The Company’s proprietary trading segment had positive results in 2023. Profits from financial assets measured at fair value through profit or loss (FVTPL) amounted to nearly VND 8.3 trillion, nearly 6.5 times the previous year, primarily from the revaluation gain of FVTPL assets (amounting to VND 6 billion, compared to a loss of over VND 1 billion the previous year).

In addition, profits from available-for-sale (AFS) financial assets and held-to-maturity (HTM) investments amounted to approximately VND 600 million, increasing by 6% and 13% respectively.

On the other hand, profits from loans and accounts receivable decreased by 73% to VND 2.2 billion. Revenue from brokerage services also decreased by 84% compared to the previous year, reaching VND 700 million.

| Revenue Changes from TVB’s Core Business Segments |

With the above fluctuations, the operating revenue in 2023 reached VND 12.5 trillion, a decrease of 19%.

Significant reductions were made in financial costs (VND 250 million) and management expenses (VND 2.8 billion), corresponding to decreases of 86% and 41% respectively compared to the previous year.

As a result, in 2023, TVB achieved after-tax profits of over VND 6.3 trillion, compared to a loss of VND 3.18 trillion the previous year. In the fourth quarter alone, the company’s after-tax profits reached VND 3.4 trillion, compared to a loss of VND 35.2 trillion in the same period last year.

With these positive results, TVB’s stock price experienced rapid growth. In the first trading session of the Year of the Horse (February 15, 2024), TVB’s stock price soared to VND 7,780 per share. Compared to the end of the lunar year 2023, TVB’s stock price increased by approximately 40%.

| TVB Stock Price Performance in 2024 |

In addition to improved business performance compared to the previous year, TVB’s stock has been upgraded from the restricted trading list to the controlled trading list since January 19, 2024, as the listing organization successfully resolved the trading restrictions on the stock.

However, TVB is still under warning status (since June 27, 2023) due to the accumulated undistributed after-tax profits in the audited financial statements for 2022 being negative and the auditors issuing exceptions on the audited financial statements for 2022.

Preliminary Gains on Investments in FPT Stocks: Nearly 44%

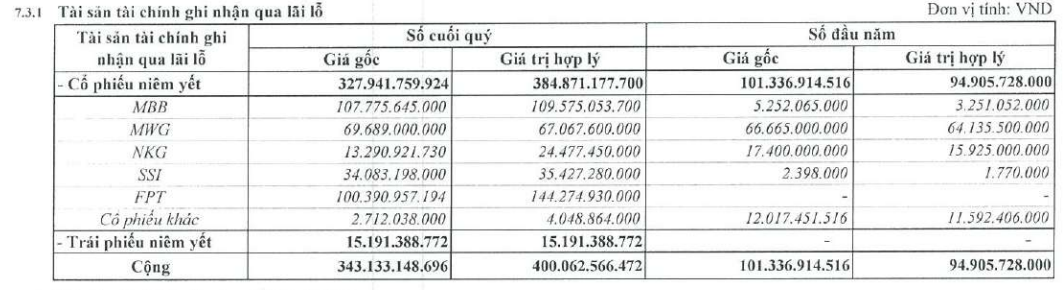

In 2023, TVB’s total assets reached VND 100.7 trillion, a slight increase compared to the previous year. Among them, the value of FVTPL financial assets reached VND 40 trillion, more than 4 times the previous year.

Source: Company’s Financial Statements

|

The FVTPL stock portfolio includes prominent stocks such as MBB, MWG, NKG, SSI, and FPT.

During the year, TVB acquired an additional VND 10 billion worth of FPT stocks (at cost). The fair value of this investment at the end of 2023 was over VND 14.4 billion, resulting in a preliminary gain of nearly 44%. Additionally, other stocks such as MBB and SSI recorded gains of 2% and 4% respectively.

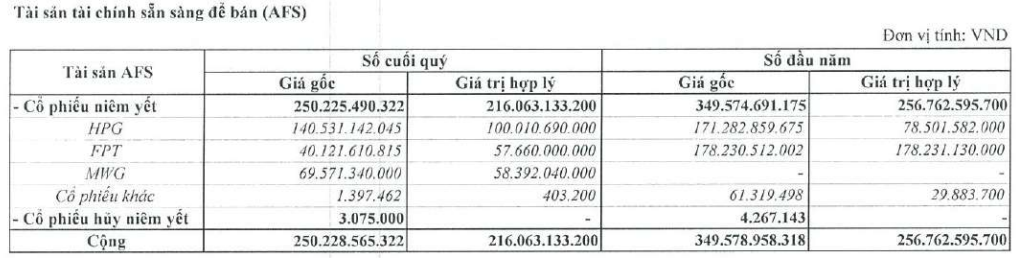

In parallel, the value of AFS financial assets amounted to VND 21.6 trillion (a 16% decrease compared to the beginning of the year), primarily held in HPG stocks with the largest proportion, over VND 10 trillion.

Source: Company’s Financial Statements

|

Trading activities involving margin loans, at cost, amounted to nearly VND 1.6 billion, with a fair value of over VND 1.1 billion. The nearly VND 500 million difference between the fair value and the cost represents the discount on FTM stocks. The company fully provisioned for this discount, and during the lending period, the company received nearly VND 300 million in interest.

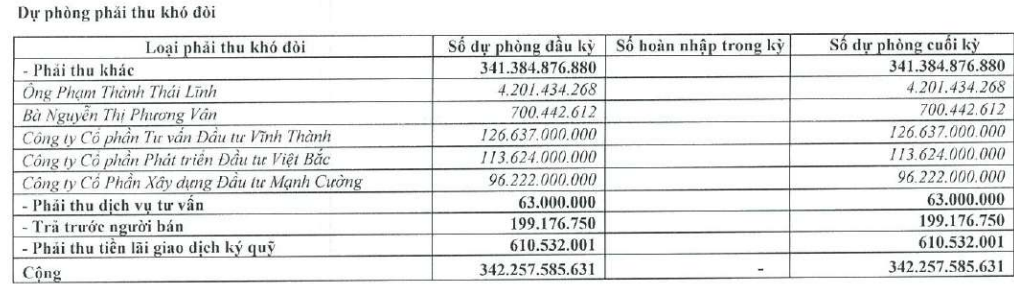

Notably, the company still maintains a provision for the impairment of receivables amounting to VND 34.2 billion, unchanged from the previous year, with the largest provision being for Vĩnh Thành Investment Advisory Joint Stock Company (VND 12.7 billion).

Source: Company’s Financial Statements

|

On the liabilities side, the company’s payable amount has decreased to VND 1.6 billion, compared to VND 13 billion at the beginning of the year. TVB no longer recognizes short-term bond liabilities, which were over VND 11.4 billion the previous year.

Kha Nguyen