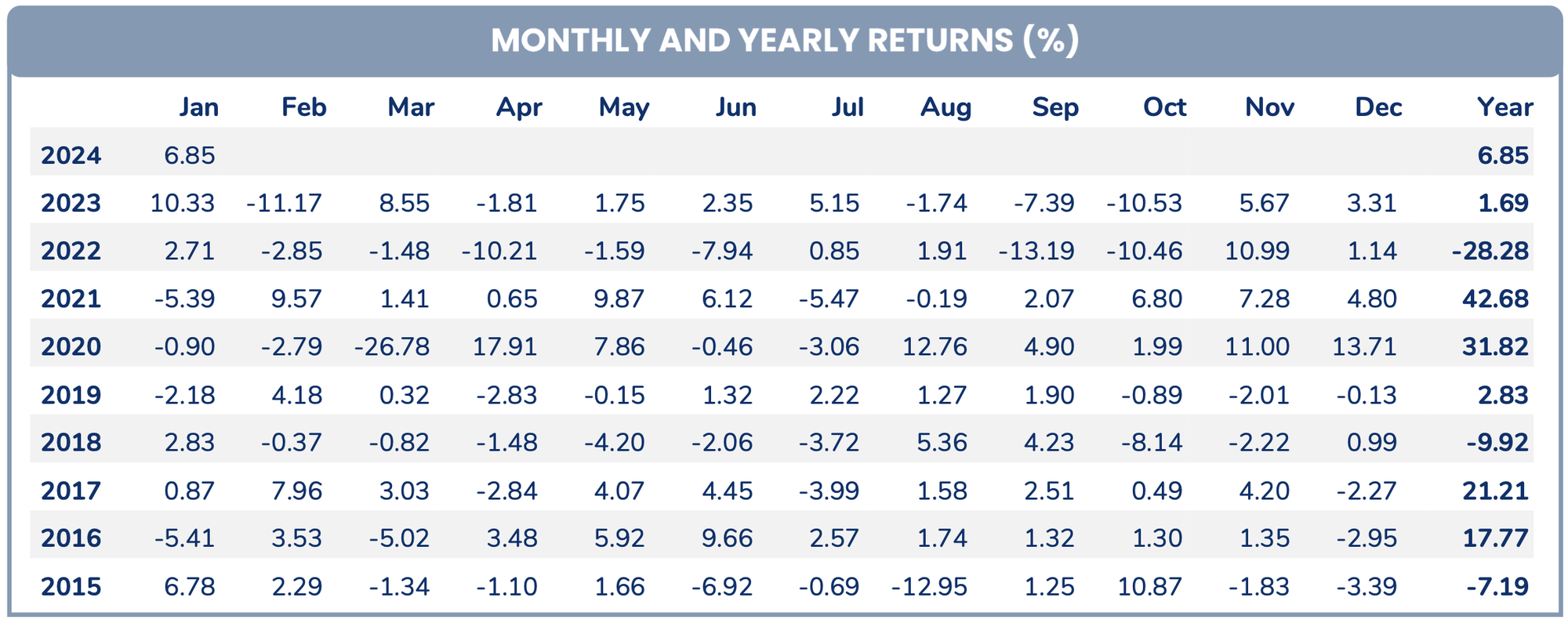

After a challenging year in 2023, Pyn Elite Fund has kicked off the new year 2024 with a strong performance, achieving a 6.85% investment return in January, outperforming the VN-Index’s 3.04% increase. This marks the third consecutive month of positive performance for the Finnish foreign fund.

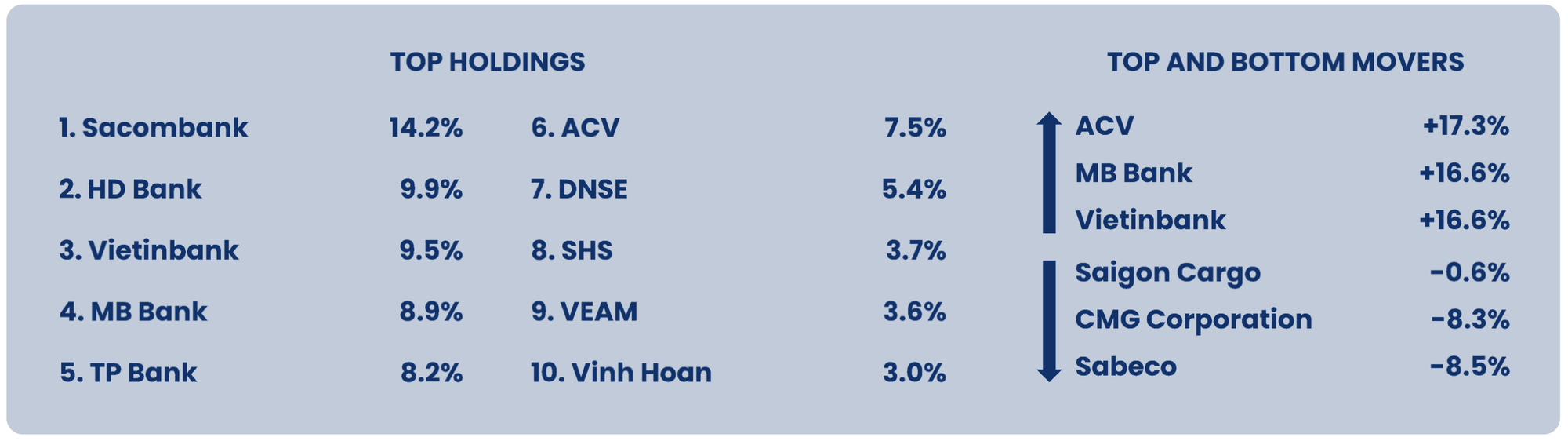

According to Pyn Elite Fund, this result was driven by the excellent recovery of ACV and banking stocks. By the end of January 2024, Pyn Elite Fund’s managed portfolio reached over 747 million EUR (~19.650 trillion VND). Among which, the top five largest investments are all in banking stocks including STB, HDB, CTG, MBB, TPB, accounting for a total weight of 50.7%.

ACV is the sixth largest investment in Pyn Elite Fund’s portfolio with a weight of 7.5%. Following it are stocks of two securities companies DNSE and SHS. Notably, DNSE recently carried out its initial public offering (IPO) at the beginning of 2024. Prior to that, Pyn Elite Fund and DNSE officially signed a cooperation agreement, in which the Finnish foreign fund will hold a 12% stake and become the second largest shareholder in this securities company.

According to Pyn Elite Fund’s explanation, the good performance of banking stocks in the fund’s portfolio is partly due to high profit growth. The total fourth-quarter income of the six banks in the fund’s portfolio increased by 31% compared to the same period in 2022. For the entire year of 2023, this figure was 18%, while the remaining portion excluding banks had a negative total income of 13% compared to 2022.

In the fourth quarter of 2022, the case involving the unlisted bank SCB caused temporary tension in the financial market. However, according to Pyn Elite Fund’s assessment, the case was handled well and listed banks unaffected are expected to grow strongly in 2024.

In addition, the foreign fund also stated that the majority of bad debts from SCB’s “internal lending” were resolved since 2022. The bad debts of the 15 largest normally operating banks remained well maintained and reached a peak of only 2.34% in the third quarter of 2023, before decreasing to 1.91% in the fourth quarter.

In terms of macroeconomic situation, trade activities showed growth momentum in January with exports increasing by 6.7% compared to the previous month and rising by 42% compared to the same period in 2023. Meanwhile, imports increased by 0.1% compared to the previous month and rose by 33% compared to 2023. Manufacturing PMI resumed growth and reached 50.3 in January, supported by expanded new orders and production.

Furthermore, disbursement of FDI also increased by 9.6%, while FDI registration increased by 40.2% compared to the same period in 2023. CPI in January 2024 increased by 3.37% compared to the same period last year, lower than the 3.6% increase at the end of last year. Deposit interest rates continued to decrease further on a broad scale, nearing the lowest level in history.