The year Quy Mao is not easy for stock investors in Vietnam although the VN-Index has returned to nearly 1,200 points. Many stocks have fluctuated abnormally, even without escaping the bottom zone. In this context, the stocks of the “FPT” group have become bright spots as FPT, FPT Retail, FPT Telecom, FPTS all increase significantly, even reaching historic highs.

FPT – Vietnam’s number 1 digital technology corporation

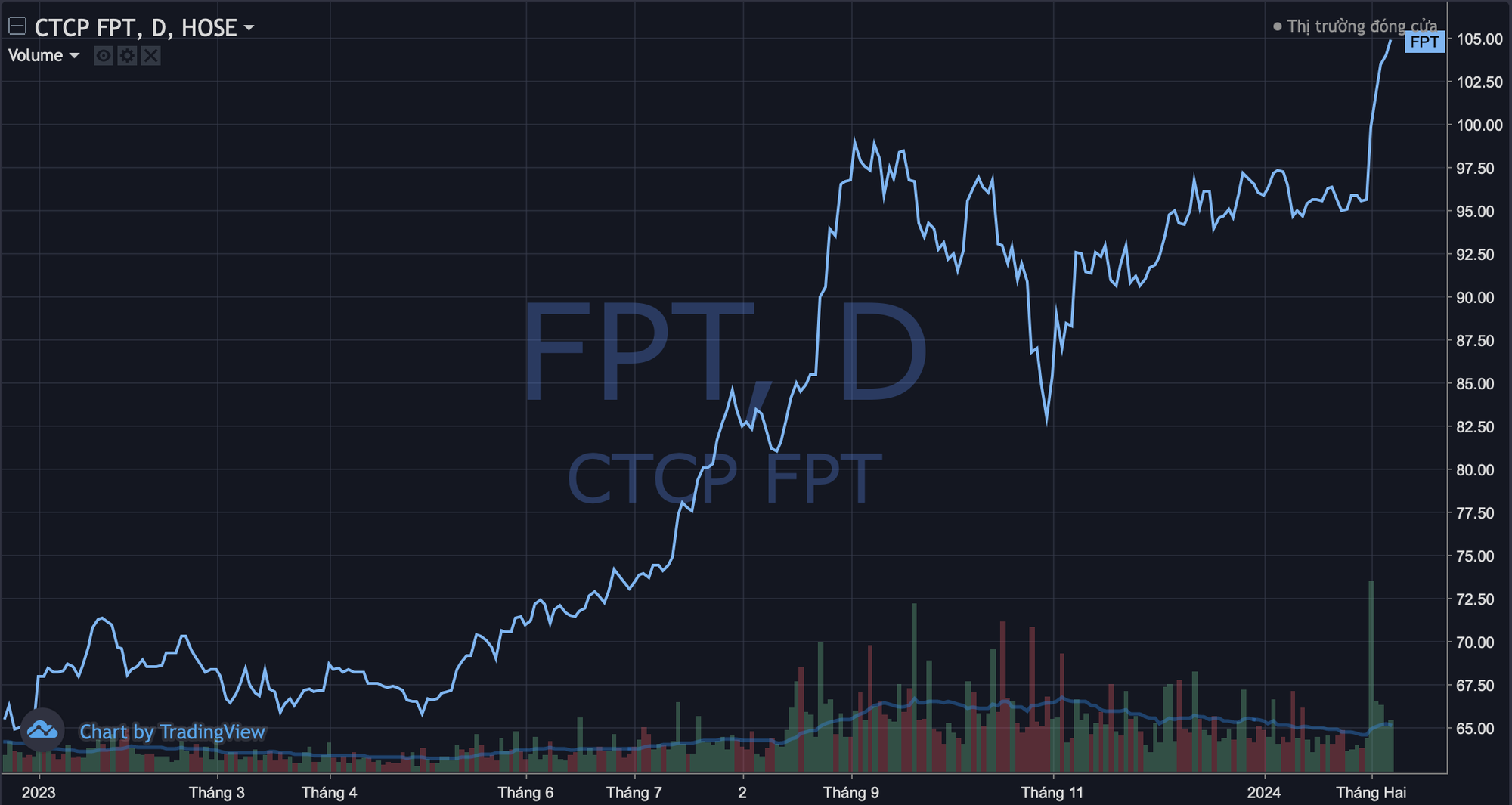

After a period of consolidation, FPT’s stock unexpectedly accelerated dramatically from the beginning of February, reaching a new all-time high of 104,900 VND/share. With a market capitalization of over 133,000 billion VND (~5.5 billion USD), an increase of nearly 50% compared to a year ago, this figure also puts FPT back in the top 10 most valuable listed companies on the stock exchange after many years of absence, and reinforces its position as the #1 technology company in Vietnam.

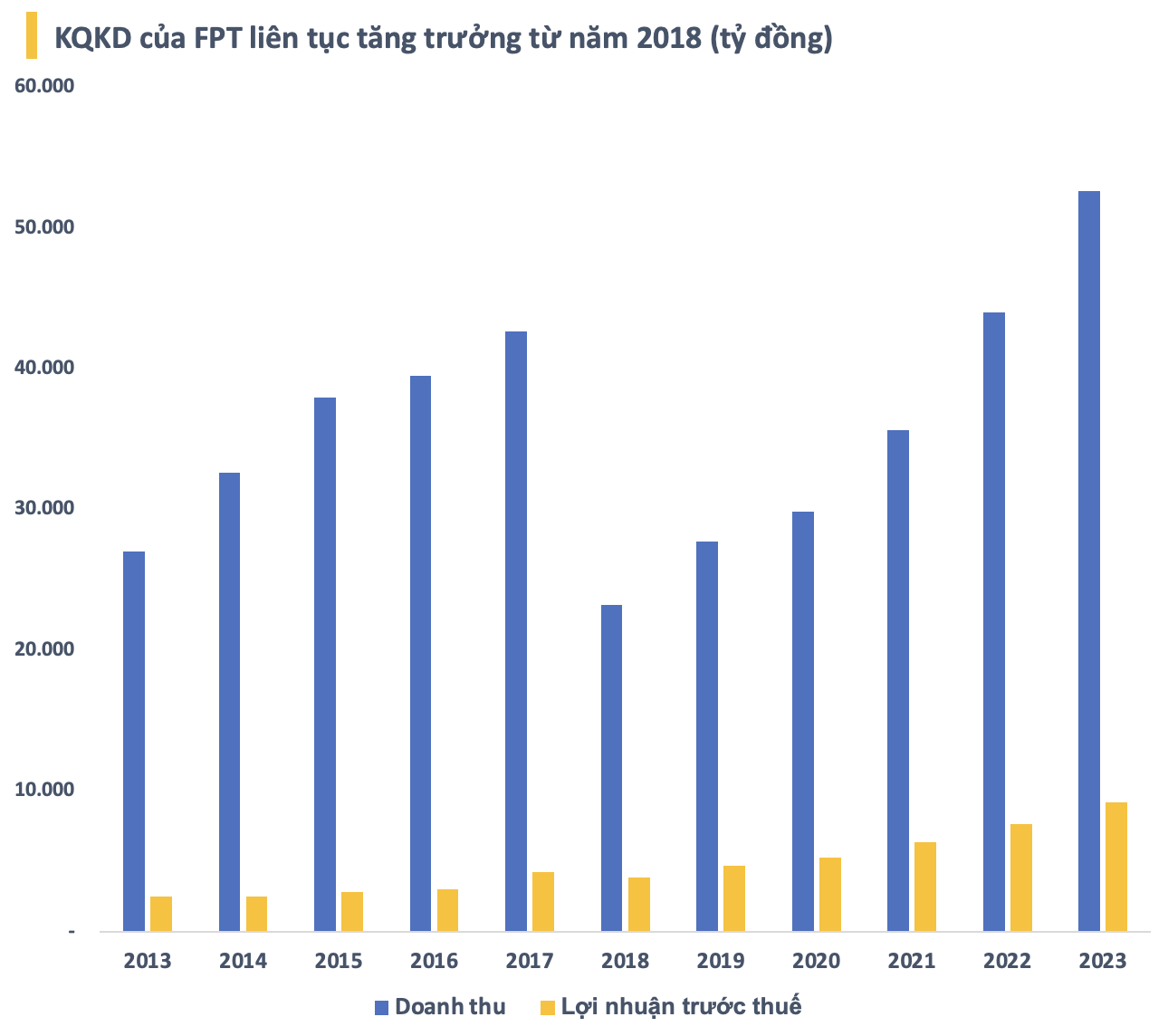

FPT’s increase is positively supported by its impressive business performance with continuously increasing revenue and profit over the years. In 2023, FPT recorded revenue of 52,618 billion VND and pre-tax profit of 9,203 billion VND, an increase of 19.6% and 20.1% respectively compared to the same period of the previous year. These are the record revenue and profit figures of this technology company since its establishment.

In 2023, the revenue of the overseas IT services segment reached 24,288 billion VND (1 billion USD), an increase of 28.4% YoY, thanks to strong growth from the Japanese market (+43.4%) and Asia-Pacific (APAC) (+37.7%). The new contracts of the overseas IT segment reached 29,777 billion VND (+37.6% YoY), including 37 projects (+19.4% YoY) with a scale of over 5 million USD. FPT sets a target of reaching 5 billion USD in revenue from overseas IT services by 2030 (equivalent to a compound annual growth rate of 26% from 2024-2030).

In 2023, FPT has vigorously expanded its market through M&A deals to spur future growth. FPT expanded its geographic scope by acquiring 3 US companies and 1 EU company in 2023, thereby significantly enhancing its technology capabilities and sales capacity. Specifically, FPT announced the acquisition of Intertec in February, Landing AI (US) in October, Cardinal Peak (US) in November, and Aosis (France) in December.

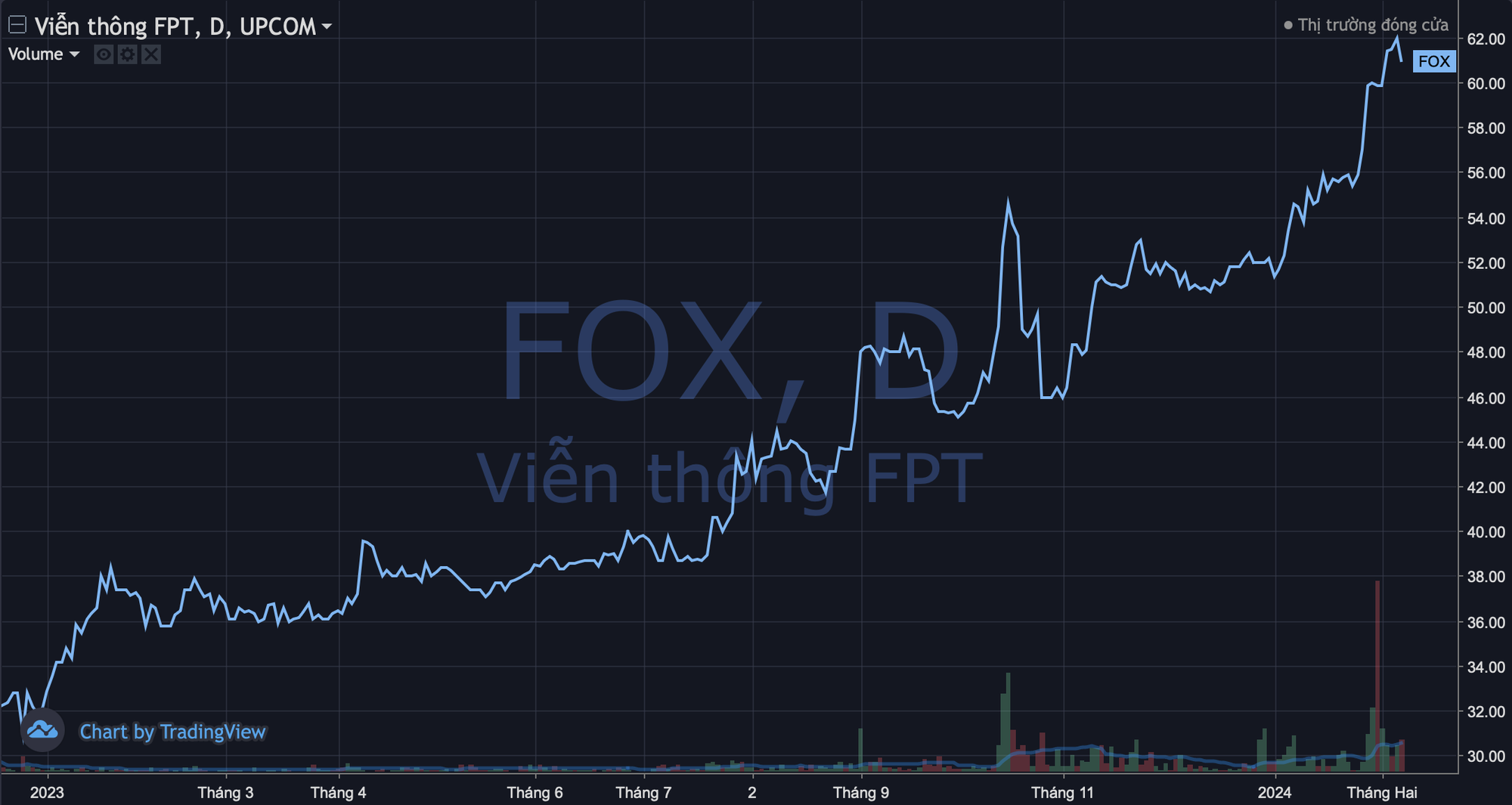

FPT Telecom (FOX) – The billion-dollar name in the telecommunications industry

Another leading business in the FPT group is FPT Telecom (FOX), which has also made significant breakthroughs in the past year. This stock has increased by more than 60% in the Year of Quy Mao and is currently trading at a historic high with a price of 61,000 VND/share. Its market capitalization is more than 30,000 billion VND (~1.3 billion USD). This figure helps FPT Telecom maintain its position as the #1 company in terms of market capitalization in the telecommunications industry on the stock exchange.

Similar to FPT, the growth of FOX stock is also supported by the excellent business performance of FPT Telecom. In Q4/2023, this telecommunications company recorded net revenue of 4,115 billion VND, an increase of 5% YoY. After-tax profit reached 590 billion VND, an increase of nearly 14% YoY.

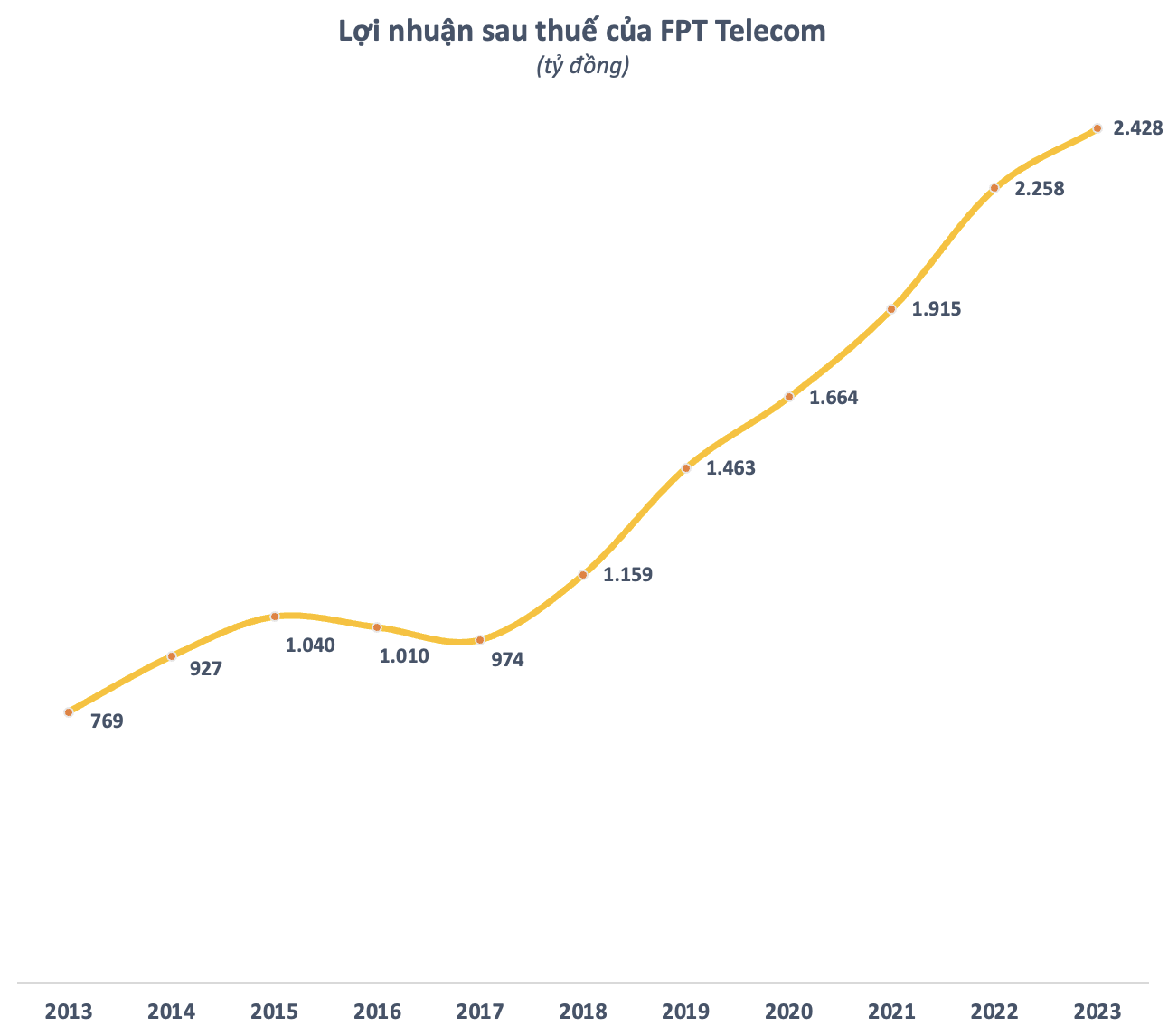

For the whole year 2023, FPT Telecom achieved net revenue of 15,806 billion VND and after-tax profit of 2,428 billion VND, an increase of 7% and 8% respectively compared to the previous year. This is the highest profit level that the company has achieved in a year. These results extend the profit growth streak to 6 consecutive years.

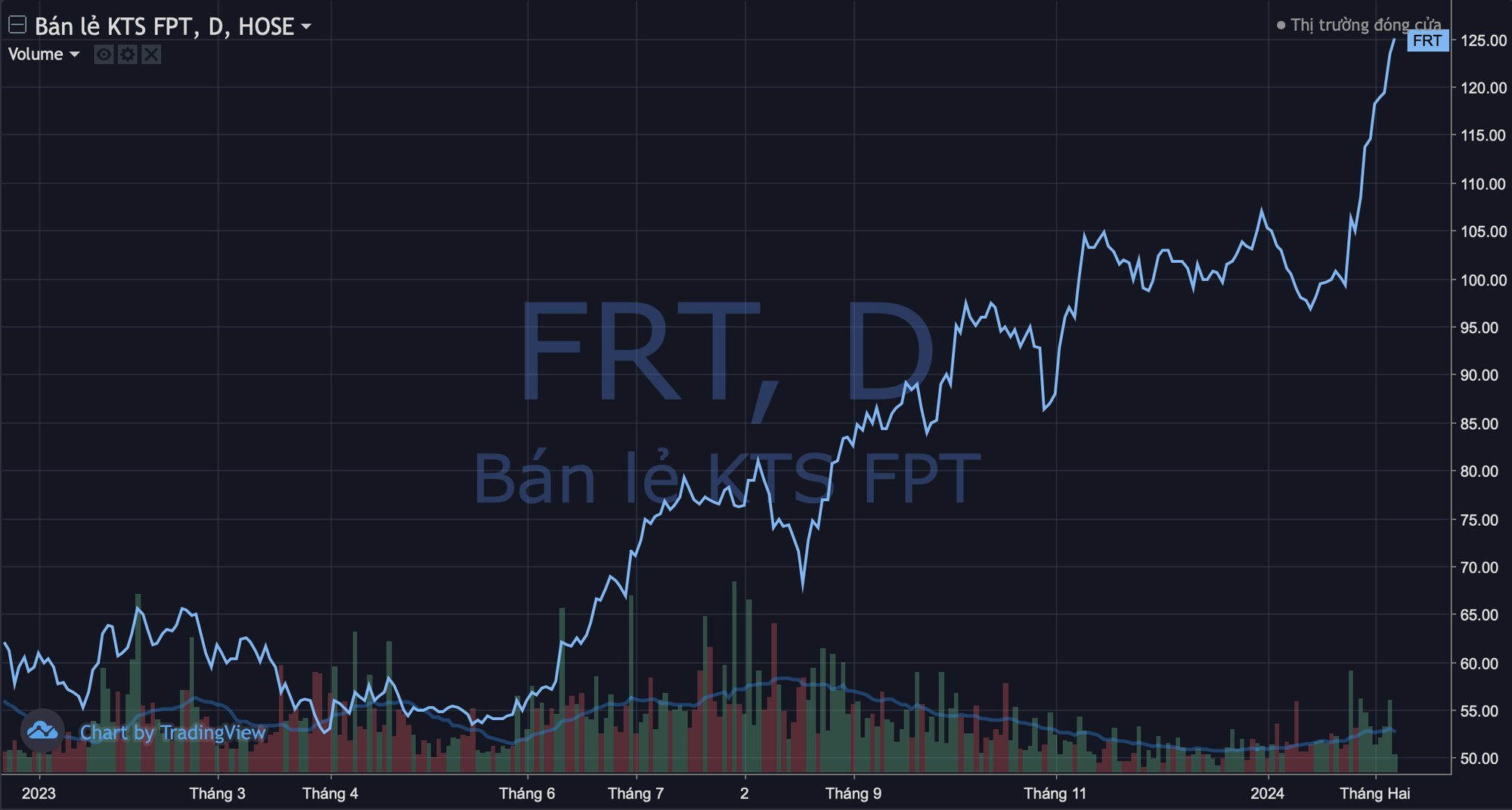

FPT Retail (FRT) – Expectation from “Long Chau”

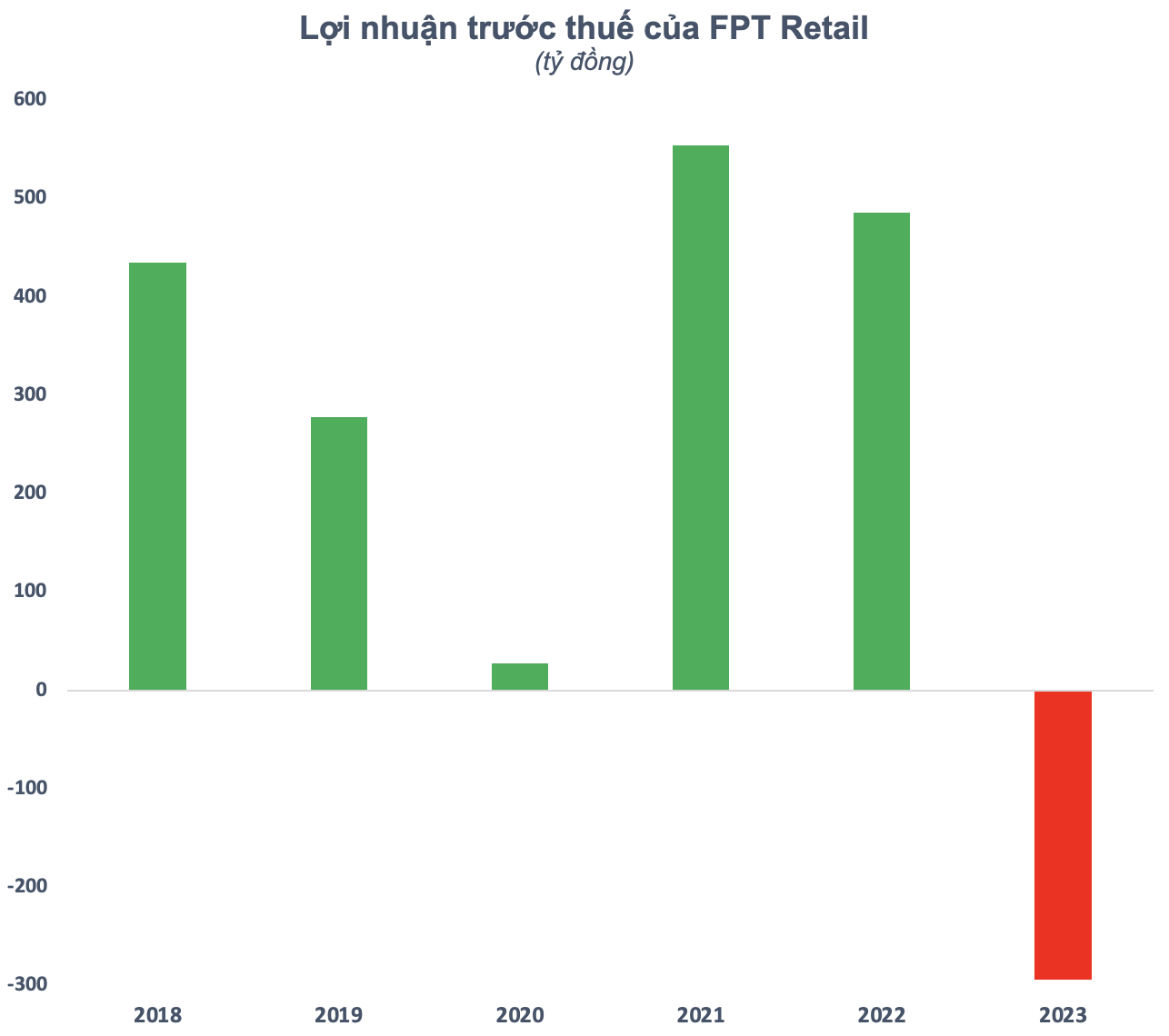

Also reaching a historic high, but the breakthrough momentum of FPT Retail (FRT) stock is even more impressive. After a year, the price of FRT has doubled to 125,000 VND/share, equivalent to a market capitalization of over 17,000 billion VND. This figure is more than 3 times higher than when FRT shares were first listed on the stock exchange nearly 6 years ago.

Notably, FRT’s breakthrough came at a time when the ICT retail industry (one of the pillars of FPT Retail) faced many difficulties due to weak purchasing power. In fact, in 2023, FPT Retail incurred losses in 3 out of 4 quarters, with a full-year pre-tax profit of negative 294 billion VND. This is the first year that this retail company has incurred losses since its listing.

However, FPT Retail still receives positive signals from Long Chau, the main growth driver in the future. Only in Q4/2023, the revenue of this pharmacy chain increased by about 60% to nearly 5,000 billion VND. This is the first quarter that the revenue of FPT Retail’s pharmacy chain has surpassed that of the ICT retail chain.

In 2023, FPT Retail continued to expand the Long Chau chain with 560 new stores, bringing the total number of pharmacies generating revenue to 1,497. This makes Long Chau the largest pharmacy chain in Vietnam. The average monthly revenue per pharmacy is still maintained at 1.1 billion VND in 2023, and new stores only need about 6 months to break even.

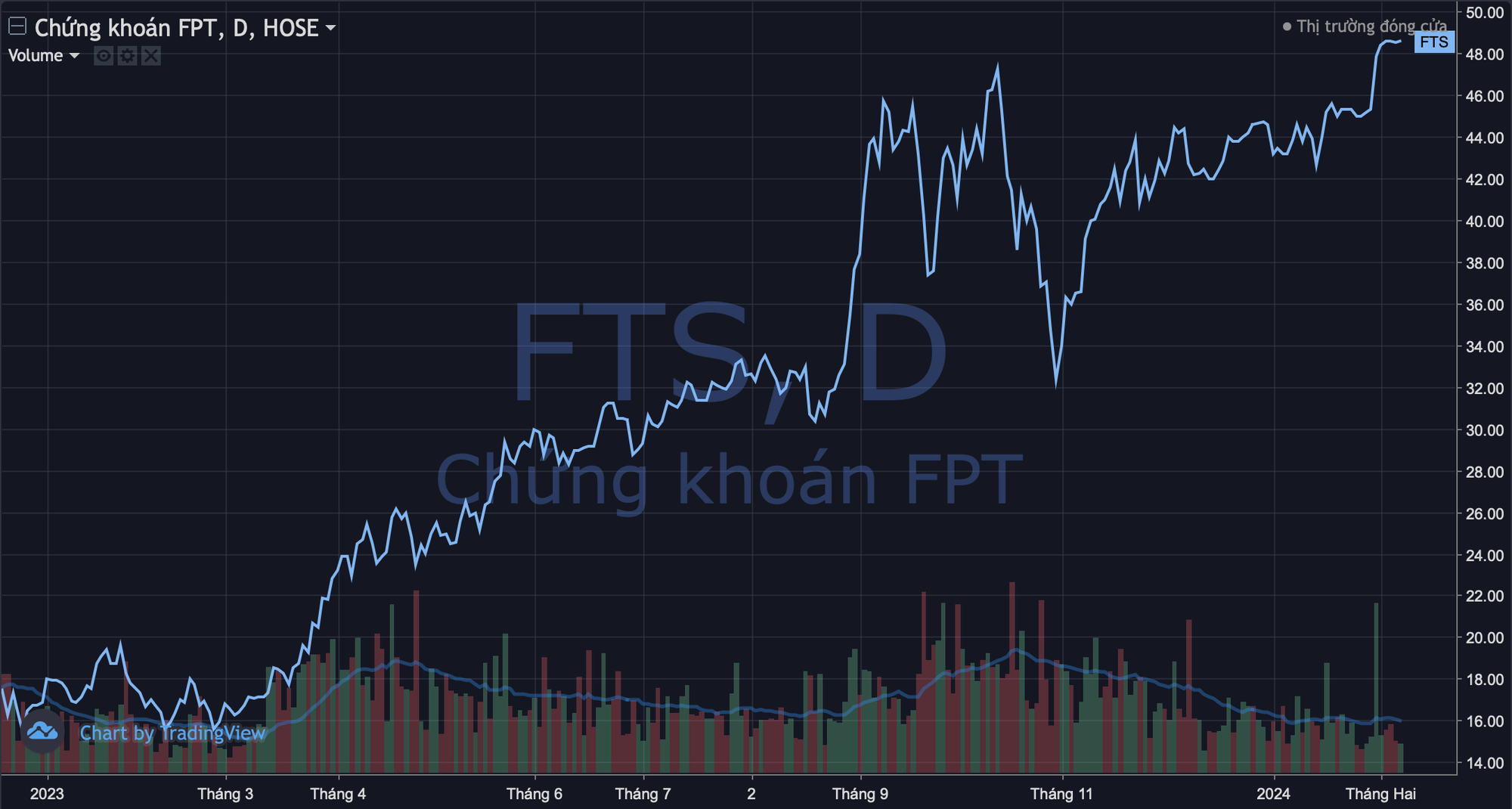

FPTS (FTS) – The stock that increased several times

Although it has not surpassed its all-time high in the Year of Quy Mao, FPT Securities’ stock (FPTS, ticker FTS) has made a very strong impression with a growth rate of up to 150%. This stock is currently trading at 48,650 VND/share, equivalent to a market capitalization of over 10,400 billion VND. This figure is only about 6% lower than the highest level that this securities company has ever reached in November 2021.

Similar to FRT, FTS stock has grown strongly despite not having a truly prosperous business situation. In Q4/2023, FPTS recorded operating revenue of over 181 billion VND, a decrease of 17% compared to the same period in 2022, mainly due to poor proprietary and brokerage performance. After deducting expenses, FPTS achieved a pre-tax profit of 63.6 billion VND, a decrease of 42% compared to Q4/2022.

However, the accumulated pre-tax profit for the whole year still increased by nearly 23% compared to 2022, reaching nearly 542 billion VND, an increase of 23% compared to 2022. With the results achieved, this securities company has exceeded its annual profit target.

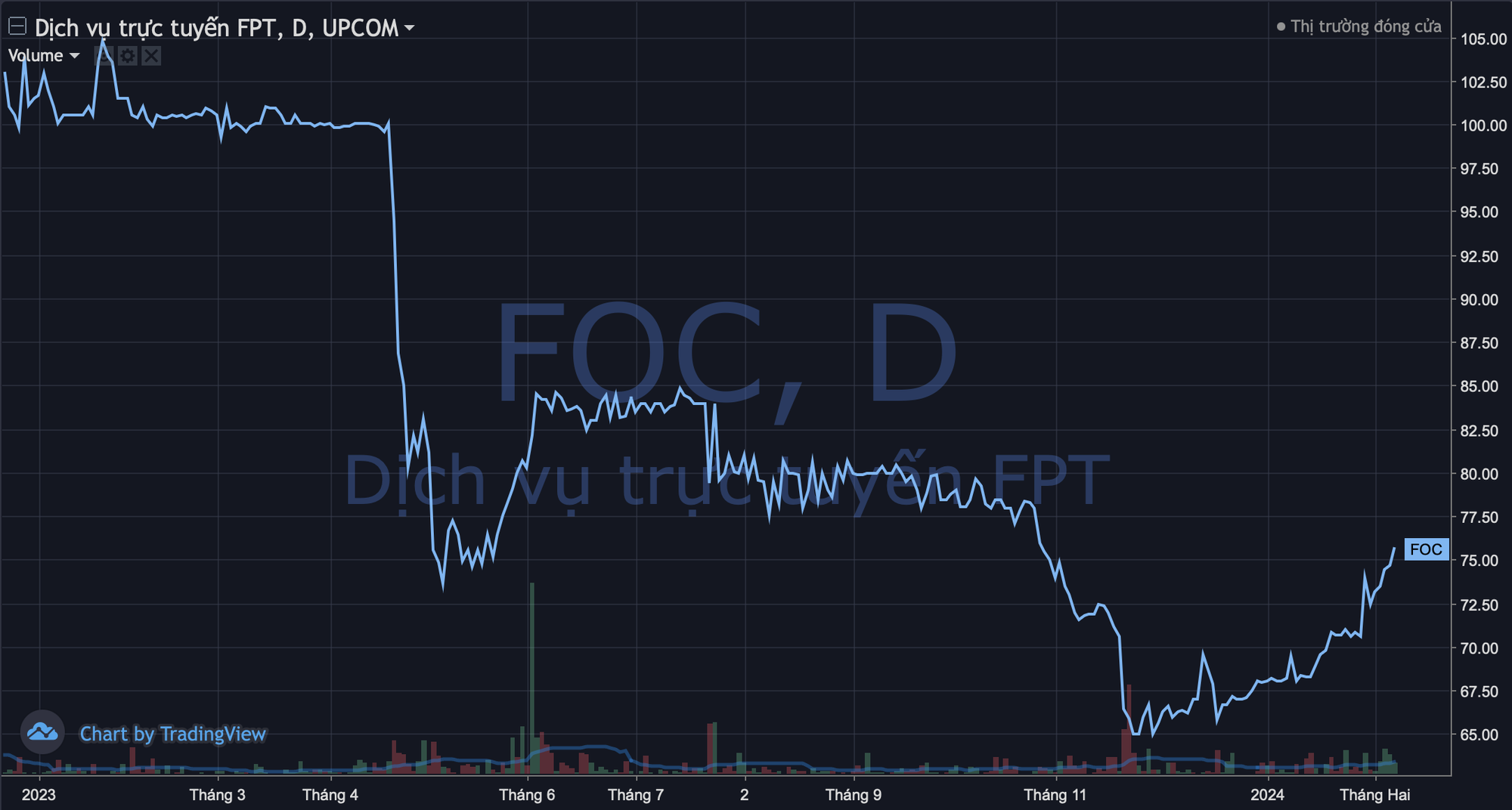

FPT Online (FOC) – Stock with declining profit

The most different in the “FPT” group, FPT Online (FOC) had a forgettable Year of Quy Mao as its price decreased by nearly 27%. This stock even reached its lowest price since its listing. Its market capitalization is 1,400 billion VND, the smallest among FPT’s companies on the stock exchange.

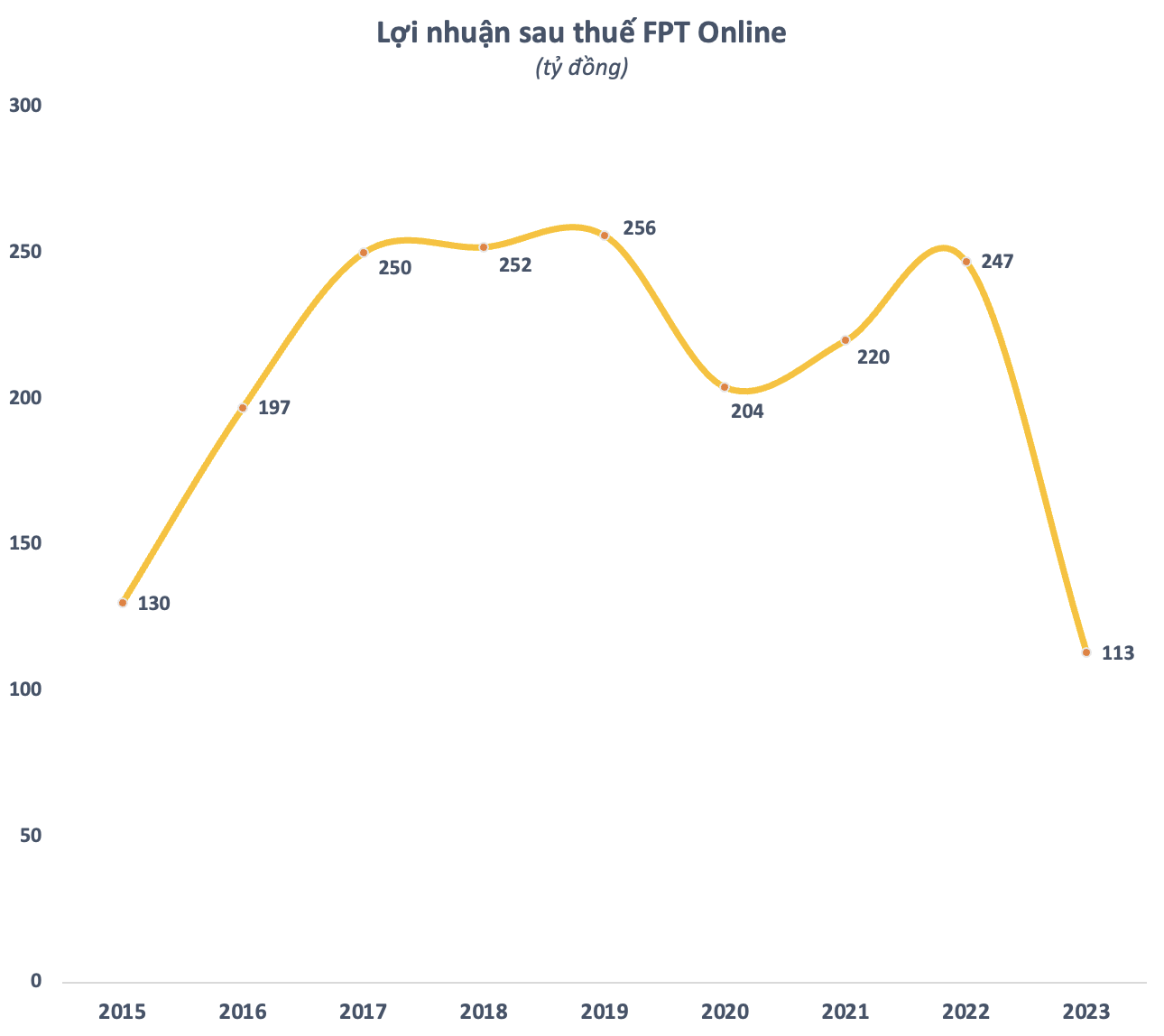

FOC’s decline coincides with the declining profit of FPT Online. In Q4/2023, the company recorded net revenue of 207 billion VND, a slight decrease compared to the same period. After deducting expenses, after-tax profit decreased by nearly 15% compared to Q4/2022, reaching 47 billion VND.

For the whole year 2023, FPT Online achieved net revenue of 620 billion VND, a decrease of 20% compared to the previous year. After-tax profit reached 113 billion VND, a decrease of 54% compared to the performance in 2022. This is the lowest profit that this company has achieved since 2015.