Illustrative image

SHB Bank Deposit Interest Rate in February 2024

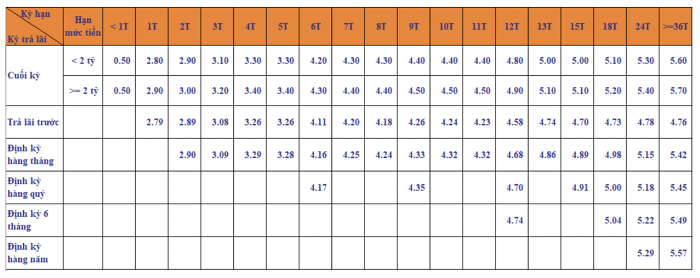

According to the latest survey, the mobilization interest rate at SHB Bank’s counter currently fluctuates from 2.8% per year to 5.7% per year for end-of-term interest payment.

Specifically, customers will enjoy the corresponding interest rates for each term according to 2 deposit levels, which are below 2 billion and from 2 billion dong and above.

For deposit levels below 2 billion dong, the interest rate ranges from 2.8% per year to 5.6% per year.

Specifically, the interest rates for 1-month and 2-month terms are 2.8% per year and 2.9% per year, respectively. The interest rate for 3-month deposits is 3.1% per year. The interest rates for 4-month and 5-month terms are the same at 3.3% per year. The mobilization interest rate for 6-month deposits is 4.2% per year.

The interest rates for 7-month and 8-month terms are the same at 4.3% per year; the interest rate for 9-11 month term is 4.4% per year, 12-month term is 4.8% per year, 13-15 month terms are 5% per year, 18-month term is 5.1% per year, and 24-month term is 5.3% per year.

For terms longer than 36 months, the interest rate is applied at 5.6% per year. This is the highest interest rate applied to individual customers with deposits below 2 billion dong.

For deposit amounts from 2 billion dong to 500 billion dong, the interest rate applied will be 0.1% higher than the deposit below 2 billion dong. Accordingly, the interest rate applied to this deposit level ranges from 2.9% to 5.7% per year.

Specifically, the interest rate for 1-month term is 2.9% per year, 2-month term is 3% per year, 3-month term is 3.2% per year, 4-5 months term is 3.4% per year, 6-month term is 4.3% per year, 7-8 month term is 4.4% per year, 9-11 month term is 4.5% per year, 12-month term is 4.9% per year, 13-15 month term is 5.1% per year, 18-month term is 5.2% per year, and 24-month term is 5.4% per year. Currently, the highest preferential interest rate is 5.7% per year, applied to deposits at the counter with terms longer than 36 months.

Term deposits below 1 month maintain the interest rate at 0.5% per year.

For deposit needs with a value from 500 billion dong and above, customers can directly contact the SHB transaction counters to receive special incentives

In addition, SHB Bank also offers a variety of flexible interest payout forms such as: Advance interest payment (Interest rates fluctuating from 2.79% to 4.78% per year); Monthly interest payment (Interest rates fluctuating from 2.9% to 5.42% per year); Quarterly interest payment (Interest rates fluctuating from 4.17% to 5.45% per year); Half-yearly interest payment (Interest rates fluctuating from 4.74% to 5.49% per year); Yearly interest payment (Interest rates fluctuating from 5.29% to 5.57% per year).

SHB Counter Deposit Interest Rates for individuals in February 2024

Source: SHB

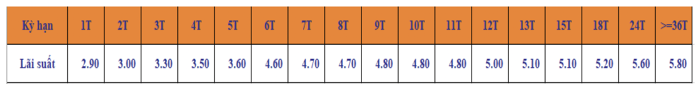

SHB Online Deposit Interest Rates in February 2024

In February 2024, SHB Bank applies online interest rate ranging from 2.9% to 5.8% per year. Accordingly, customers depositing online will enjoy interest rates 0.1 – 0.4 percentage points higher than traditional deposits.

Specifically, the interest rate for 1-month term is 2.9% per year, 2-month term is 3% per year, 3-month term is 3.3% per year, 4-month term is 3.5% per year, 5-month term is 3.6 % per year, 6-month term is 4.6% per year, 7-8 month term is 4.7% per year, 9-11 month term is 4.8% per year, 12 month term is 5% per year, 13-15 month term is 5.1% per year, 18 month term is 5.2% per year, and terms from 24 months and above enjoy an interest rate of 5.6% per year.

The highest interest rate currently applied by SHB Bank is 5.8%, for deposits online from 36 months and above.

SHB Online Deposit Interest Rates for individual customers in February 2024

Source: SHB

In addition, SHB is also deploying various deposit packages under a separate program for customers to refer to, such as: Dai Loi Savings, Phat Loc Deposit Certificate, Smart Savings, Love Saving for Children,…