Illustrative image

|

LPBank stock changes Chairman for the second time in less than 4 months

Looking back at 2023, LPBank stock underwent two changes in positions of Chairman of the Advisory Board within just 4 months. Since December 9, Mr. Le Minh Tam has been appointed Chairman of the Advisory Board, replacing Ms. Vu Thanh Hue (who held this position since August 28).

In addition to the change in Chairman of the Advisory Board, the company also changed its brand name from Viettraninmex Securities Joint Stock Company to LPBank Securities Joint Stock Company. One of the reasons is to enhance and facilitate cooperation with LPBank.

|

LPBank Securities was formerly known as Viettraninmex Securities. The company changed its name to Lien Viet Securities Joint Stock Company (LVS) in 2010. In September 2023, the company changed its name to LPBank Securities. By the end of 2023, the company’s charter capital reached 250 billion VND, with major shareholders including Ms. Pham Thu Hang holding 66%, Ms. Vu Thanh Hue holding 14%, Ms. Nguyen Thi Bich Hong holding 5.5%, and LPBank holding 5.5%. |

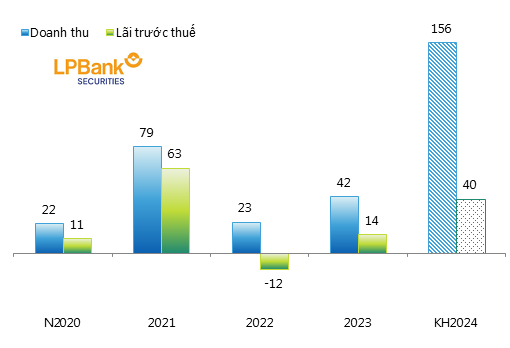

Determined to transform after the change of ownership, LPBank Securities has achieved positive results in 2023. The company’s revenue reached nearly 42 billion VND (a 77% increase compared to the same period) and pre-tax profit reached 14 billion VND (compared to a loss of 12 billion VND in the same period). These results helped the company exceed its revenue target by 23% and its profit target by 10% for the year.

In 2024, LPBank Securities has set ambitious targets with revenue of nearly 156 billion VND and pre-tax profit of 40 billion VND, corresponding to a 270% and 185% increase compared to the achievement in 2023.

|

Business results from 2020-2023 and the plan for 2024 of LPBank Securities

(Unit: billion VND)

Source: LPBS, compiled by the author

|

This year, LPBank Securities also has an important objective to implement a plan to issue shares to existing shareholders to increase its capital from 250 billion VND to 3,888 billion VND, nearly 16 times – which was approved at the extraordinary general meeting in December 2023.

The company stated that the purpose of increasing capital is to expand its business operations, enhance financial capacity, and improve competitiveness against other securities companies.

To achieve the set plan, the company will expand its network and open branches in major cities such as Danang, Can Tho, and Haiphong to reach more customers.

In addition, the company will complete the registration process to become a member of the Ho Chi Minh City Stock Exchange (HOSE) and the Hanoi Stock Exchange (HNX) to expand its business scope.

In the past, LPBank Securities terminated its membership with HOSE and HNX in 2013. Currently, the company only provides a limited number of products such as shareholder management, financial advising, investment advising, and auction consulting.

Furthermore, the company will register for securities margin trading to optimize capital and profit. At the same time, the company will improve the quality of advisory products, develop its customer network, and enhance advisory and brokerage activities.

It is worth noting that LPBank Securities plans to strengthen recruitment in 2024 with an expected increase of 200 employees, a 171-person increase compared to 2023 (nearly 7 times). By the end of 2023, the company recorded a reward fund and welfare of more than 985 million VND (a 63% increase compared to the same period), and labor-related liabilities of more than 623 million VND (a 5% increase).