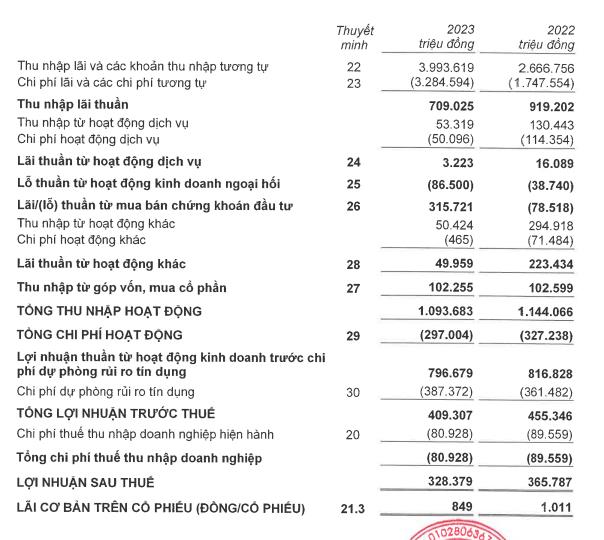

Accordingly, the audited financial figures for EVF in 2023 do not differ from the previously announced figures for the fourth quarter of 2023. Total interest income and similar income in 2023 reached VND 3,993.6 billion, an increase of 49.7% compared to 2022. However, due to the significant interest rate volatility in 2023, leading to a sharp increase in market-wide interest costs, EVF also faced significant interest expenses, resulting in a net interest income of VND 709 billion in 2023, a decrease of 22.8% compared to the net interest income in 2022.

In addition to net interest income, securities trading and equity investment activities are among the profit-contributing activities of the Company. A bright spot in EVF’s financial picture lies in the control of operating costs. Total operating expenses in 2023 are lower than 2022, improving the operational efficiency of EVF, as demonstrated by the CIR ratio of 27.16% in 2023, a decrease of 5% compared to 2022’s CIR ratio of 28.6%, significantly lower than the industry average (around 30%). According to the company, the reason why EVF was able to reduce its CIR ratio was due to the strong digitization of its business activities, integrating technology into every aspect of business to enhance customer experience and improve labor productivity, as well as proper human resource management in the business context. Good control of operating costs has contributed positively to EVF’s pre-tax profit in 2023.

In terms of basic earnings per share, with changes in the number of outstanding shares and changes in after-tax profit, EVF’s EPS in 2023 reached VND 849/share.

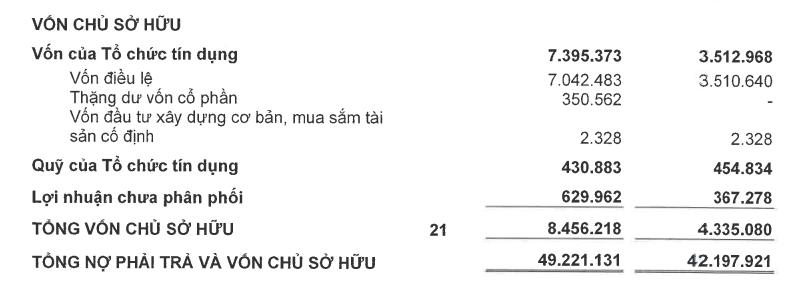

Regarding assets and capital, EVF’s total assets as of December 31, 2023 reached VND 49,221 billion, an increase of 16.6% compared to December 31, 2022. At the end of 2023, EVF successfully increased its charter capital 1:1 for existing shareholders at an issue price of VND 11,000/share and issued stock options for employees (ESOP) at a price of VND 10,000/share, resulting in an increase in EVF’s charter capital from VND 3,510 billion to VND 7,042 billion and for the first time, EVF has a capital surplus of VND 350.5 billion. Increasing charter capital and having a capital surplus will increase EVF’s proactive use of equity capital, as well as greatly improve financial ratios, especially the CAR capital adequacy ratio of EVF.

Early publication of the audited financial statements for 2023 is an important condition for EVF to hold its annual general shareholders’ meeting in 2024. In fact, on January 26, 2024, EVF announced that the final registration date to finalize the list of shareholders eligible to attend the 2024 annual general shareholders’ meeting is February 16, 2024.

In the stock market, for over a month, EVF’s stock price has been trading in the range of VND 15,500 – 18,000 per share.