January effect?

To analyze the period that generates the best return on investment (ROI) in a year, we need to calculate the superior ROI (excessive profit) of the VN-Index. This superior ROI is calculated by subtracting the average annual ROI from the monthly ROI. For example, the superior ROI of March 2023 is calculated by subtracting the March 2023 ROI (3.9%) from the average annual ROI of 2023 (0.96% per month or 12.2% per year), resulting in a superior ROI of 2.94% for March 2023.

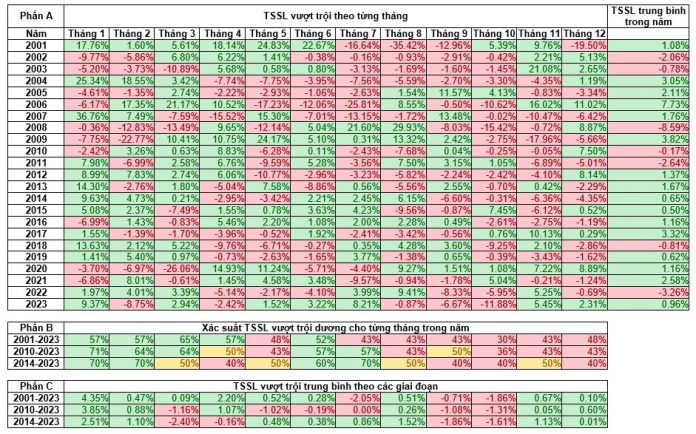

Table 01 presents statistical data on the superior ROI of each month for different time periods. In Column B, it shows the percentage of months in a year with a positive superior ROI, while Column C represents the average superior ROI of the months in a year. For example, in July of each year, Column B shows that out of the period from 2014-2023, 7 out of 10 years (70%) will have a positive superior ROI, while Column C shows that the average superior ROI over the 10 years (from 2014-2023) is 0.86%.

In addition, the superior ROI in table 1 is also divided into three different periods: 2001-2023, 2010-2023, and 2014-2023, to examine the consistency of the results. The reason comes from the characteristics of the Vietnamese stock market. Since the Vietnamese stock market has only been active for 24 years, including some early stages before 2007, there may be an impact on the statistical results. Therefore, dividing into different periods can help us have a better understanding of the ROI over those periods.

|

Table 1. Superior ROI of VN-Index for different periods

|

According to Table 1, the probability of January and February having a positive superior ROI is the highest and most consistent among the periods from 2001-2023, 2010-2023, and 2014-2023. Specifically, the highest superior ROI in January is about 2.51% if calculated for the period from 2014-2023 and 3.85% if calculated from 2010. This is followed by February with a superior ROI ranging from 0.88% to 1.10% depending on the period.

The tendency of January to have a better ROI than the remaining months of the year implies the existence of the January effect in the Vietnamese stock market.

Therefore, the best period to generate superior ROI with stocks on the HOSE exchange will be the January-February period each year. Holding stocks during these 2 months can result in a superior ROI of around 4%. Note that this superior ROI represents the excess profit over the average annual ROI.

Holding stocks in February

For the Hanoi exchange, the HNX-Index will be used as a representative. Table 02 shows the statistics on the superior ROI for different years and periods. The results are slightly different from the VN-Index as the highest growth probability of the index is in February and March each year. If we consider the past 10 years, February has the highest probability in 8 out of 10 years, and March has the highest probability in 8 out of 10 years. Additionally, this is also the period that generates the best superior ROI in a year, with a range of 3.12%. Therefore, standing on a high probability and good returns, February each year will be the best period to hold stocks on the HNX-Index.

If we consider lower growth probabilities (above 50%), the best period to generate good returns on the Hanoi exchange will be significantly expanded. According to this, the period from November of the previous year to March of the following year will be a good period to hold stocks with high profit. However, there are some months in this period that have a low probability of generating a positive superior ROI, such as November, December, and January each year.

|

Table 2. Superior ROI of HNX-Index for different periods

|

Tran Truong Manh Hieu – Head of Securities Analysis at KIS Vietnam