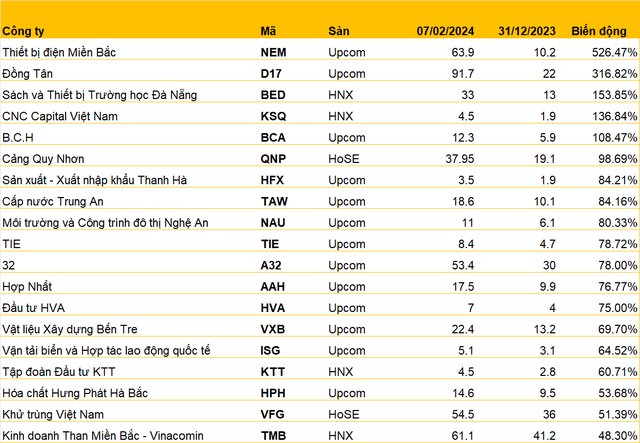

Leading the list is Northern Electricity Equipment Joint Stock Company (Upcom: NEM), though newly listed on January 5 and first traded on January 15, this stock has achieved an impressive growth rate with its stock price on February 7 at 63,900 VND/share, a 526% increase. NEM shares have experienced 13 consecutive limit up sessions from January 15 to January 31, the company explains that the upward trend is due to the demand of the stock market and the trading needs of investors in the market.

Currently, Ms. Tran Thi Thu Thuy, a member of the Board of Directors and General Director, owns nearly 3.2 million NEM shares, accounting for 35.98%; Ms. Nguyen Thi Phuong – a member of the Board of Directors owns over 2.3 million shares, accounting for 26.26%, and Ms. Vu Thi Thu owns 2.3 million shares, accounting for 26.04%.

In second place, another newly listed stock on Upcom, Dong Tan Joint Stock Company (D17) has skyrocketed from 22,000 VND/share to 91,700 VND/share, a 317% increase with a series of 10 consecutive limit up sessions from January 17 to January 30. Notably, the trading volume of D17 shares per session is only about 100 – 200 shares.

In addition, there are also stocks of Da Nang School Books and Equipment Joint Stock Company (BED) increased by 154%, CNC Capital Vietnam Joint Stock Company (KSQ) increased by 137%, and B.C.H Joint Stock Company (BCA) increased by 108%. In total, there are 5 stocks that have increased by over 100% from the beginning of the year to before the Lunar New Year.

Stocks with the highest price increase from the beginning of the year to Lunar New Year 2024

Listed on Upcom since January 11 and continuously limit up for the first 4 sessions since listing date, Consolidation Joint Stock Company (AAH) has increased by 77% from the beginning of the year to now.

AAH is one of the leading coal mining and trading units in Bac Giang province with a 15-year history. The company’s annual coal output is about 180 million tons of commercial coal. The geological coal reserves granted are 4,177,004 tons.

In the top 20 highest increasing stocks, there are 2 stocks listed on HoSE, including Quy Nhon Port Joint Stock Company (QNP). Previously, more than 40.4 million QNP shares officially “moved” from HNX to HoSE on January 18, 2024, and continuously limit up for 11 sessions. As of Lunar New Year, QNP shares have increased by 98.69%.

QNP recorded a strong profit increase in 2023. Specifically, in 2023, Quy Nhon Port recorded VND 938 billion in revenue, a 12.3% decrease compared to the same period last year. Deducting costs, the company’s after-tax profit reached VND 112.3 billion, an increase of 154% compared to 2022.

In addition, the remaining stock listed on HoSE is Vietnam Fumigation Joint Stock Company (VFG) with a 51% increase from the beginning of the year to the Lunar New Year.

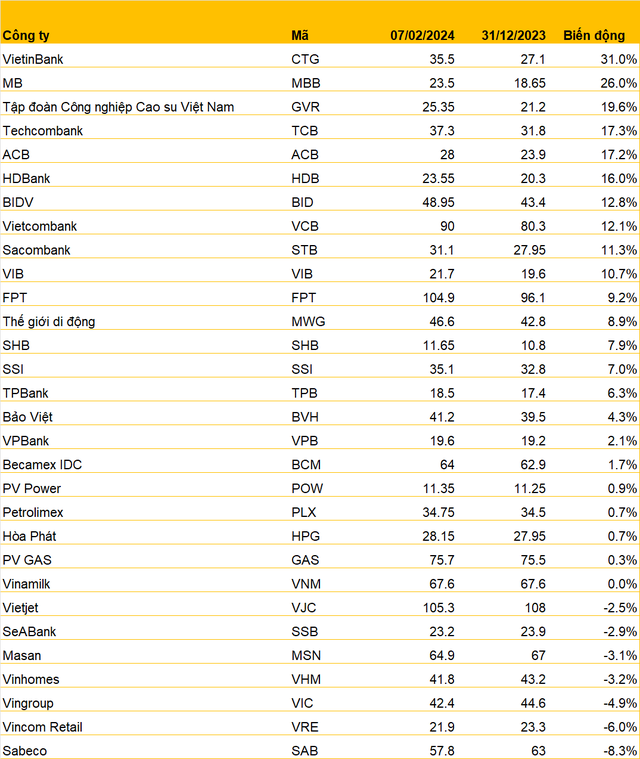

VN30 group stock performance since the beginning of the year to Lunar New Year 2024

In the VN30 group, VietinBank (CTG) leads in terms of stock price growth rate with a price on February 7 of 35,500 VND/share, a 31% increase compared to the beginning of the year.

Significantly, the banking group almost occupies the top 10 except for the 3rd position with Vietnam Rubber Industry Group (GVR) when GVR stock price has increased by 19.6% since the beginning of the year.

The Q4/2023 financial statements with the business results of 2023 showed a sharp decrease when the increasingly fierce competition forced Mobile World Investment Corporation (MWG) to engage in a price war. This retail company recorded a revenue decrease of over 11% compared to 2022, reaching nearly 118.280 trillion VND. Net profit reached nearly 168 billion VND, evaporating 96% compared to 2022 and only accounting for 4% of the annual target set. However, MWG stock price still increased by 8.9% since the beginning of 2024.

There are 7 VN30 group companies whose stock prices have decreased, including 1 bank, SeABank (SSB), and 3 Vin related stocks including Vingroup (VIC), Vinhomes (VHM), and Vincom Retail (VRE). The VN30 stock that has decreased the most is Sabeco (SAB) with a decrease of 8.3% since the beginning of the year.