Illustrative image

Oil rises due to Middle East tensions

Oil prices rose on Friday due to increased political tensions in the Middle East exerting a stronger-than-expected impact on the slowdown in demand from the International Energy Agency.

Brent crude oil ended the session up 61 cents, or 0.74%, at $83.47 a barrel. US West Texas Intermediate (WTI) crude oil for March delivery rose $1.16, or 1.49%, to $79.19 a barrel during the expiration session. The WTI crude oil contract for April rose 87 cents to $78.46.

Compared to a week ago, Brent crude oil prices increased by more than 1% and US benchmark crude oil prices increased by about 3%.

The increasing risk of conflict in the Middle East has supported crude oil prices. On Thursday, Hezbollah said it had fired dozens of missiles at a northern Israeli town, while threats remained in the Red Sea after a missile was fired from Yemen targeting a crude oil tanker en route to India.

Gold rises

Gold prices rose on Friday but fell for the second consecutive week after US inflation data spiked, dampening prospects of an early interest rate cut by the Federal Reserve.

Spot gold prices on the continental exchange in London ended the session up 0.4% at $2,012.86 an ounce, but fell 0.6% for the week. US gold contracts for April rose 0.5% to $2,024.1.

Data showed that US producer prices rose more than expected in January. A previous report showed that US consumer prices had risen more than expected the previous month.

Although gold is considered an inflation hedge, high interest rates reduce the attractiveness of gold bars.

In Asia, spot gold prices in India this week reached their highest level in more than four months as demand increased as jewelers stocked up for the wedding season, although activity was sluggish in other trading centers due to the Lunar New Year holiday.

Gold prices in India were traded around INR 61,600 per 10 grams on Friday, after reaching a record high of INR 65,040 earlier this month.

Copper rises

Copper prices rose on Friday, posting their strongest weekly gain in 11 months, supported by falling inventories and expectations that China – the world’s leading copper consumer – will provide more economic support.

The three-month copper contract on the London Metal Exchange (LME) rose 2.1% to $8,488 a tonne, rising 3.9% this week, the highest weekly increase since March last year.

Corn continues to decline, while soybeans rally

Soybean prices surged on Friday due to pre-weekend selling, a day after falling to their lowest level in three years.

Meanwhile, corn prices fell for the third consecutive session to a new three-year low under pressure from ample supply. Wheat prices also extended their decline to a two-and-a-half-month low.

At the close, the most active soybean contract rose 10 cents to $11.72 1/4 a bushel, and corn prices fell 1 1/4 cents to $4.16 1/2 a bushel. The most active wheat contract fell 6 1/2 cents to $5.60 1/2 a bushel and fell 6.1% for the week.

Cocoa plunges on profit-taking and demand concerns

Cocoa futures prices fell sharply on Friday as speculators decided to liquidate part of their long positions after a strong rise this year.

Cocoa prices for May delivery on the London exchange fell £171, or 3.6%, to £4,524 per tonne.

Cocoa prices for May delivery in New York fell even more, losing 4.7% to $5,341 per tonne.

Agents said speculators decided to sell off after the market could not continue its recent gains to all-time highs.

“That’s profit-taking, along with some concerns about demand as retail prices rise,” said a US-based cocoa broker, adding that the market is still supported in the medium term.

Coffee rises

Arabica coffee prices for May delivery rose 1.55 cents, or 0.8%, to $1.867 per pound, but this contract fell 2.5% for the week.

Brazilian rain – the world’s leading arabica producer – is boosting coffee crop prospects, while ICE-registered inventories are also putting pressure on prices.

Robusta coffee for May delivery rose 1.1% to $3,141 per tonne, down 2% for the week.

In Asia, Vietnamese coffee prices have started to cool but remain high as supply tightens and trading activity picks up after the Lunar New Year holiday, while Indonesian coffee prices rise due to limited supply.

S dak coffee in the Central Highlands is being sold at VND 78,900-VND 79,200 ($3.23-$3.24) per kg, down from VND 79,100-VND 80,000 before the holidays. Robusta coffee grade 2 (5% black and broken) is being offered at a premium of $150-$200 per tonne compared to the May contract traded on the London exchange.

In Indonesia, Sumatra Robusta coffee this week was quoted $550 higher than the March contract on the London exchange, up $10-20 from two weeks ago.

Rubber hits 7-year high

Rubber prices on the Japanese futures market rose for the fifth consecutive session to their highest level in seven years as the domestic stock market rallied, boosting investor sentiment, while the weak yen provided further support.

The July delivery rubber contract on the Osaka Exchange (OSE) rose 7.3 yen, or 2.53%, to 296.1 yen ($1.97)/kg, the highest closing level since February 20, 2017.

The Japanese yen fell 0.18% to 150.19 against the dollar, boosting Japanese stocks and investor sentiment in the rubber market as it made yen-denominated assets more attractive to foreign buyers.

The March contract on the SICOM platform of the Singapore Exchange last traded at 154.10 US cents/kg, up 0.65%.

Rice remains steady

Indian rice prices remained at record highs this week even as demand from African customers weakened, while Vietnam saw increased trading activity after the holidays.

Indian 5% broken rice was quoted at record levels of $542 to $550 per tonne this week, unchanged from the previous week.

In Vietnam, 5% broken rice was quoted at $637-$640 per tonne, compared to $635-$640 before the holidays. In Thailand, 5% broken rice was quoted at $610 per tonne, down from $630 the previous week, due to a weaker Baht.

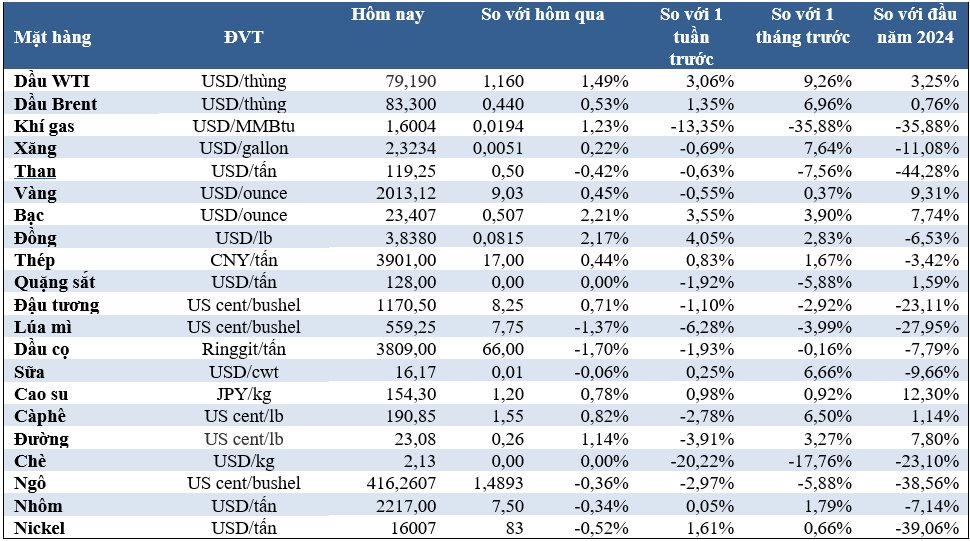

Price of key commodities as of morning February 17: