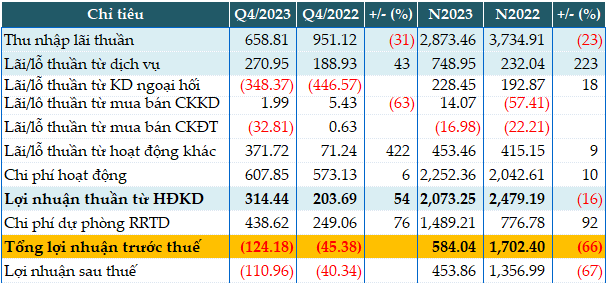

As a whole in 2023, ABBank’s core business only generated VND 2,873 billion in net interest income, a 23% decrease compared to the previous year due to implementing interest rate adjustments in lending to timely support businesses in difficult period as directed by the Government.

The highlight contribution to the results is nearly VND 749 billion in profit from services, 3.2 times higher than the previous year. Foreign exchange trading also grew by 18% with over VND 228 billion in interest received.

In the context of increasing bad debts, the Bank also increased its risk provisions by 92% by allocating over VND 1,489 billion, enhancing the coverage ratio of bad debts. As a result, pre-tax profit was only VND 584 billion, a 66% decrease compared to the previous year. Thus, ABBank only achieved 21% of the set pre-tax profit target of VND 2,826 billion for the whole 2023.

|

Fourth quarter and whole year 2023 business results of ABBank. Unit: Billion VND

Source: VietstockFinance

|

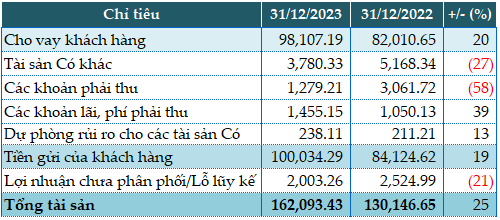

ABBank’s total assets as of the end of 2023 reached VND 162,093 billion, a 25% increase compared to the beginning of the year. Credit outstanding reached VND 102,448 billion, a 16% increase compared to 2022 – close to the credit room granted in the context of the market’s ability to absorb capital decreasing sharply.

Customer deposits reached VND 115,654 billion, a 26% increase. CASA balance also slightly increased by 6% compared to 2022.

The Capital Adequacy Ratio (CAR) at the end of 2023 reached 11.1%.

|

Some financial indicators of ABBank as of 31/12/2023. Unit: Billion VND

Source: VietstockFinance

|

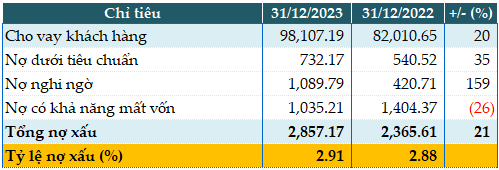

ABBank’s total bad debts as of 31/12/2023 recorded over VND 2,857 billion, a 21% increase compared to the beginning of the year. The bad debt/loan ratio increased from 2.88% to 2.91%.

|

Loan quality of ABBank as of 31/12/2023. Unit: Billion VND

Source: VietstockFinance

|