A The Body Shop store. Source: Reuters

|

A Pioneer Continuously Changing Hands

According to Reuters, business consulting firm FRP will become the company responsible for handling bankruptcy procedures for The Body Shop in the UK. FRP announced that 199 stores will continue to operate as normal even after the cosmetics brand is put into bankruptcy.

Moreover, The Body Shop’s business operations in international markets are also being restructured due to financial difficulties.

Founded in Brighton, UK in 1976, The Body Shop brand was introduced by British entrepreneur Anita Roddick with a different approach from the giants in the cosmetics industry at the time. In addition to using natural ingredients, The Body Shop is also considered a pioneer brand in not testing on animals.

Today, there are over 2,500 The Body Shop stores worldwide, spanning Europe, North and South America, the Middle East, Africa, and Asia.

However, the pioneering advantage is starting to become a target that competitors can take advantage of to create even more fierce competition within the industry. The over 40-year-old brand was acquired by French cosmetics and luxury goods group L’Oreal in 2006 and officially delisted from the London Stock Exchange.

Over 6 years ago, The Body Shop was acquired by Brazilian cosmetics company Natura & Co in a deal worth up to 1.1 billion USD.

The journey of the British cosmetics brand did not stop there. In 2023, Natura & Co agreed to sell The Body Shop to Aurelius Group in a binding agreement with a business value of only 254 million USD due to profitability difficulties, according to Reuters.

“The Body Shop has been dealing with financial problems for a long time under the management of previous owners, as well as difficulties from the retail market in recent times,” shared FRP.

Reassured Franchise Partner

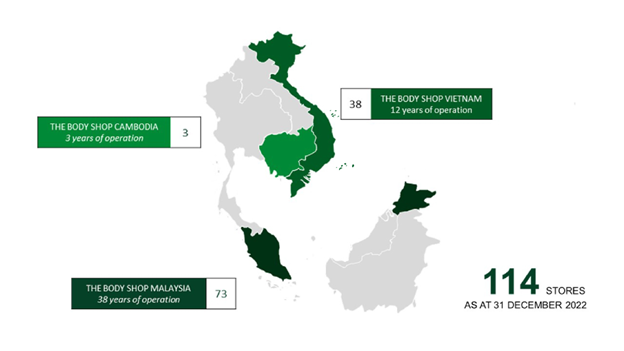

InNature Berhad – the franchise partner of The Body Shop brand in Malaysia, Cambodia, and Vietnam – stated that the company will still “operate normally” as they have been assured by The Body Shop International (TBSI) that “the events in the UK are not related to global franchise partners like InNature.”

Stores managed by InNature Berhad. Source: InNature Berhad

|

Speaking to The Edge, CEO Datin Mina Cheah-Foong said that the biggest concern for InNature is supply chain, whether the products will continue to be supplied and if there will be any disruptions. She also mentioned that the franchisor has assured them that they will “definitely maintain the supply capability” until the contract ends in 2025.

In a disclosure document in 2020, InNature stated that the company has continuously been awarded additional franchise agreements by TBSI, starting in Vietnam in 2009 and subsequently renewed in 2019; in Sabah and Labuan in 2015; and in Cambodia in 2019. The current commercial franchise agreements granted to the group are valid for 10 years with options to extend for another 5 years.

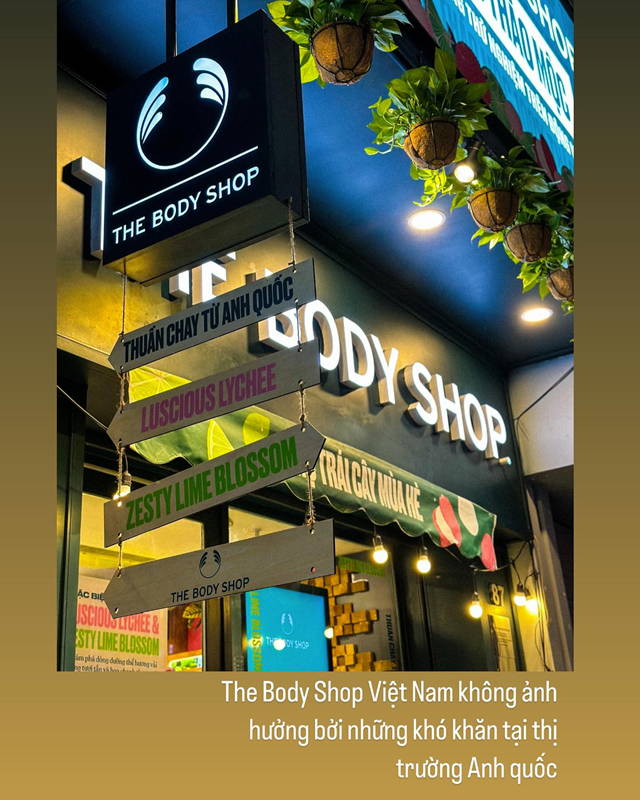

Similarly, The Body Shop Vietnam Facebook page reassured its customers about upcoming operations. The page also announced that in 2024, The Body Shop plans to expand its network with additional stores in central areas such as HCMC and Hanoi, as well as continue to enhance its online business.

An assurance message from The Body Shop Vietnam. Source: Facebook The Body Shop Vietnam

|

Not stopping there, InNature’s financial results also somewhat reflect the slowdown of the once highly popular cosmetics brand, mainly due to COVID-19.

InNature’s revenue has been steadily increasing in the period from 2016 to 2019, from around RM 160 million (USD 33 million) to about RM 191 million (USD 40 million), before continuously decreasing to RM 155 million (USD 32 million) in 2020 and RM 131 million (USD 27 million) in 2021 due to the pandemic. In 2022, the recovery after the difficult period helped InNature earn RM 149 million (USD 31 million).

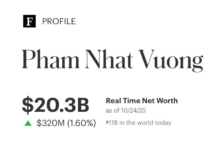

Meanwhile, net profit has significantly declined since 2018, from RM 45.6 million (USD 9.5 million) to only RM 15 million (USD 3.1 million) in 2021.

|

InNature’s net profit from 2016 (Unit: USD million)

Source: VietstockFinance

|

As of the 9-month period of 2023, InNature achieved a meager net profit of around RM 5.9 million (USD 1.2 million), which is a 60% decrease compared to the same period despite a 9.6% decrease in revenue to RM 98 million (USD 20.5 million).

Malaysia is still the main source of profit for this franchise partner, with RM 8.3 million (USD 1.7 million) while Vietnam resulted in a loss of RM 1.3 million (USD 0.27 million).

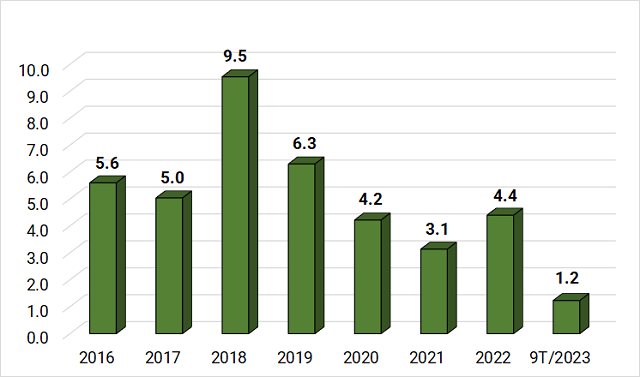

In addition, the Malaysian market has consistently accounted for the majority of InNature’s revenue in recent years, contributing to 78%, with Vietnam making up about 20%, and the remaining less than 3% coming from Cambodia.

|

InNature’s revenue split in Southeast Asia (Unit: %)

2022: small circle; 9M2023: large circle. Source: Compiled

|

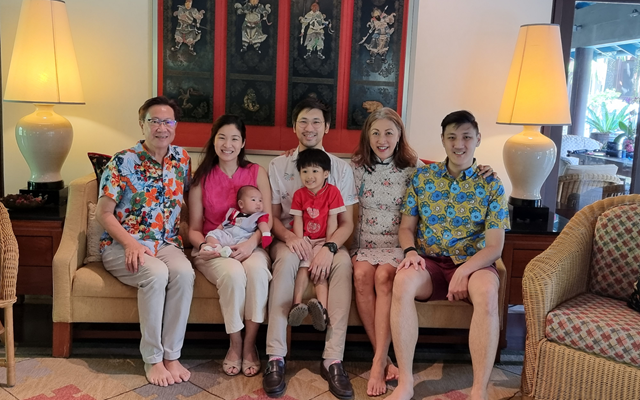

Owned by the Cheah-Foong family

The Cheah-Foong family. Mr. Dato’ Simon (left) and Ms. Datin Mina (white clothes) along with their two sons, Daryl Foong (white clothes) and Dexter Foong (right). Source: Zue Wei Leong

|

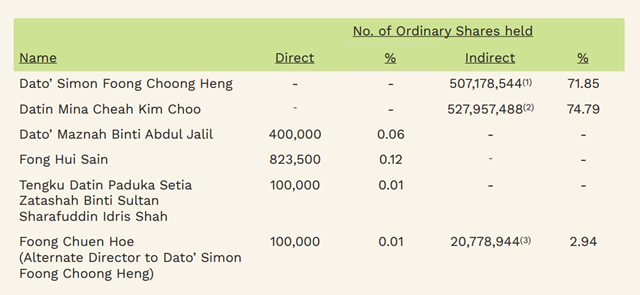

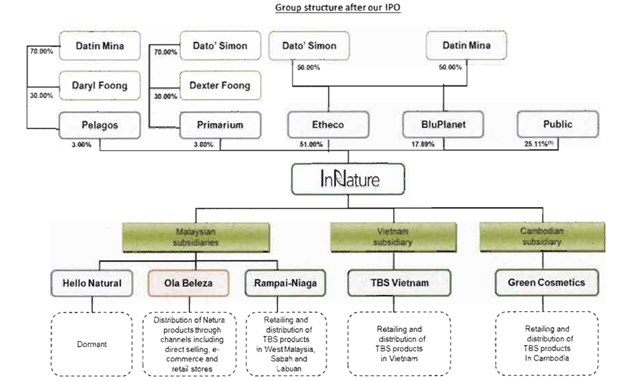

InNature Berhad is largely held by Mr. Dato’ Simon Foong Choong Heng (Non-Executive Chairman) and Ms. Datin Mina Cheah Kim Choo (Co-Founder and CEO). Both Mr. Dato’ Simon and Ms. Datin Mina have held these positions for about 30 years, since 1994.

Specifically, Mr. Dato’ Simon indirectly owns 71.85% of InNature Berhad through Etheco Sdn. Bhd., BluPlanet Sdn. Bhd., and Primarium Sdn. Bhd. Similarly, Ms. Datin Mina holds indirect ownership of 74.79% through Etheco Sdn. Bhd., BluPlanet Sdn. Bhd., Pelagos Sdn. Bhd., and Primarium.

Ownership structure by individual at InNature Berhad as of 2022. Source: InNature Berhad

|

According to InNature’s disclosure, companies such as Etheco, BluPlanet, Pelagos, and Primarium are pure investment holding companies established in 2018 and 2019 operated by Mr. Dato’ Simon and Ms. Datin Mina.

Relationship diagram of InNature with family shareholders as of end 2020. Source: InNature

|

Etheco and BluPlanet are jointly owned by Mr. Dato’ Simon and Ms. Datin Mina, each holding a 50% stake. Pelagos is 70% owned by Ms. Datin Mina with the remaining 30% owned by her son, Mr. Daryl Foong (as Director). Similarly, 70% of Primarium is owned by Mr. Dato’ Simon and 30% by his son, Mr. Dexter Foong.

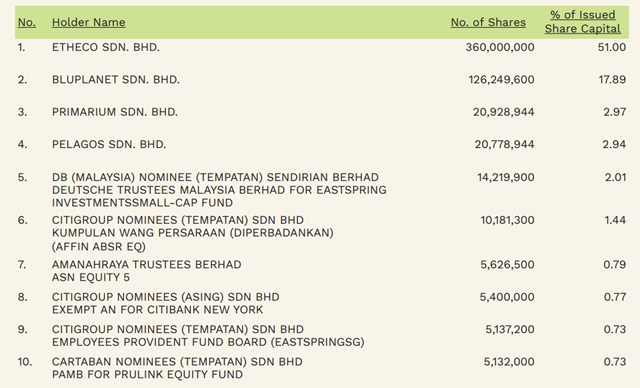

As of Q1 2023, the 30 largest shareholders of InNature hold nearly 90% of the capital. The top 5 shareholders account for up to 78% of the share capital, with Etheco holding 51% stake, followed by BluPlanet at 17.89%.

Ownership structure of InNature Berhad in 2022. Source: InNature Berhad

|

In 1984, The Body Shop began franchising in West Malaysia. In 2009, the British cosmetics brand made its first appearance in Vietnam through TBS Vietnam Co., Ltd., which initially belonged to TBS Franchise SDN BHD, and officially entered the Cambodia market in 2019.

Established in 2009 with a charter capital of VND 5.6 billion, TBS Vietnam was initially 100% owned by TBS Franchise SDN BHD and primarily provided consulting and marketing services for The Body Shop. In October 2018, this entity changed ownership and became part of InNature Berhad. The legal capital of the enterprise has been maintained until now, along with the position of CEO and legal representative held by Ms. Datin Mina Cheah Kim Choo (a Malaysian citizen).

Ms. Datin Mina Cheah Kim Choo. Source: The Edge

|

Tu Kinh