| Earnings performance of FCN since 2008 |

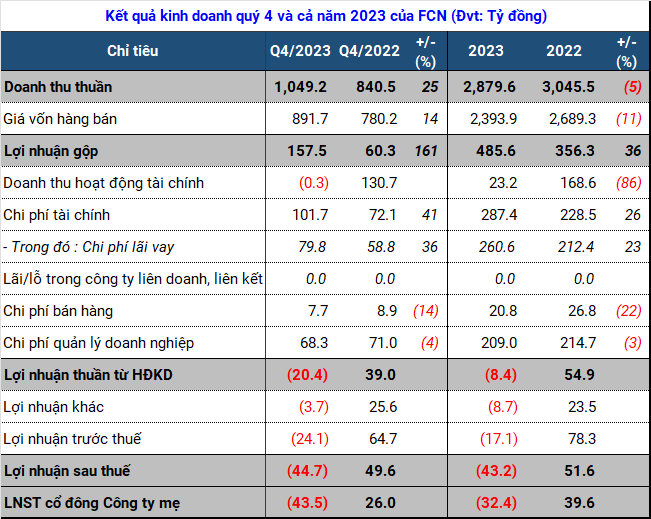

If you look at the first part of the business activity report of FECON JSC (HOSE: FCN), few would think that the end result would be disappointing.

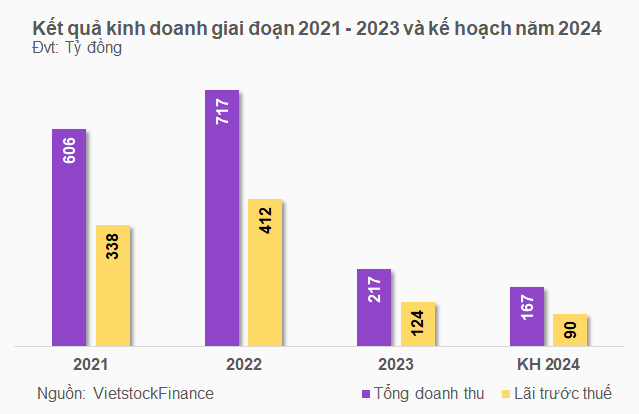

Revenue from sales and services in the fourth quarter of 2023 increased by 25% compared to the same period in 2022, indicating a partial recovery of the construction sector, the main area in which FCN is involved, coupled with a proportional increase in gross profit, contributing to a 161% increase.

FCN also benefited from the reduction in sales and business management costs, 14% and 4% respectively.

However, as the company explained, these positive factors were not enough to offset the large discrepancy in financial operating income, specifically a loss of 260 million VND compared to a profit of 131 billion VND in the same period last year, mostly due to the sale of the Vĩnh Hảo 6 solar power project. Not to mention the 36% increase in interest expenses due to the impact of the interest rate hike since the end of 2022 and the increase in loan balance.

Source: VietstockFinance

|

The loss of 3.7 billion VND in other income of FCN can also be seen as another disadvantage in achieving different end results as the company no longer recognizes income from the joint venture agreement for the use of the transmission line of the Wind Power Plant of Quốc Vinh Sóc Trăng, which previously had a profit of nearly 26 billion VND.

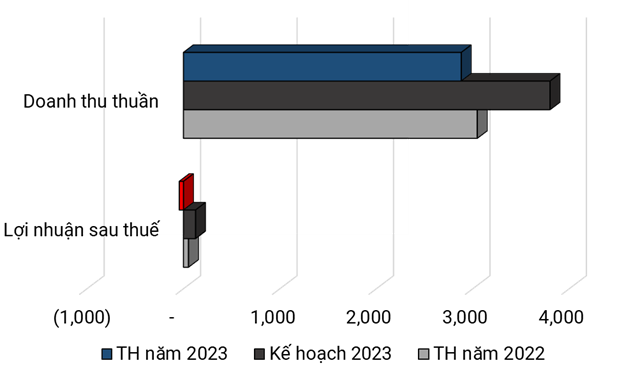

Just in the fourth quarter, the decline resulted in a loss of 32 billion VND for the whole year 2023, continuing to be a disappointing year for FCN shareholders as profits have continued to decline since 2018. And only achieved about 76% of the previously set revenue target.

|

Actual performance compared to the 2023 plan of FCN (unit: billion VND)

Source: VietstockFinance

|

At the end of 2023, FCN’s cash and cash equivalents were 4 times higher than at the beginning of the year, reaching over 700 billion VND. On the other hand, on the balance sheet, short-term advances from buyers increased by nearly 870 billion VND compared to the previous year, reaching the highest level so far at 1.1 trillion VND, but no specific explanation was given. As a result, FCN’s net cash flow from operating activities was positive 409 billion VND, compared to negative 202 billion VND in the same period.

Other significant changes include prepayments to short sellers of 676 billion VND, an increase of 440 billion VND compared to before. Investment in associate and joint venture companies doubled to 329 billion VND.

| Development of significant items of FCN over the years |

In 2023, there were also some changes in FCN’s subsidiary structure. The Q4 financial statements of the company added names such as FECON Hiệp Hòa JSC and FECON Phổ Yên JSC. On the other hand, the Raito – FECON Advanced Geotechnical Engineering Public Company Limited, previously a joint venture and associate company, is now included in the list of consolidated subsidiaries. In contrast, FECON Human Resource Source Co., Ltd. was no longer present at the end of the year.

FECON Hiệp Hòa emerged after FCN received a decision from the Bac Giang People’s Committee, becoming the investor in the construction of technical infrastructure for the Danh Thắng-Đoan Bái industrial cluster in Bac Giang province. This project has a total investment of about 1 trillion VND.

Similarly, from the beginning of 2023, FECON Phổ Yên was officially announced as the investor of the Nam Thái urban area project (with an area of 25 hectares) (commercial name Quảng Trường urban area) in Phổ Yên city, Thái Nguyên province, with a total investment of over 2.2 trillion VND.

In addition, in its strong areas such as foundation and infrastructure construction, FCN has won a series of contracts with a total value of over 4.7 trillion VND in the past year. Especially in the last phase of the year, FCN and its joint venture companies achieved a breakthrough by winning contracts with a total value of over 3.3 trillion VND, which are items in large projects such as the Phoenix Harbor – Vũng Áng Port Investment Project, Quảng Ninh Provincial Police Headquarters, Nhơn Trạch 3&4 Power Plant, and more.

Rendering of the Danh Thắng – Đoan Bái Industrial Cluster Project. Source: FCN

|

FCN becomes the investor of two projects worth over 3,200 billion VND in Bắc Giang and Thái Nguyên

Tử Kính