Warren Buffett’s Berkshire Hathaway sold 10 million shares of Apple in the last three months of 2023, reducing the stake of the group of stocks that the legendary investor calls the “four giants” that make up the majority of his investment portfolio.

According to the Financial Times, the shares sold above represent 1.1% of the Apple shares held by Berkshire. This is a notable move as Buffett said in 2021 that a previous decision by Berkshire to reduce its Apple holdings “may have been a mistake.”

In recent years, Apple has become an important part of Berkshire’s investment portfolio, currently accounting for about one-fifth of the total portfolio value. Buffett’s conglomerate, which invests in various sectors, including its stake in different industries from BNSF railroad to Geico insurance, first invested in Apple in 2016 following the investment direction of Buffett’s two deputies, Todd Combs and Ted Weschler.

Buffett himself has since pushed for further investment in the iPhone manufacturer as he saw the potential of the company. Berkshire has spent tens of billions of dollars to buy Apple shares. In 2022, Buffett revealed that Berkshire spent over $31 billion to buy Apple shares.

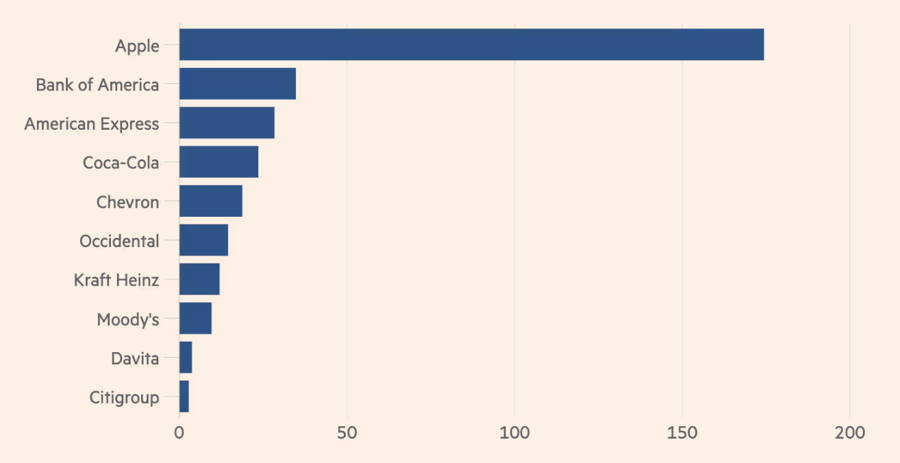

Buffett’s big bet on Apple has paid off. Even after the recent sale, Berkshire’s 5.9% stake in Apple is still valued at $174 billion at the end of 2023, according to data from the U.S. Securities and Exchange Commission (SEC). This stake value far exceeds the second-largest investment in Berkshire’s portfolio, which is its stake in Bank of America.

Berkshire’s SEC filing also shows that the conglomerate reduced its stake in printer and personal computer (PC) manufacturer HP, with a 78% decrease, which is equivalent to selling nearly 80 million shares of the company in Q4. Additionally, Berkshire also reduced its stake in Paramount Global by 32%, selling 30.4 million shares of the media company.

Berkshire’s acquisition of Paramount shares in 2022 attracted special attention from the media industry, as it was seen as Berkshire’s bet on the online content platform Paramount+ and its potential against financial heavyweights like Netflix, Disney, and Warner Bros Discovery. However, it is unclear whether Buffett himself made the decision to invest in Paramount from the start, or if it was the decision of his deputies Combs and Weschler.

Paramount’s controlling shareholder Shari Redstone has been in negotiations with potential partners to sell the company, as Paramount is trying to cut losses after an expensive price war that has put significant downward pressure on the company’s stock price.

Berkshire’s reduction in its holdings in these companies means that its stock count of billions of dollars in value in the investment portfolio decreased to 41 at the end of 2023, from 49 a year ago. Previously in 2023, Berkshire also divested from several other major stocks in its portfolio such as General Motors, UPS, and Procter & Gamble.