Illustration photo

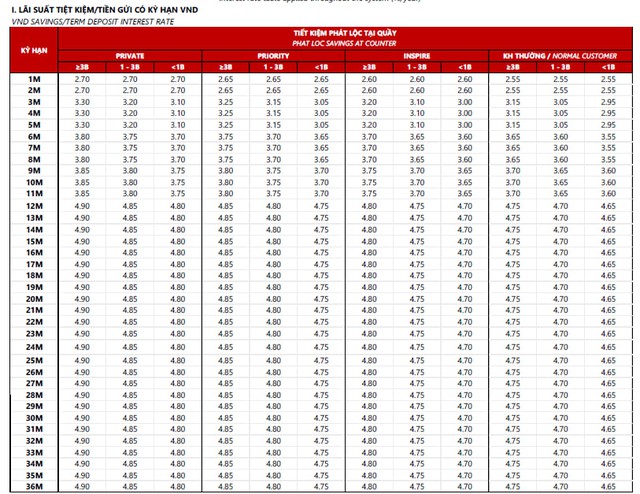

Techcombank Vietnam Joint Stock Commercial Bank (Techcombank) has just announced the application of new deposit interest rates from February 16, 2024. Accordingly, Techcombank has simultaneously increased the deposit interest rates by 0.2 percentage points for terms of 1 – 5 months and maintained the rates for other terms compared to the announced interest rate table on February 3.

Specifically, for “Phat Loc tai quay” deposit product, the applicable interest rate for terms of 1 – 2 months ranges from 2.55 – 2.7% per year; for 3 – 5 months, the rate is 2.95 – 3.3% per year; for 6 – 8 months, the rate is 3.55 – 3.8% per year; for 9 – 11 months, the rate is 3.6 – 3.85% per year; and for 12 months or more, the rate is 4.65 – 4.9% per year. The interest rates for each term will vary depending on the customer segment and deposit amount.

Source: Techcombank

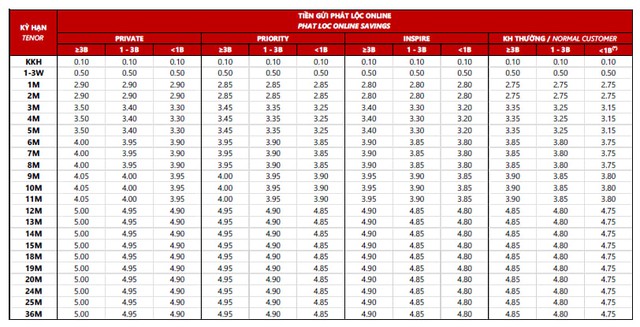

For online deposit, the applicable interest rates will be 0.1 – 0.2 percentage points higher than those for in-person deposit.

Specifically, for terms of 1 – 2 months, the interest rate ranges from 2.75 – 2.9% per year; for 3 – 5 months, the rate is 3.15 – 3.5% per year; for 6 – 8 months, the rate is 3.75 – 4.0% per year; for 9 – 11 months, the rate is 3.8 – 4.05% per year; and for 12 months or more, the rate is 4.75 – 5% per year. The interest rates for each term will also vary depending on the customer segment and deposit amount.

The highest deposit interest rate currently applied by Techcombank is 5% per year, for Private customers with terms of 12 – 36 months and a minimum deposit amount of 3 billion VND. For regular customers, the highest applicable interest rate is 4.65% per year, for terms of 12 months or more and a minimum deposit amount of 3 billion VND.

Source: Techcombank

Techcombank is the first bank to adjust interest rates upwards after the Lunar New Year holiday. However, the deposit interest rates at this bank still belong to the lowest group at present.

Currently, the highest deposit interest rates applied by state-owned commercial banks range from 4.7 – 5% per year, while those of private banks are mainly in the range of 5 – 5.8% per year.

In a newly published analysis report, KB Securities (KBSV) forecasts that the deposit interest rate landscape will continue to remain low in most of 2024 due to various factors.

The first factor is that credit demand is likely to recover, but with no significant breakthrough. The lingering difficulties from 2023 have yet to be completely resolved in the next year. Vietnam’s economy is forecasted to grow at around 6% with real estate, a sector with a high contribution to credit growth, not being able to fully recover. Therefore, the pressure on interest rates from the demand side will not be significant. KBSV forecasts credit growth to reach around 13.5% – 14.5%, lower than the target of 15% set by the State Bank of Vietnam in 2024.

The second factor is that the monetary policy of the State Bank of Vietnam is still easing as inflation and exchange rates cool down. Specifically, with inflation trending downward in most major economies, including the United States and China, the 2 leading engines of global economic growth, which are forecasted to have slower growth in the coming year, KBSV believes that global inflation will continue to trend downward in 2024, supporting Vietnam’s stable inflation. As for the exchange rate, the Federal Reserve’s reversal to lower interest rates in 2024 will help ease exchange rate pressures, making it less risky for Vietnam in 2024.

With these analyses, KBSV forecasts that the 12-month deposit interest rate will range from 4.85% – 5.35% in 2024.

Meanwhile, Military Commercial Joint Stock Bank Securities (MBS) forecasts that the deposit interest rate is likely to bottom out in Q1/2024 and is unlikely to decrease further mainly because credit demand is expected to increase in 2024. In the context of positive export growth at around 6 – 7%, both investment and consumption showing resilience on a low base compared to the same period last year, the analyst group believes that capital utilization will return to balance with the current excess liquidity situation.

MBS expects credit growth in 2024 to reach about 13 – 14%. However, in the opposite direction, there is not much pressure for interest rates to rise as the monetary tightening cycle of the United States has ended. With the Fed’s forecasted interest rate policy to be lowered to around 4% by the end of 2024, with no major exchange rate pressure, the State Bank of Vietnam will have room to maintain its current monetary policy.

“We expect the 12-month deposit interest rates of major banks to increase by 0.25 – 0.5 percentage points, returning to the range of 5.25% – 5.5% in 2024,” said MBS.

In a recent analysis report, Dragon Capital Securities (VDSC) also stated that the current deposit interest rates are very low, mostly due to weak capital demand in the economy, causing banks to have little pressure in deposit competition through interest rates – a situation often seen in times of vibrant economic activity in previous years.

In addition, the support level from Circular 26 for including State Treasury deposits in the Loan-to-Deposit Ratio calculation will gradually decrease starting from 2024, to some extent, which will gradually spread the rising cost pressure on deposits in the system.

“We believe that deposit interest rates may gradually increase in 2024, at the same pace as the recovery of economic activities,” VDSC evaluated.