In the Q4 2023 financial statements, VPH stated that 2023 was a challenging year for the company. VPH is trying to complete the legal procedures in order to implement the project.

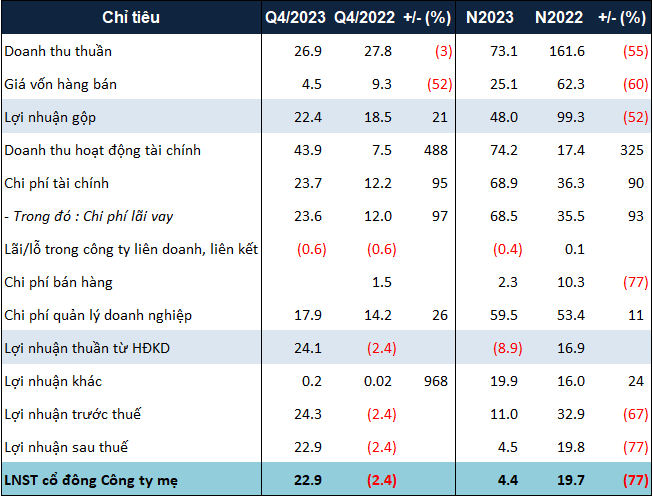

Accordingly, the net revenue for the whole year of 2023 only reached over 73 billion VND, a 55% decrease compared to the previous year. Of which, over 21 billion VND came from the transfer of a part of land in Nhon Duc commune, Nha Be district (Ho Chi Minh City).

On the other hand, financial revenue became a bright spot for the company when it recorded over 74 billion VND, 4.3 times the figure in 2022, thanks to the interest income from the share transfer in the fourth quarter.

Despite the significant increase in financial revenue, after deducting expenses, VPH only achieved a net profit of just over 4 billion VND, a 77% decrease. This is the lowest result of the company in the past 9 years (since 2015).

In addition, with a after-tax profit of 4.5 billion VND, VPH only achieved more than 6% of the set target of 69.2 billion VND for 2023.

|

Business performance of VPH in 2023. Unit: Billion VND

Source: VietstockFinance

|

In the balance sheet, the total assets of VPH as of December 31, 2023 amounted to nearly 2.4 trillion VND, a 6% increase compared to the beginning of the year. The largest item was inventory, which increased by 17% to nearly 1.2 trillion VND. On the other hand, the company’s cash holdings decreased sharply by 76%, to nearly 21 billion VND. Notably, the trade advantage accounted for only nearly 50 billion VND, a 55% decrease.

Meanwhile, the company’s liabilities increased by 10%, to over 1.3 trillion VND. Of which, the borrowings increased by 50% to nearly 793 billion VND, all of which were loans from banks or individuals, other companies.