SCIC Investment Joint Stock Company (SIC) has registered to sell all 1.35 million MBB shares for financial investment purposes from February 20th to March 20th. The transactions will be conducted through matching and/or negotiation. If the transaction is successful, SIC will not hold any MBB shares.

SIC is an organization related to MBBank’s member of the Board of Directors – Ms. Vu Thai Huyen, the representative of the State Capital Investment and Business Corporation (SCIC), the owner of SCIC Investment Joint Stock Company at MBB.

Earlier, from January 17th to February 15th, SCIC has registered to sell all 3 million MBB shares. However, at the end of the trading period, the company only successfully sold 1.65 million shares through matching. The reason for not selling all shares is due to market fluctuations.

In the new year, many divestment plans at companies listed on the stock exchange will be implemented.

Sonadezi Corporation (stock code SZN) has just announced the minutes of the shareholder’s opinions on approving the Restructuring Plan of the corporation phase 2021-2025 and approving the production and business investment plan – development period with a approval rate of 99.6%.

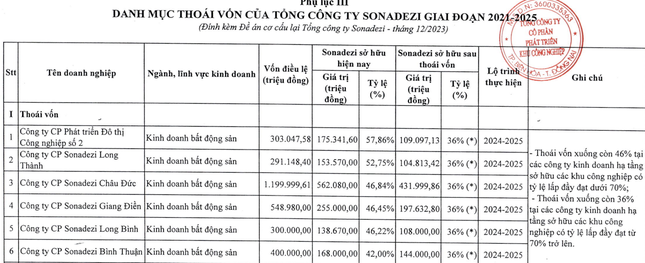

According to the restructuring plan phase 2021-2025, the corporation plans to divest from a series of subsidiary companies in the infrastructure, materials, construction sectors…

Six industrial park infrastructure companies including Sonadezi Long Thanh (code SZL), Sonadezi Chau Duc (code SZC), Sonadezi Giang Dien (code SZG), Sonadezi Long Binh (code SZB), Sonadezi Binh Thuan, and Industrial Development Urban Area No. 2 (code D2D) will be divested to remain 36% ownership.

The divestment proportion will depend on the land leasing situation. Units with an occupancy rate of less than 70% will be divested to 46% ownership, and units with an occupancy rate of over 70% will divest to 36%. Sonadezi will also divest its capital in Dong Nai Construction and Building Materials Joint Stock Company (code DND) from 52.59% to remain 36%.

Six industrial park infrastructure companies will be divested to remain 36% ownership.

Sonadezi plans to divest completely from 5 other units, including Dong Nai Construction Joint Stock Company with 40% ownership, Son Dong Nai (code SDN) with 30% ownership, Civil and Industrial Construction No. 1 Dong Nai with 15% ownership, Amata Bien Hoa Urban Area with 10% ownership, and Dong Nai Traffic Construction (code DGT) with 0.31% ownership.

Regarding the parent company Sonadezi, according to the Prime Minister’s decision on November 29th, 2022, the State will maintain a 99.54% ownership stake in Sonadezi until 2025.