Illustrative image

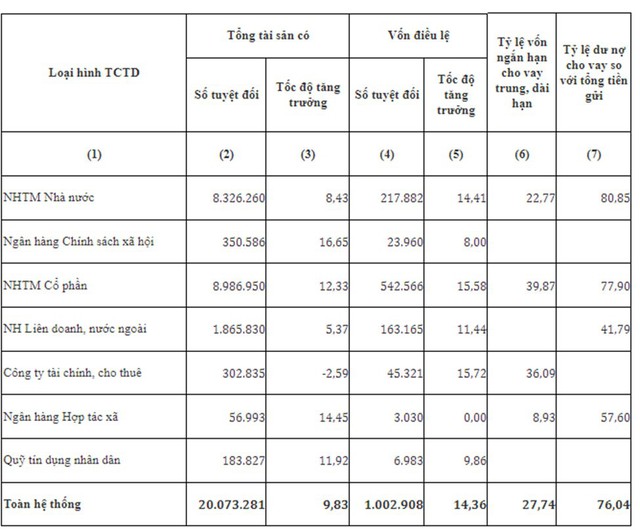

According to the latest data from the State Bank of Vietnam (SBV), as of the end of December 2023, the short-term capital-to-loan ratio for medium and long-term loans of the entire system has decreased to 27.74% from 28.39% recorded at the end of September.

Specifically, this ratio in the State-owned Commercial Banks group (Agribank, BIDV, VietinBank, Vietcombank, CBBank, GP Bank, OceanBank) decreased from 24.31% to 22.77%; while the Joint-stock Commercial Banks group increased from 39% to 39.87%.

Source: SBV

According to the regulations of Circular 08/2020/TT-NHNN issued by the State Bank on August 14, 2020 amending and supplementing Circular 22/2019/TT-NHNN, the maximum short-term capital-to-loan ratio for medium and long-term loans of the official banks has reduced from 34% to 30% from October 1.

Thus, the average short-term capital-to-loan ratio for medium and long-term loans of the Joint-stock Commercial Banks group at the end of 2023 was nearly 10 percentage points higher than the prescribed ceiling level. This situation puts significant pressure on the Joint-stock Commercial Banks group in restructuring their capital sources and lending balances. Meanwhile, the State-owned Commercial Banks group has more “room” in their activities of medium and long-term lending.

According to analysts, the high short-term capital-to-loan ratio for medium and long-term loans compared to the prescribed ceiling level will encourage banks to mobilize medium and long-term capital sources through issuing valuable papers, especially bonds to deal with this ratio.

Data from the Vietnam Bond Market Association (VBMA) shows that up to 44 out of 55 bond issuances in December 2023 are from commercial banks. Throughout 2023, commercial banks were the largest group of bond issuers with VND 176,006 billion (equivalent to 56.5% of the total market issuance value).

According to statistics from MB Securities, the value of bonds issued by banks in 2023 increased by 31% compared to 2022, with an estimated average yield of 6.5% per year and an average term of 4.7 years. The top 5 bond issuers in 2023 are all joint-stock commercial banks, including: Techcombank (VND 23,500 billion), OCB (VND 22,350 billion), LPBank (VND 19,640 billion), ACB (VND 18,900 billion), TPBank (VND 15,339 billion).

On the other hand, data from SBV shows that as of the end of 2023, the loan-to-deposit ratio of the entire system was 76.04%. Specifically, in the State-owned Commercial Banks group, the ratio was 80.85%; in the Joint-stock Commercial Banks group, the ratio was 77.9%; and in the Joint Venture and Foreign-Credit Institutions group, the ratio was 41.79%.