Continuing the upward trend from December 2023, VN-Index continued to record a (+3.04%) increase in January 2023 with money flowing into the “banking stock” group. The impressive rise of the Banking group since the end of December 2023 helped VN-Index surpass the fluctuations and enter a good upward trend towards the 1,200 point threshold.

The State-level visit of the General Secretary, the President of China to Vietnam along with the important decision of the National Assembly when approving 02 important amendment bills (Land, Credit Institutions) is expected to create a breakthrough in the near future. The business results of the 4th quarter of enterprises that are gradually being announced will reflect specific information about these enterprises and the stock differentiation will be clearer.

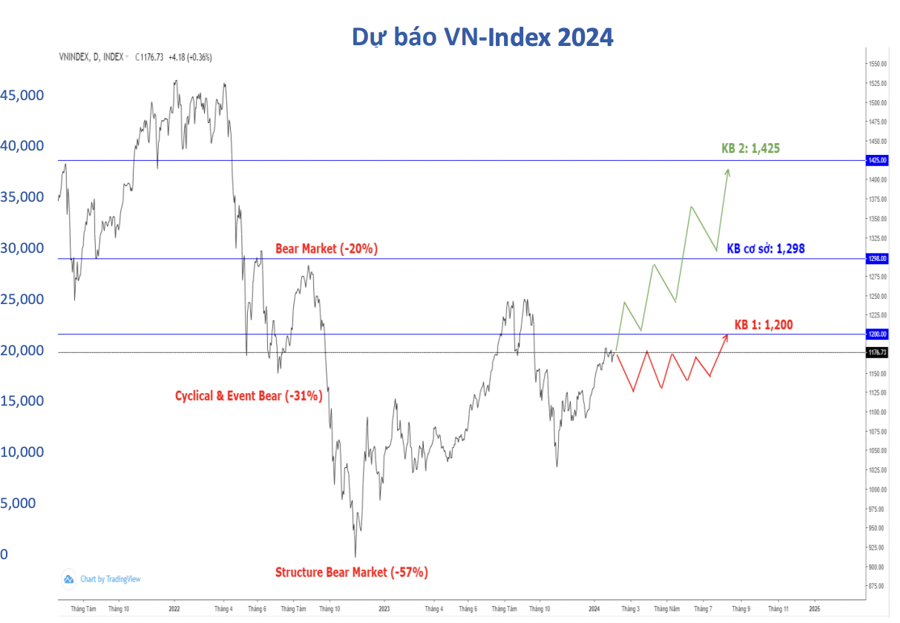

BSC Research has provided scenarios for VN-Index in 2024. Accordingly, in the positive scenario, VN-Index aims for 1,425 points; negative scenario close to 1,200 points; fundamental scenario 1,298 points with a higher probability.

2024 is expected by BSC to be the premise year in a new cycle for both the economy and the stock market. BSC believes that 2024 will show more opportunities compared to the relatively difficult baseline of 2023, with an expected profit decline of about -5%, creating a low support level for profit growth in 2024.

BSC has noticed that the current stage has many similarities to the 2014-2016 stage, the transition stage to a new cycle, including: Low-interest rate level to support economic growth; Strong focus on public investment; Export recovery and FDI wave returning. Therefore, BSC believes that the 2024-2025 period will be a transition period for a new growth cycle.

The investment shift of industry group will be more pronounced in 2024. As our industry shift predictions throughout the industry reports in 2023, some sectors continue to outperform VN-Index such as Financial Services, up 95.7% since the beginning of the year, Technology up 46.5%, Industrial up 42.3%, Basic Resources up 41.9%.

BSC expects money flow to gradually shift to industries related to Industrial – Manufacturing, Basic raw materials, Exports, Energy, Retail – Consumption, and Banking. Narrowing valuation gap will be the driving force for this trend based on two main factors: These are the industry groups with poor performance in 2023, but expected to record optimistic profit growth in 2024.

Accordingly, BSC forecasts that the expected profit growth in 2024 will recover by 17% compared to 2023. Several industry groups are expected to experience a strong profit recovery from the low baseline of 2023, including Raw materials (+103%), Aquaculture (+81%), Utilities (+48%), Retail & F&B (+45%), Textile (+44%), Fertilizer & Chemicals (+39%), Banking (+20%). With the economic recovery scenario, VN-Index profit growth in 2024 will record positive growth, supporting the return of the “bull market” trend.

Market valuation for stock groups is at a reasonable level for accumulation at the starting point of a new cycle, especially large-cap groups (Banks – Retail). Based on BSC’s projected profit growth in 2024, the P/E FWD 2024 for the mid-cap and small-cap groups (excluding banks and real estate) will be adjusted to 12.4 times, less than 1 standard deviation, thereby creating attractive investment opportunities in the medium and long term. Meanwhile, VNIndex 2024 FWD P/E is currently trading at 10.1 times, the lowest in the 5-year average history.