The index’s rise today was once again ensured by the group of non-bank stocks. Despite a significant decrease in liquidity due to a decrease in trading in financial stocks, other stocks have shown more signs of attracting money. VN-Index continued to advance for the 5th consecutive session.

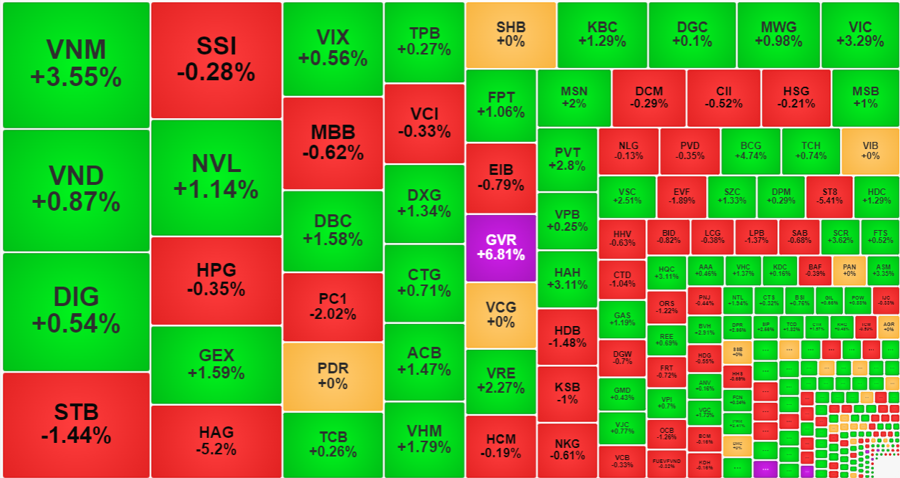

The closing index increased by 0.6% compared to the reference, equivalent to +7.2 points to the level of 1,209.7 points, with more than 6 points coming from the top 6 stocks: GVR increased to the ceiling limit of 6.81%, VIC increased 3.29%, VNM increased 3.55%, VHM increased 1.79%, GAS increased 1.19% and MSN increased 2%. The presence of the banking group has completely disappeared in the leading group of the index.

Furthermore, the stocks that lost points today were mainly banking stocks. BID led the decrease by 0.82%, VCB decreased 0.33%, HDB decreased 1.48%, STB decreased 1.44%, MBB decreased 0.62%, LPB decreased 1.37%. The banking sector still had 9 out of 27 stocks in the green, but only ACB increased significantly by 1.47%.

The phenomenon of rotation in the market leaders appeared in the morning and was well maintained in the afternoon session. Even some stocks exploded strongly. VNM made an impression with an increase of 3.55%, the strongest since late August 2023 and the largest liquidity in the market, reaching VND 770 billion and 11.1 million shares, the highest in 8 months. In the afternoon session alone, VNM increased by an additional 1% compared to the morning session and traded VND 331.5 billion, the highest in the VN30 basket. GVR was also very strong, regaining the ceiling price lost in the morning. Old market leaders such as VIC, VHM, MSN also expanded their price increases in the afternoon.

However, the overall liquidity in the afternoon session decreased by more than 28% compared to the morning session, HoSE and HNX only matched VND 7.828 trillion. HoSE alone decreased by 27% with VND 7.403 trillion. The main reason for this decrease came from the weak trading status of banking stocks. Specifically, the total trading value of HoSE for the whole day decreased by VND 1.115 trillion, while the banking sector on this exchange decreased by VND 2.102 trillion. Looking at these figures, there are positive signs when the overall decrease is slower than the decrease of banking stocks, which means that the remaining stocks have increased liquidity.

Banks only STB was among the top 10 largest trading stocks in the market today with VND 644.4 billion and deep price decrease. On the contrary, the impressive 1% increase in trading large stocks belonged to many other groups such as GVR, BCG, HAH, PVT, VSC, MSN, GEX, DBC…

This opens up the expectation that money will continue to circulate after profit taking in the banking group. Other stocks will gradually receive this money flow and improve their prices. Of course, the risk is that the banking group has a significant impact on the index, so it is likely that the market will be polarized and the index will go against the stock.

The breadth today also shows this when VN-Index’s declines do not go along with the narrowing of the number of stocks that increased. HoSE closed with 288 stocks up / 201 stocks down, of which 108 stocks increased by more than 1% with a liquidity concentration of nearly 34% of the exchange.

Foreign investors were a negative factor today when they sold a net of VND 402 billion on the HoSE exchange, and only in the afternoon session, they sold a net of VND 165.3 billion. Even VNM was heavily sold by this group with VND 122.9 billion despite the strong domestic money pushing up prices. Other big sell-offs were STB – VND 119 billion, VND – VND 83.6 billion, MWG – VND 52.8 billion, VIX – VND 47.2 billion, VCG – VND 47.2 billion, DGC – VND 33.5 billion, HCM – VND 32.9 billion, HDB – VND 32.5 billion… The net selling value today is quite large, and from the beginning of February 204 to now, the total net selling value of stocks on HoSE has been over VND 1.231 trillion.