The development of the stock market in terms of both volume and value of transactions is in line with the outstanding growth expectations of the Vietnamese economy, attracting the attention of domestic and foreign investors. The story of market upgrade has been mentioned for many years, but 2024-2025 as a period of compression towards the goal thanks to determined reform moves to be upgraded by the Government. A typical example can be mentioned is the Dispatch No. 1360/CĐ-TTg on December 13, 2023, enhancing solutions to promote safe, transparent, efficient, and sustainable development of the stock market which was signed by Prime Minister Pham Minh Chinh; and the Decision No. 1726/QD-TTg approving the Stock Market Development Strategy until 2030 by Deputy Prime Minister Le Minh Khai.

Upgrading the stock market brings many benefits, including attracting the attention of foreign investors and creating favorable conditions for listed companies to access foreign investment capital. A typical example is in June 2013, MSCI announced that Qatar and the United Arab Emirates (UAE) would be upgraded from frontier markets to emerging markets in May 2014. Research and analysis by Fairvue (2014) also indicated that from 2012 to 2014, investment from foreign organizations in the Gulf Cooperation Council (GCC) region had increased from 5 billion USD in June 2012 to about 10 billion USD at the end of March 2014. Of the total foreign investment capital, 80% was concentrated mainly in Qatar and the UAE.

Upgrading the stock market also has a positive impact on the profitability of stocks. According to the hypothesis of investor perception, it provides another explanation for the behavior of stock prices around the market upgrade announcement. According to this hypothesis, investors predict that some stocks listed in these markets will be transferred to a new market index (inclusive index). As a result, these investors are willing to buy them (Merton, 1987), leading to an increase in stock prices (Yun and Kim, 2010). During the period from June 2013 to June 2014, the Qatar and UAE stock markets (including the two indices DFM – Dubai Financial Market and ADX – Abu Dhabi Securities Exchange) also experienced an increasing process when receiving information about the upgrade. It can also be seen that the increasing process started before the announcement of the upgrade.

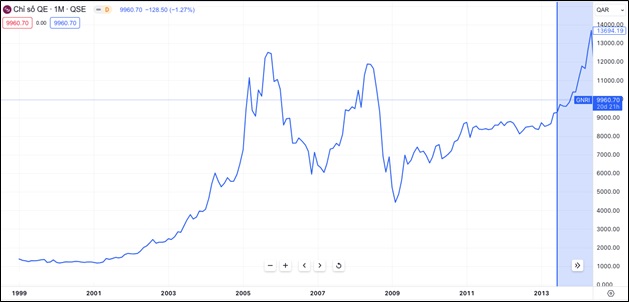

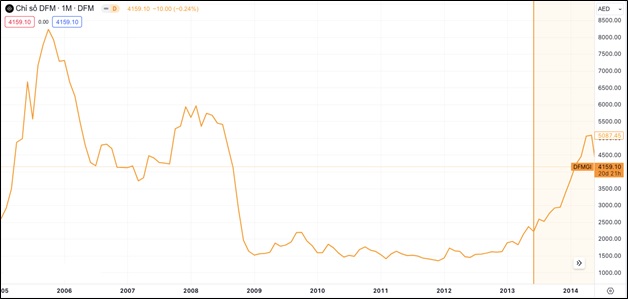

Below is a chart of stock indices of some countries reaching historical highs around the time of the announcement of the stock market upgrade:

Qatar Stock Exchange (QSE) index reaches a record high when receiving information about the upgrade from June 2013 to May 2014

|

Dubai Financial Market (DFM) index of the UAE stock market

|

Abu Dhabi Securities Exchange (ADX) index of the UAE stock market

|

Monetary policy during the waiting period for the market upgrade?

In the second half of 2023, with Vietnam’s expansive monetary policy, through four cuts in the operating interest rate by the State Bank of Vietnam has had a positive impact on the economy. GDP in the fourth quarter of 2023 increased by 6.72% compared to the same period last year, thereby helping GDP for the whole year to rise by 5.05%.

In the short term, the expansive monetary policy helps increase money supply, which has a positive impact on the stock market and the economy. However, in the long run, the stock market reacts negatively because expanding money supply will increase inflation in the future, thereby negatively affecting the economy and the stock market. In addition, the State Bank of Vietnam does not have much room to further cut interest rates. Therefore, monetary policy needs to be used flexibly and effectively. Especially when countries like the US and Europe reverse their policies from tightening to expansion.

In the waiting period for the market upgrade, maintaining stable interest rates is often preferred in countries that have been upgraded before Vietnam. It can be seen that stable interest rates during this period have many significant benefits. Firstly, it creates a stable environment that helps investors and businesses plan and make long-term investment decisions and encourages economic development. Moreover, maintaining stable interest rates also minimizes financial risks for both borrowers and lenders. A fluctuation outside the expected interest rate can cause instability in the market and affect credit and investment. By maintaining stable interest rates, the market can maintain confidence in credit and economic stability, creating favorable conditions for borrowing and investing. Moreover, stable interest rates also come with stable exchange rates, thereby attracting foreign investment capital. In general, maintaining unchanged interest rates during the waiting period for the market upgrade is a measure that some countries have applied to maintain stability and confidence in the financial market when facing the market upgrade issue.

Specifically, the Chinese and Qatari stock markets underwent a waiting period for market upgrade. During this time, maintaining stable interest rates has kept the market stable and minimized financial risks. This has promoted economic development and created long-term investment opportunities, contributing to the sustainable development of both countries.

Võ Thị Tú Trinh, CMT