates range from 4.6% to 5.05% per year. The highest interest rate is 5.55% per year, applicable for terms from 18 months to 60 months.

(Source: NCB)

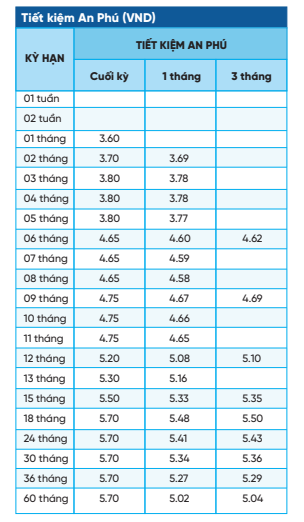

Under the An Phu savings interest rate package, the interest rates for the 1-5 month terms have decreased by 0.3 percentage points. Specifically, the interest rate for a 1-month term is reduced to 3.6% per year, for a 2-month term is reduced to 3.7% per year, and for the 3-5 month terms is reduced to 3.8% per year.

The deposit interest rates for the 6-11 month terms have decreased by 0.2 percentage points. The interest rate for the 6-8 month term is lowered to 4.65% per year, and for the 9-11 month term is lowered to 6.75% per year.

Meanwhile, the deposit interest rates for the remaining terms have all decreased by 0.1 percentage points. The interest rate for the 12-month term is now 5.2% per year, for the 13-month term is now 5.3% per year, for the 15-month term is now 5.5% per year, and for the 18-60 month terms is now 5.7% per year.

(Source: NCB)