| Net profit trend by quarter of DAH since 2016 |

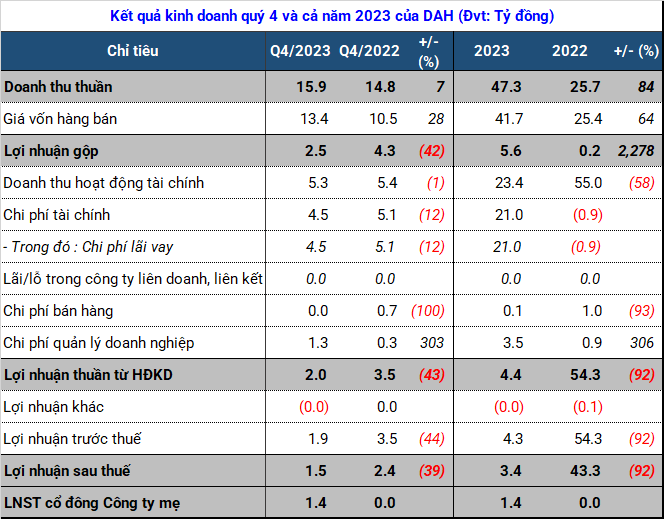

Despite a slight 7% increase in revenue to reach VND 16 billion, the fourth-quarter results of Dong A Hotel Group Joint Stock Company (HOSE: DAH) can be attributed to several main factors.

Firstly, the cost price has been significantly increased, reaching 28% compared to the same period, contributing to the gross profit shrinking to 42%. Second, the company’s business management expenses in this period increased by an extraordinary 303%, mostly due to labor costs and the commercial advantage from investment and consolidation of subsidiaries.

These two points alone are sufficient to explain why the net profit in the fourth quarter of DAH was narrowed down to just over VND 1.4 billion despite the reduced borrowing costs by 12%.

Source: VietstockFinance

|

Throughout 2023, the revenue of the company operating in the tourism and hospitality industry increased by an impressive 84%, reaching VND 47 billion. However, unfavorable factors have impacted DAH significantly. For instance, in the past year, the company’s financial operations revenue has been reduced by more than half, and the interest expense has surged by an additional VND 21 billion compared to the previous period, not to mention the escalated business management costs which caused the profit to drop to only VND 1.4 billion, a decrease of 97%.

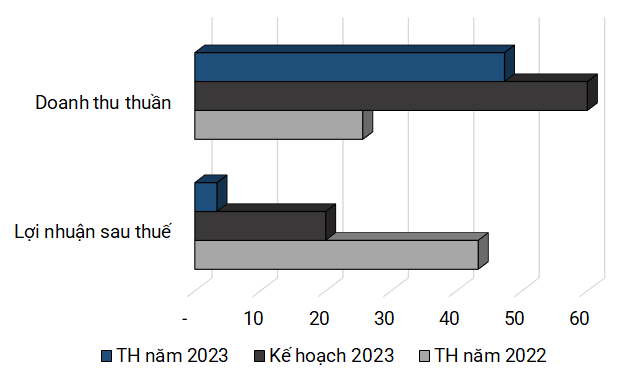

The results achieved by DAH in the fourth quarter are not considered low when compared to previous quarters, but these only helped the company achieve 17% of the after-tax profit plan.

On the other hand, setting a revenue target for 2023 that is twice the actual performance in 2022, as well as the fact that there has been a significant growth, indicates positive recovery signals for the hospitality and tourism industry, although DAH has only reached 79% of its plan.

|

Comparison of actual results against the 2023 plan of DAH (Unit: billion VND)

Source: VietstockFinance

|

In the accounting balance sheet, DAH’s total assets did not show significant changes, but short-term assets decreased sharply by 87% compared to the beginning of the year due to several reasons. Firstly, short-term receivables from customers dropped to only VND 8.7 billion, decreased by 92%, the most significant reduction from SmartInvest Consulting and Management Limited Liability Company, followed by Dong A Hotel Group Limited Liability Company and Thai Nguyen University of Medicine and Pharmacy, with a combined decrease of over VND 100 billion.

Moreover, the advance payment for the renovation works of Dong A Plaza (MAY Plaza) for SmartInvest of VND 40 billion has almost disappeared. Similar case with the advance payment of VND 33.3 billion for PJACA Group Joint Stock Company.

In addition, the amounts of VND 13.6 billion and VND 60 billion loaned to Dong A Hotel Group and Mr. Nguyen Duc Manh have been fully settled during the year.

Correspondingly, cash flow from business operations at the end of the year reached VND 147 billion, while it was negative VND 23 billion in the same period, mainly due to a decrease in receivables by VND 172 billion. This can be considered the most positive achieved result in many years of operation for DAH.

| Operating cash flow trend by quarter of DAH since 2016 |

During the period, DAH also made some investments, leading to an increase of about VND 12 billion in unfinished assets. The largest one is the renovation project of Dong A Plaza with an investment of VND 8.1 billion; the Bac Van Phong Khanh Hoa project added VND 3.7 billion.

There have also been notable changes in financial investments. Last year, DAH spent VND 178 billion investing in Van Phong Investment and Development Joint Stock Company, a company that operates restaurants and mobile food services, thereby gaining a 75% controlling stake.

In addition, the company acquired a 19.9% stake in Cho Mo Joint Stock Company in the investment and commercial center sector for VND 155 billion. Furthermore, DAH divested from Green Island Joint Stock Company and Sao Kim Financial Investment Joint Stock Company.

Approving a VND 178 billion expenditure, DAH is about to invest in the high-end Van Phong resort