After Tet holiday, many parents plan to save their children’s lucky money in savings accounts. For parents, saving money for their children is not just about earning interest and preparing for the future, but also about helping children learn about personal finance management.

Currently, with a minimum amount of 1,000,000 VND, parents can immediately open an online savings account at most banks such as VPBank, TPBank, Ocean Bank, VietinBank, etc. At VietBank, the minimum amount to open an online savings account is 500,000 VND.

At Vietcombank, the minimum amount to open a savings account is 3,000,000 VND.

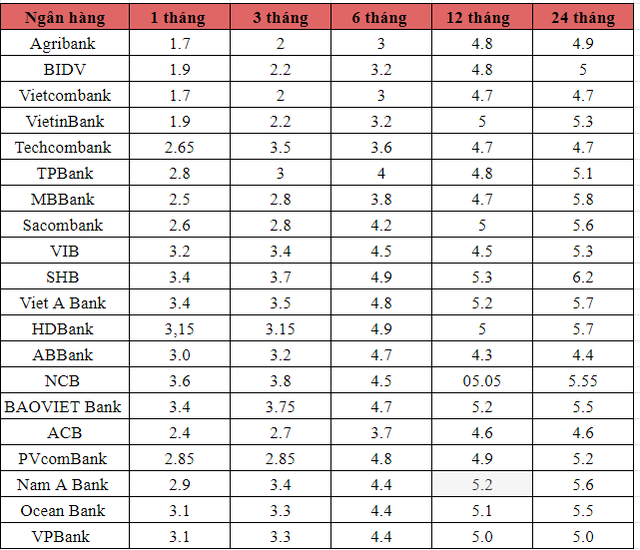

Regarding the interest rates for online savings, currently, no banks offer a 6% annual interest rate for a 12-month term. Only for a 24-month term, the interest rate for savings can reach over 6% per year.

Specifically, for a 1-month term, the highest interest rate is 3.6% per year, applied at NCB Bank. For a 3-month term, no banks offer a 4% interest rate, the highest being NCB Bank (3.8%), BAOVIET Bank (3.75%), SHB (3.7%), etc.

For a 6-month term, SHB Bank and HDBank are applying the highest interest rate of 4.9% per year. The next highest are ABBank, PVcomBank, etc.

For a 12-month term, out of the 21 surveyed banks, only a few banks apply interest rates of 5% or higher, including Vietinbank, SHB Bank, Viet A Bank, NCB Bank, HDBank, Nam A Bank, Ocean Bank, VPBank, etc.

For a 24-month term, SHB Bank offers a high interest rate of 6.2% per year. Other banks apply interest rates below 6% per year.

Below is the table of online savings interest rates for 21 banks.