CTCP Đầu tư Cao su Đắk Lắk (stock code DRI) has recently announced its consolidated financial statements for the fourth quarter of 2023, with a revenue of 148 billion VND – a slight increase compared to the same period last year. In that, rubber revenue still accounts for the majority with over 144 billion VND, banana revenue reaches 812 million VND, and notably, there is revenue from durian with over 2 billion VND.

This is the first quarter that DRI has recorded revenue from durian – a notable agricultural product in the past year with continuously high prices, bringing in billions of USD for the Vietnamese agriculture industry. Durian is also one of the three main products of Hoang Anh Gia Lai Group (HAGL, HAG) with a “huge” profit margin: 1 invested equals 5 gained.

In fact, according to DRI’s records, with a cost of only 365.4 million VND, this means DRI’s durian segment is achieving a profit margin of “1 invested equals 6 gained.”

According to Mr. Doan Nguyen Duc – Chairman of HAGL Group’s Board of Directors, durian has a very large market, as much as can be consumed. Mr. Duc said that currently only 10% of the Chinese population consumes durian due to its high price. If the price drops to 50,000 VND/kg, Chinese people will still eat it. Moreover, the United States and many other markets have also started to consume durian.

With the above reasons, Mr. Duc affirmed that durian can be priced down rather than not being sold. Another lucky thing for Vietnam is that China cannot grow durian due to its climate characteristics, even from Hai Van Pass onwards, it cannot be grown, leading to a limited supply of durian to the market, so the price keeps increasing instead of decreasing.

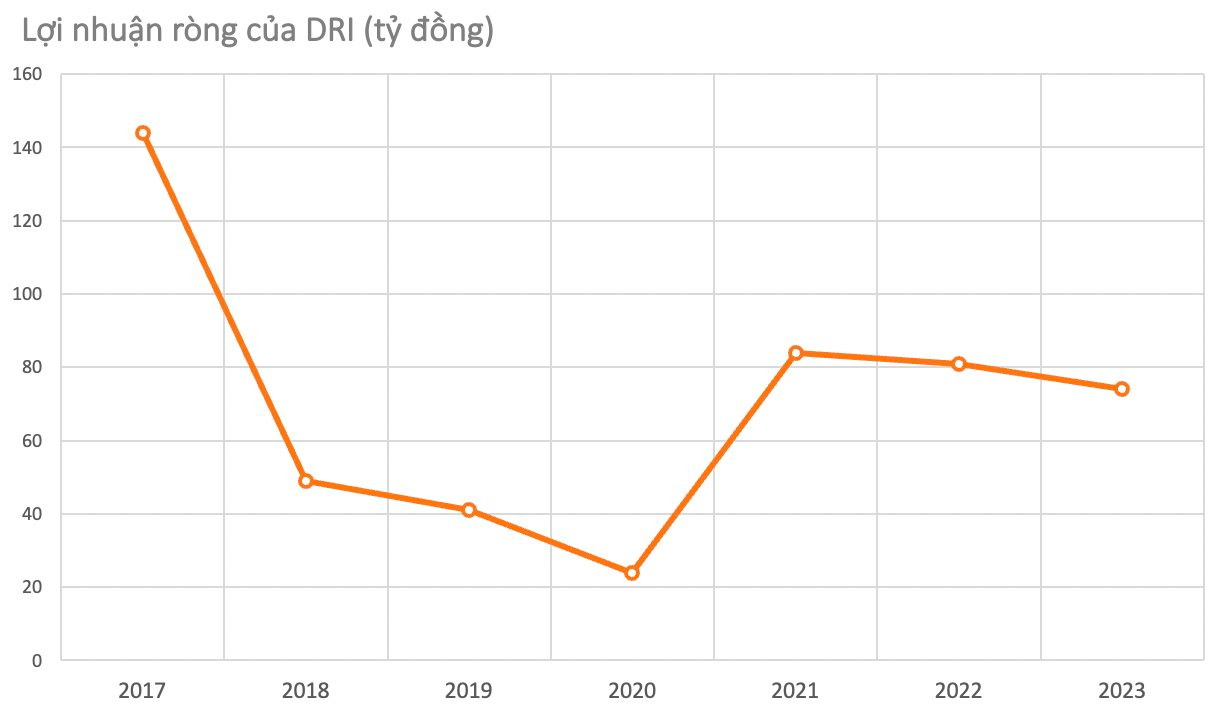

DRI’s financial statements for 2023 indicate that, excluding expenses, the company’s net profit reached 31.6 billion VND – a decrease of over 35% compared to the same period last year. Accumulated for the whole year of 2023, DRI achieved a revenue of 444 billion VND and a net profit after tax of 74 billion VND, both also decreased compared to the previous year.

As of December 31, 2023, DRI’s total assets reached 643 billion VND, with equity of nearly 538 billion VND.

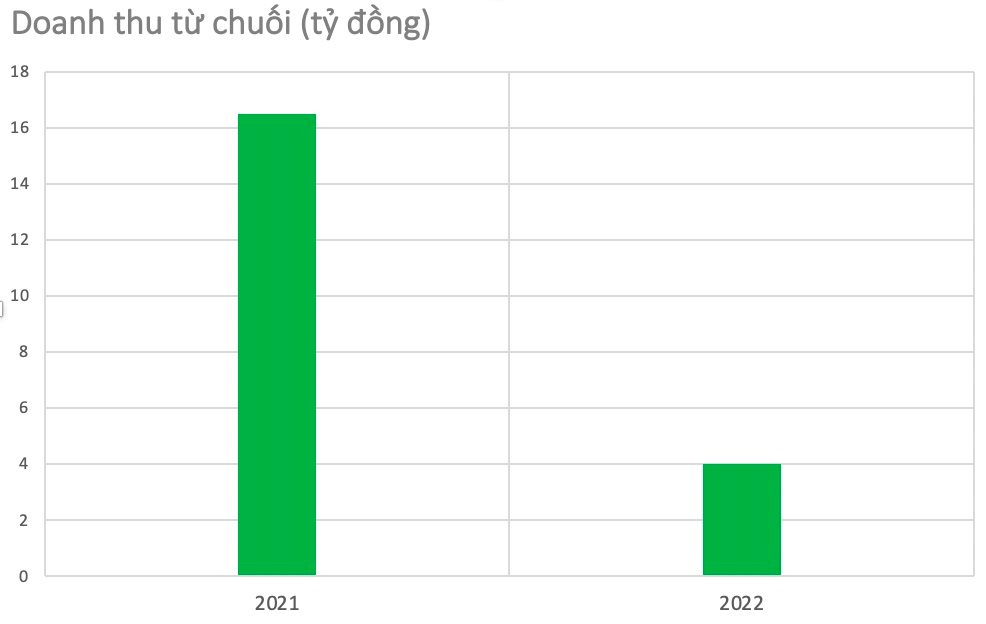

It is known that as a large rubber enterprise in the market, since 2018 the company has started to diversify its investments into bananas, avocados, and durians. In 2021, DRI began to record revenue from bananas with 16.5 billion VND, and it was also the year of strong fluctuations in rubber, causing DRI’s business performance to decline. In 2022, revenue from bananas decreased sharply to only 4 billion VND – less than a quarter of the previous year. In 2023, DRI has not specifically disclosed the revenue from the banana segment.