The stock market has shown positive developments in the first trading session after the Tet holiday. The VN-Index closed the session on 15th February, rising by 3.97 points (0.33%) and officially surpassing the 1,202-point mark. Liquidity remained good, with a trading value of over VND 18,000 billion on HOSE. However, foreign trading was a downside as a net selling value of VND 363 billion was recorded across the entire market.

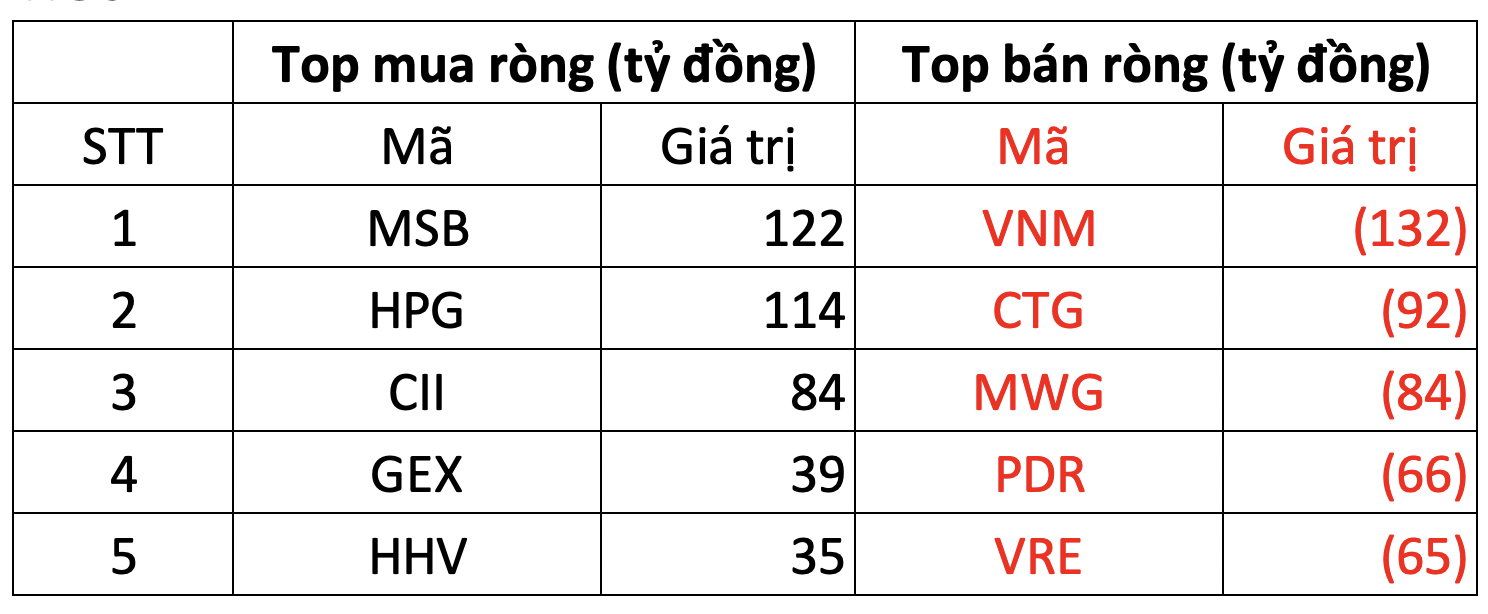

On HOSE, foreign investors were net sellers with an approximate value of 328 billion VND.

In terms of buying activities, MSB shares were the most net bought with a value of VND 122 billion. Additionally, HPG and CII were also net bought with values of VND 114 billion and VND 84 billion, respectively. GEX and HHV were also among the net bought stocks on HoSE, with values of VND 39 billion and VND 35 billion, respectively.

On the other hand, VNM faced the strongest selling pressure from foreign investors with a value of VND 132 billion. CTG and MWG were the two next stocks sold with values of VND 92 billion and VND 84 billion per stock.

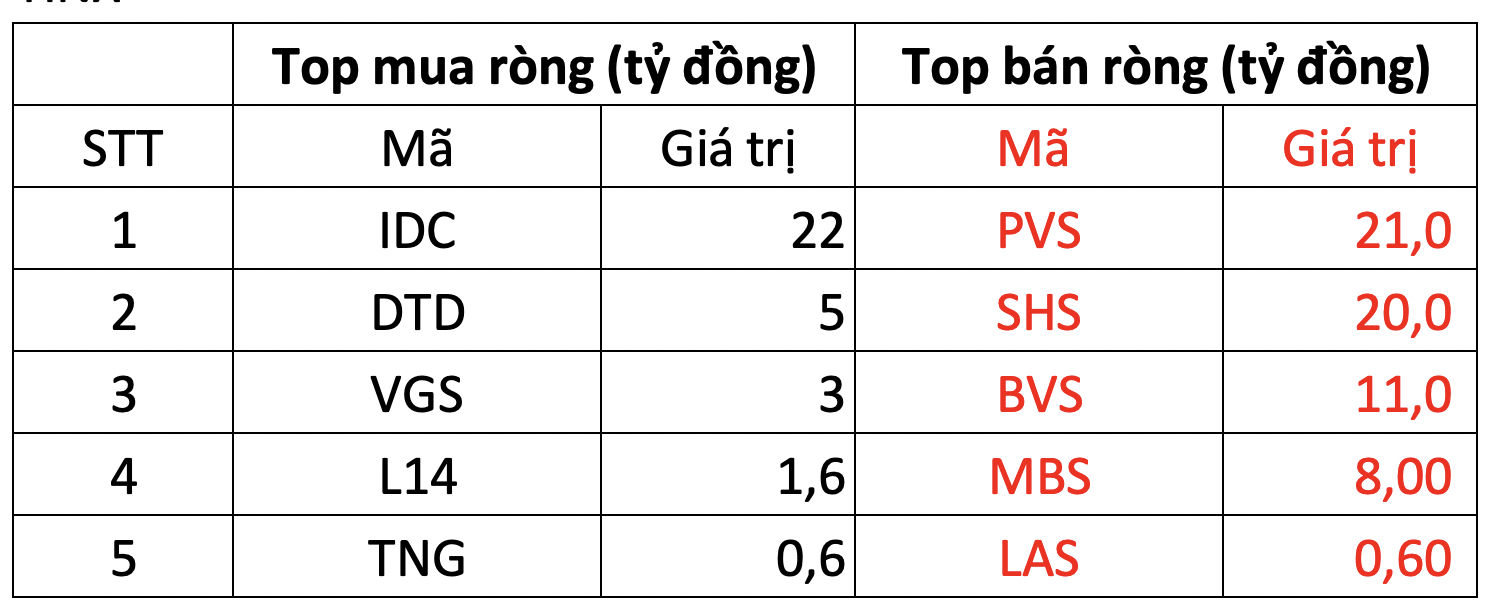

On HNX, foreign investors were net sellers with 29 billion VND

In terms of buying activities, IDC was strongly net bought with a value of VND 22 billion. In addition, DTD was also on the list of stocks net bought on HNX, with a value of VND 5 billion. Moreover, foreign investors also net bought VGS, L14, and TNG with not-so-large values.

On the other hand, PVS faced net selling pressure from foreign investors with a value of VND 21 billion, followed by SHS, which faced net selling pressure of around VND 20 billion.

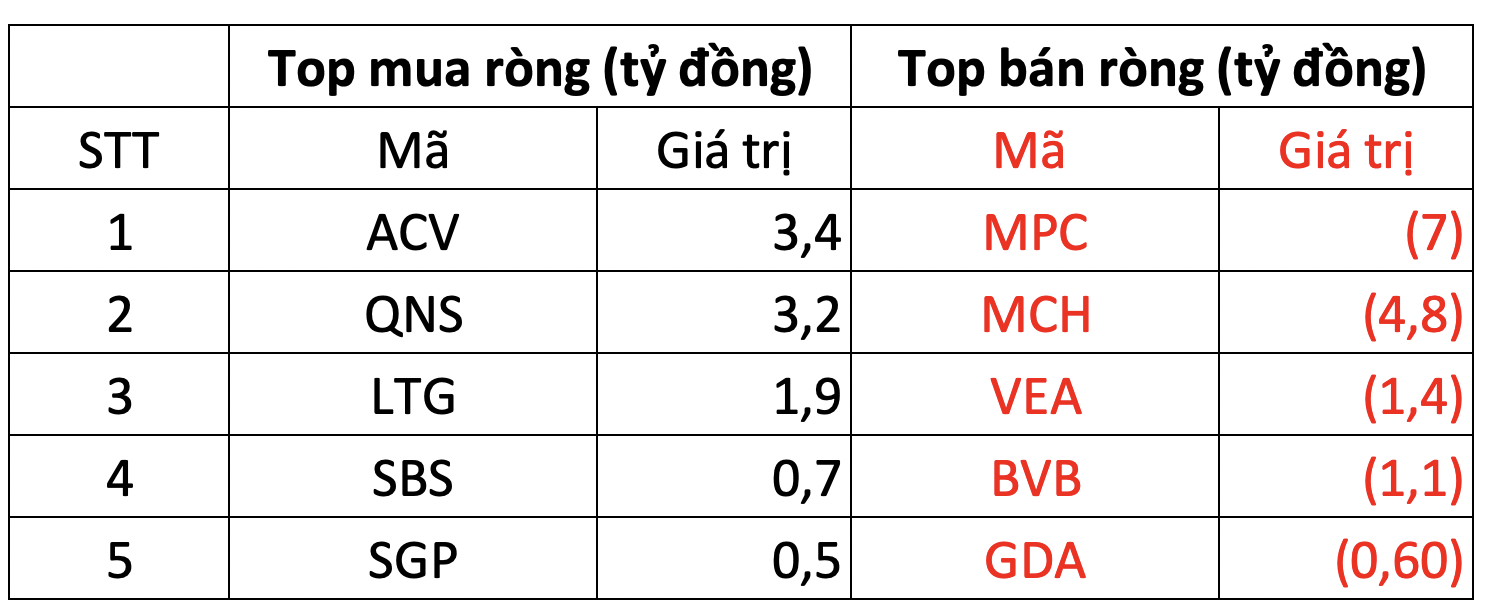

On UPCOM, foreign investors were net sellers with over 6 billion VND

In terms of buying activities, ACV shares were bought by foreign investors with a value of VND 3.4 billion. Similarly, QNS and LTG were also net bought with each stock having a value of a few hundred million VND.

MPC faced strong net selling pressure today with a value of around VND 7 billion. Moreover, foreign investors also faced net selling pressure with MCH, VEA, BVB stocks, and more.