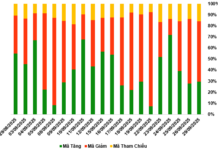

Stock market The year Giap Thin 2024 started with 2 exciting trading sessions. The VN-Index continuously increased, surpassing the 1,200 point mark and closing the week at the highest level in the past 5 months.

The stock market saw strong gains in the first 2 trading sessions of the year.

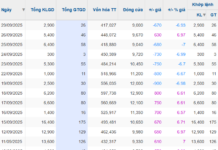

Specifically, on February 15th session, the VN-Index increased by 0.33% after a late-session profit-taking, closing at 1,202.5 points with positive liquidity. The VN-Index continued its upward trend on the next session, closing at 1,209.7 points, a 0.6% increase. The price increase spread from the banking sector to stocks in the VN30 basket.

In the past week, the total trading value of the whole market increased by 20.2% compared to the previous week, reaching VND 20,637 billion/session, thanks to the positive sentiment after Tet holiday.

However, foreign investors continued to be net sellers with a net selling value of VND 768 billion across all 3 markets. Specifically, foreign investors net sold VND 726 billion on HoSE, VND 62 billion on HNX, and net bought VND 20 billion on Upcom.

CEO resigns

Ms. Doan Hoang Anh – daughter of Mr. Doan Nguyen Duc (Bau Duc, Chairman of Hoang Anh Gia Lai Joint Stock Company – HAG) – has sold 2 million shares, reducing her ownership to 9 million shares. The transaction was executed on February 15th.

On January 19th, Ms. Doan Hoang Anh bought an additional 1 million HAG shares to increase her ownership from 1.08% to 1.19% of the charter capital.

HAG receives the letter of resignation of Mr. Vo Truong Son from the position of CEO for personal reasons.

Another notable development, on February 15th, HAG announced that it had received a letter from the State Securities Commission approving its filing for the private placement of shares.

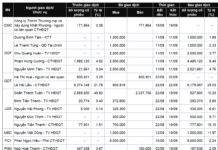

After various adjustments to the participating organizational structure and capital utilization plan, in January 2024, Hoang Anh Gia Lai finalized its plan to privately place 130 million shares at VND 10,000 per share to raise VND 1,300 billion.

Among the investors expected to participate in the private placement are 3 investors, including LPBank Securities Joint Stock Company, which will purchase 50 million shares, Thaigroup Corporation which will purchase 52 million shares, and investor Le Minh Tam who will purchase 28 million shares.

Recently, Hoang Anh Gia Lai suddenly approved the change of CEO position. Specifically, on February 7th, HAG received the letter of resignation from Mr. Vo Truong Son from the position of CEO for personal reasons.

Mr. Vo Truong Son (born in 1973), holds a Master’s degree in Finance. Prior to joining HAG, he worked at A&C Auditing and Consulting Company from August 1996 – November 2003, then worked as a Senior Auditor at Ernst & Young Vietnam Co., Ltd.

Since October 2008, he has joined HAG. In 2015, he was appointed as CEO and a member of the Board of Directors of HAG. Therefore, Mr. Son has worked at HAG for 16 years and held the position of CEO for 9 years.

Also on February 7th, HAG appointed Mr. Nguyen Xuan Thang to the position of CEO, replacing Mr. Vo Truong Son. Mr. Nguyen Xuan Thang, born in 1977, holds a bachelor’s degree in Corporate Finance, does not own any HAG shares, and does not hold any positions at other organizations at the time of appointment.

Major shareholder loss for Gelex Power

Tran Phu Electro-Mechanical Joint Stock Company has just sold 7.95 million shares of Gelex Power Joint Stock Company (GEE) and is no longer a major shareholder of GEE.

Tran Phu Electro-Mechanical Joint Stock Company is no longer a major shareholder of Gelex Power Joint Stock Company.

Specifically, on February 2nd, Tran Phu Electro-Mechanical successfully sold 7.95 million GEE shares, thereby reducing its ownership in Gelex Power Company from 22 million shares to 14.05 million shares (equivalent to 4.68% of the charter capital) and is no longer a major shareholder of the company.

Coteccons Construction Joint Stock Company (CTD) has just completed the acquisition of 100% of the contributed capital of Sinh Nam Metal Co., Ltd. (Vietnam) and UG Vietnam Mechanical and Electrical Co., Ltd.

Specifically, Sinh Nam Metal Co., Ltd. (Vietnam) was established on June 25th, 2008, and is mainly engaged in the production of other metal products that are not classified elsewhere (specializing in the supply of front-glass aluminum system design, fabrication, installation, and project management services for intermediate and high-end projects).

Meanwhile, UG Vietnam Mechanical and Electrical Co., Ltd. was established on May 16th, 2007, and operates in the field of non-residential construction (specializing in the installation of mechanical and electrical systems – M&E).

As of December 31st, 2023, Coteccons owns 2 directly-owned and 2 indirectly-owned subsidiaries. Specifically, the directly-owned subsidiaries are Unicons Investment Construction Joint Stock Company and Covestcons Joint Stock Company.

In addition, Coteccons also invests in 2 affiliated companies, including FCC Infrastructure Investment Joint Stock Company, and Quang Trong Trading Joint Stock Company and holds a 14.43% stake in Ricons Construction Investment Joint Stock Company (investment accounted for at cost in other entities).

Pomina Steel Joint Stock Company requests shareholder opinion on raising the investment capital of the blast furnace project at Pomina 3 branch from over VND 4,975 billion to nearly VND 5,880 billion.

Pomina Steel Joint Stock Company (POM) has just announced the extraordinary general meeting documents for 2024, scheduled to be held on March 1st in Ho Chi Minh City. Accordingly, Pomina Steel will present to shareholders a plan to raise the investment capital of the blast furnace project at the Pomina 3 branch from over VND 4,975 billion to nearly VND 5,880 billion.

Pomina Steel did not disclose the reason for raising the investment capital for the blast furnace project at the Pomina 3 branch. The company only mentioned the investment value of nearly VND 5,880 billion based on the audit results by AFC Vietnam Auditing Limited Liability Company on March 2nd, 2023, compared to the approved investment capital plan on October 31st, 2020.

In 2023, Pomina Steel reported a revenue of over VND 3,281 billion, a decrease of nearly 75% compared to the same period, and after-tax profit attributable to shareholders, the parent company recorded an additional loss of nearly VND 960 billion.