House Prices and CPI

Hung (an office worker in HCMC) said that this year, renting a house is something that gives him a headache as the rent prices in places near his workplace have increased. In the middle of 2022, he found a studio apartment in Phu Nhuan district with a rent of 3-3.2 million VND/month (excluding electricity and water), but now it has increased to 4-4.5 million VND/month. If you factor in electricity, water, and management costs, the rent price can go up to 5-5.5 million VND/month.

Hung’s family moved to an apartment on Pham Van Dong Street, Go Vap District for the convenience of his wife’s work and his children’s education. She rents a house with 1 ground floor and 2 floors in an alley near Mega Market supermarket, District 12, for 12 million VND/month, an increase of 2 million VND compared to a year ago.

Phuc, for the past 3 years, has moved to an apartment near Tan Son Nhat Airport for the convenience of his wife’s work at the airport, so he rents a house in the Thach Da market area, Go Vap District. The house, which used to be rented for 8 million VND/month, has been increased to 9.5 million VND/month for the past 3 months. Tenants continuously come to him, and as soon as someone leaves, there is always someone new looking to rent.

Some other tenants said that the rent prices have been stable for about a year, but the electricity and water prices have increased by an additional 20-30%.

According to the General Statistics Office, the average basic inflation in 2023 increased by 4.16% compared to 2022, 0.91% higher than the average CPI increase. The main reasons for the CPI increase in the past year, as pointed out by the Ministry of Finance, were: apart from the education group, which increased by 7.44% compared to the previous year due to localities raising tuition fees according to the roadmap, the housing and construction materials group increased by 6.58%, impacting the overall CPI increase by 1.24%. This housing group price index is influenced by the increase in cement and sand prices, pushing up the prices of inputs and thus increasing rental prices.

|

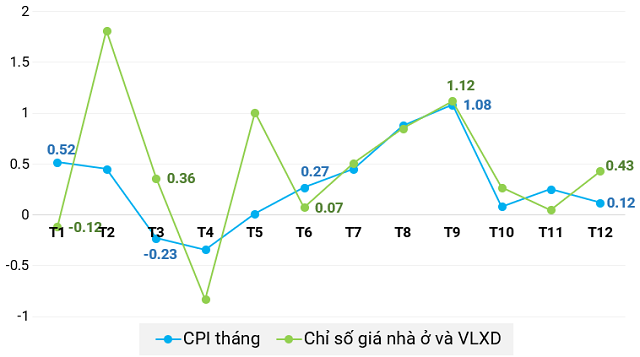

CPI index, housing and construction materials index by month change compared to the previous month (in 2023) – Unit: %

Source: Compiled by the author

|

|

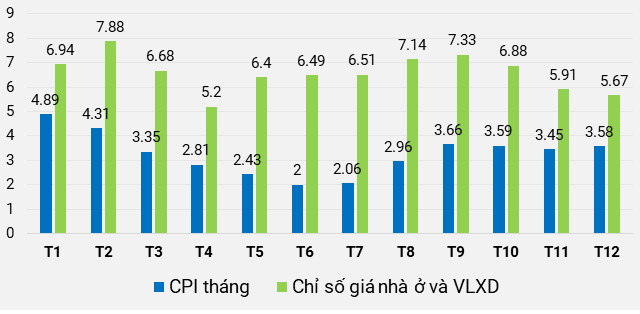

CPI index, housing and construction materials index by month (in 2023) change compared to the same period last year – Unit: %

Source: Compiled by the author

|

|

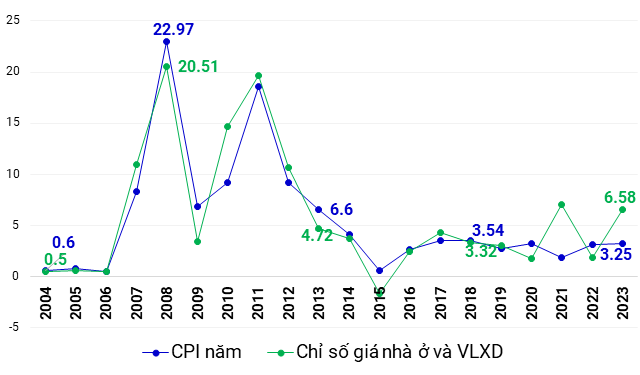

CPI index, housing and construction materials index over the period 2004-2023 (change compared to the previous year) – Unit: %

Source: Compiled by the author

|

It can be seen that in 2023, despite the real estate market liquidity remaining stagnant, the housing index still has a strong impact on the CPI. If we look at the past 3 years, 2021 was the peak of the real estate boom and saw a double-digit increase in average house prices. The shock of 2022 brought the market crashing down, but in 2023, on the low base of the previous year, housing and construction materials prices increased almost double compared to CPI.

Why are house rents increasing?

These statistics show that the increase in house rents is a reality that has been occurring recently when housing prices have exceeded the affordability of many people.

A report on real estate trends and consumer psychology by Batdongsan.com.vn notes that in the second half of 2023, among the 3 most common reasons for renting a house, the highest priority was flexibility (38%), followed by not buying a house because the prices are not reasonable (29%), and not having enough money to buy a house (26%).

In the first half of 2024, a survey showed that the top reason for people choosing to rent a house is not having enough money to buy a house, accounting for 33%; while the priority on flexibility decreased to 27% and not wanting to buy a house because of unreasonable prices decreased to 25%.

According to a survey by DXS-FERI, 63% of the reasons for people not deciding to buy real estate are related to finance. Changes in customer behavior also indicate that 71% prioritize renting a house, while only 29% prioritize buying.

Le Bao Long, the Director of Strategy at Batdongsan.com.vn, said that most Vietnamese people are only willing to spend 10-30% of their income on monthly rent. The average rent for apartments in Hanoi and HCMC is 3.5 and 4.8 million VND/month, respectively, while the average rent for condominiums in these two cities is 12.5-13 million VND/month. This means that for an individual or a family to be able to afford rent, their total monthly income must be around 15-20 million VND for renting an apartment and 30-40 million VND for renting a condominium. These income levels are not considered low for the majority of Vietnamese people. Therefore, high rent prices are a barrier for the people.

Rented segments that are “hot”

The segment that tenants prioritize the most is still condominiums, serving the housing needs, accounting for 43%; followed by renting private houses at 18%; renting rooms at 18%; renting storefront houses at 9%; renting offices at 5%; and others at 8%.

To overcome financial difficulties, Long suggests that tenants actively look for real estate with smaller sizes or located further away from the city center.

According to a report on real estate trends and consumer psychology (CSS) by PropertyGuru, in the first half of 2024, when asked about their adaptation plans in response to high rent prices, 67% of real estate consumers said they would choose smaller rentals, 27% would choose to rent further away, 20% would consider living with more people, and 13% would choose places with fewer amenities. In the context of most tenants trying to tighten their budgets and expecting more reasonable prices, 70% of landlords are also willing to reduce rents, with the most common reduction being less than 10%.

Nguyen Minh

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)