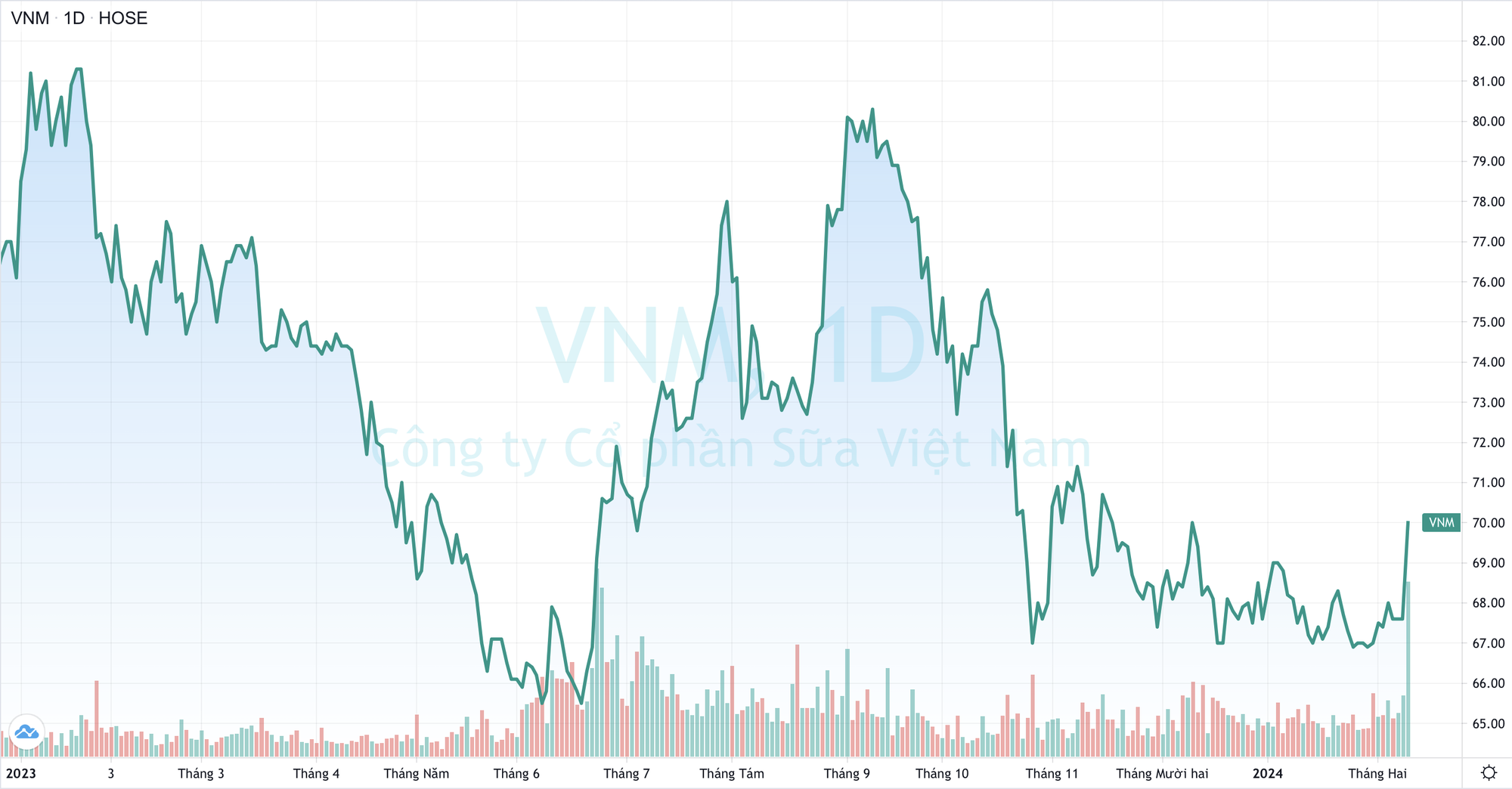

After a long period of consolidation, the stock VNM of Vietnam Dairy Products Joint Stock Company (Vinamilk) unexpectedly surged in the last trading session. The stock increased by 3.55%, reaching VND 70,000/share, the highest in 3 months. The corresponding market capitalization reached approximately VND 146.3 trillion (~ USD 6 billion).

Notably, a strong inflow of money poured into the leading dairy stock, pushing the trading volume to a record-breaking level of over 11 million shares, more than 4 times the average trading volume in the past year. This is also the second highest trading volume in the history of VNM stock, only behind the record session on June 23, 2023.

The strong breakthrough together with high liquidity has raised investors’ expectations for a new wave of VNM stock with promising sidelines, such as the listing transfer from UPCoM to HoSE of Moc Chau Dairy Cattle Breeding Joint Stock Company (Moc Chau Milk – stock code MCM). The listing on HoSE will contribute to enhancing the company’s value, increasing transparency in all aspects, both in production and business activities and in management, thereby ensuring benefits for shareholders.

Indeed, MCM stock has also performed well as the official listing date is approaching. Currently, Vinamilk holds more than 86% of the shares at Vietnam Livestock Corporation – JSC (Vilico – stock code VLC), and the parent company owns over 59% of the capital at Moc Chau Milk. The strong recent increase in MCM stock may have a positive impact on the revaluation of Vinamilk’s investment.

Positive business performance after restructuring

In addition to the aforementioned sidelines, the fundamental foundation of the company’s operations remains the most solid launchpad for a truly long-term wave. In 2023, Vinamilk made many efforts in corporate restructuring, notably with a brand identity change strategy.

The strategy aimed to meet the development of the new generation of consumers, expand the target customer base without age limitations, and promote the company’s image to global markets. Thanks to that, Vinamilk’s market share in 2023 improved compared to the same period in 2022, and Agriseco Securities expects that this strategy will help the company regain market share in 2024-2025.

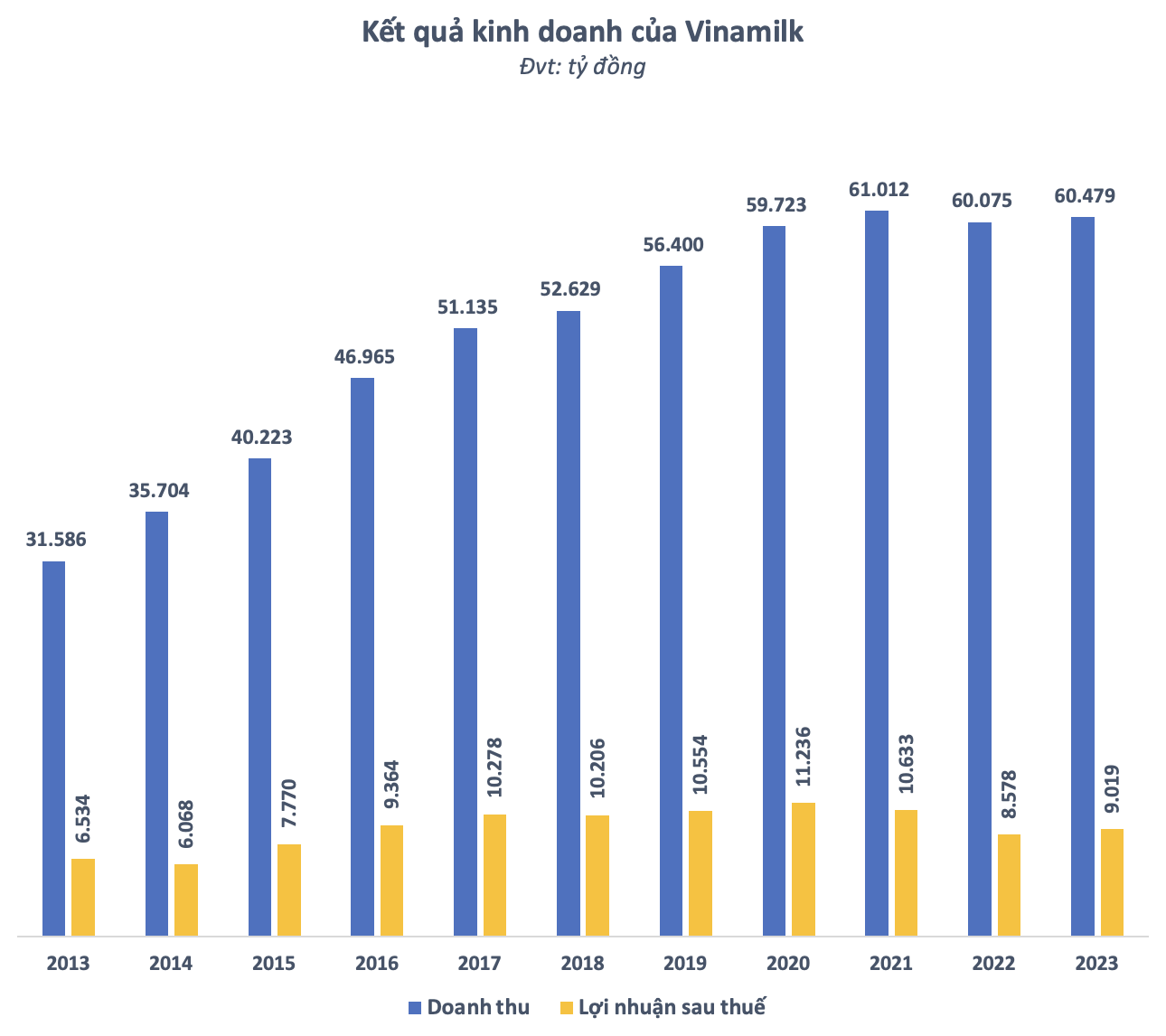

After changing the brand identity, Vinamilk quickly achieved some positive results. In Q4/2023, Vinamilk’s gross profit margin significantly improved from 38.8% in the same period in 2022 to over 42.5%. After-tax profit reached VND 2,351 billion, an increase of 24% compared to Q4/2022, thereby recording the 3rd consecutive quarter of year-on-year growth. Accumulated net profit for the whole year reached VND 9,019 billion, an increase of 5% compared to 2022, ending 2 consecutive years of decline.

In 2023, the consumption demand for Vietnamese dairy products declined due to the impact of private economy. However, entering 2024, Agriseco expects the domestic economy to gradually recover thanks to the reversal of monetary policies in the US and Europe, which will stimulate consumer demand. Products in fast-moving and essential consumer goods categories, such as milk, will have the first signs of recovery.

Along the same line, BSC Securities also highly evaluates Vinamilk’s growth potential in 2024 based on the assumption that gross profit margin will improve thanks to lower raw material prices. The company projects Vinamilk’s net revenue and after-tax profit to reach VND 63,501 billion and VND 9,928 billion, respectively, an increase of 5.6% and 14% compared to 2023.

On the other hand, BSC also points out some risks for Vinamilk, such as the possibility of losing market share due to competitive pressures and rising input material prices, which could narrow profit margin.