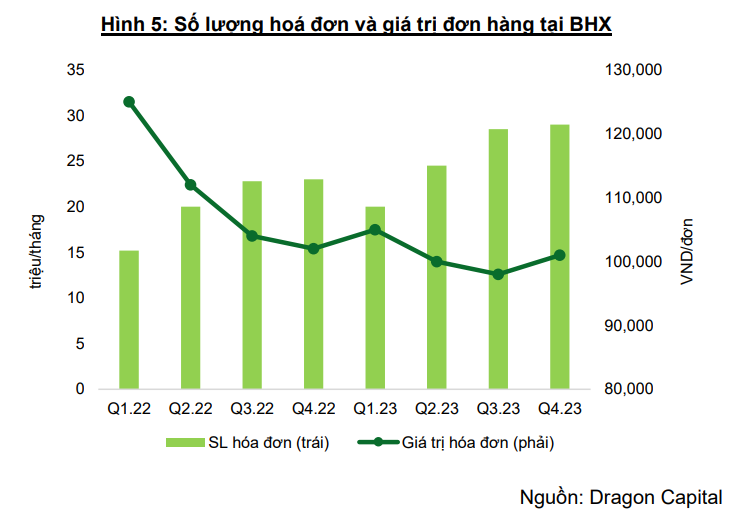

According to VCBS’s latest report on Mobile World Investment Corporation (MWG), VCBS stated that after restructuring, Bach Hoa Xanh’s revenue has shown good growth. Bach Hoa Xanh has successfully attracted new customers with a 20% increase in purchase volume, and key products with increased sales include: fresh products with a 35-40% increase and FMCG products with a 5-10% increase compared to the same period last year.

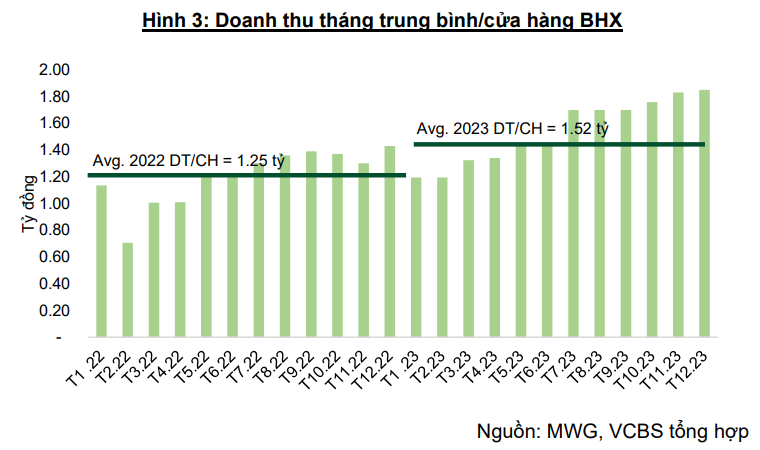

Bach Hoa Xanh’s monthly/store revenue continues to improve significantly, averaging 1.52 billion VND/month, a 21% increase compared to the same period. In December, Bach Hoa Xanh reached breakeven point with a revenue of 1.8 billion VND/store/month.

VCBS sees this as a very positive point for MWG in the context of the key business sector experiencing serious decline, paving the way for capital recovery prospects and profitability for the entire chain by 2024.

VCBS believes that Bach Hoa Xanh’s revenue in 2024 can increase significantly by 15-20% thanks to the gradual recovery of invoice value to the Q1.22 peak and the continuous increase in purchase volume due to positive impacts of focusing on providing fresh products with reasonable prices.

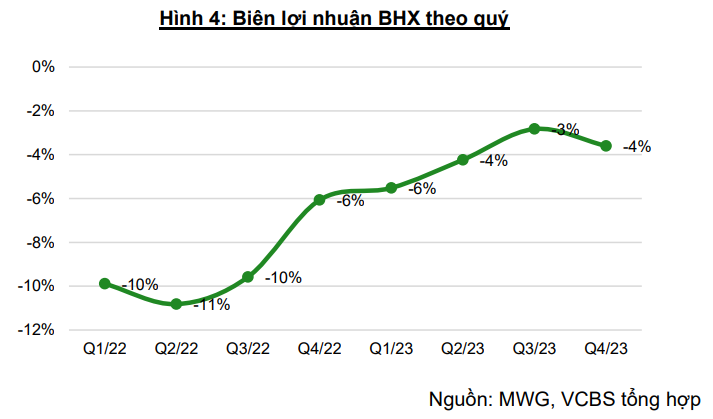

In 2023, Bach Hoa Xanh recorded a net loss of 1,200 billion VND, with a net margin of -3.8%. In 2024, VCBS expects Bach Hoa Xanh to generate a total chain revenue of about 36,700 billion VND, an 18% increase compared to the same period, and a profit of about 300-400 billion VND in 2024 based on the following assumptions: Revenue growth of 15% in 2024 based on a 15% growth in revenue of existing stores and the opening of 50 new stores by Bach Hoa Xanh, SG&A costs improving by about 5% compared to 2023 due to cost optimization in logistics and sales management.

In January this year, Bach Hoa Xanh Technology and Investment Corporation (BHX Investment Corporation) – the parent company of Bach Hoa Xanh, announced a resolution of the BOD regarding the plan to raise capital through private placement of ordinary shares to potential investors. The capital raising is expected to be completed in the first half of 2024.

The purpose is to serve the general business activities of BHX Investment Corporation and its subsidiaries. The number of shares to be offered for sale is expected to be from 5% to a maximum of 10% of the total shares of BHX Investment Corporation, depending on the actual capital utilization needs at the time of capital raising.

Under the initial plan, BHX Investment Corporation will issue private placements to investors with a maximum offer for sale of 20% of the shares. The issued shares will be offered to partners, investors in the region or worldwide (except direct competitors in Vietnam) to bring the best benefits to Bach Hoa Xanh and MWG with a reasonable purchase price.

However, according to the newly approved resolution, BHX Investment Corporation stated that with positive results and cash flow in 2023, the company does not need to raise capital up to the maximum 20% as initially planned.

The offer price has not been disclosed. Earlier, at the end of September, Reuters cited exclusive sources as saying that the valuation of Bach Hoa Xanh was about 1.5-1.7 billion USD, but this information was later denied by MWG’s representative.

At the online meeting updating the Q3 business results of MWG in mid-November last year, regarding the sale of Bach Hoa Xanh shares, the company’s management announced that they are in the negotiation process and will not comment to ensure the confidentiality of information.