VnEconomy provides updated savings interest rates from over 30 commercial banks as of February 19, 2024, showing a slight decrease in interest rates compared to January 2024.

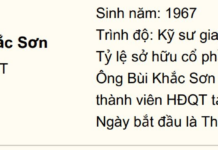

The highest savings interest rate in February 2024 for a 1-month term is 4.65% per year, applied by NamABank. Next, banks with high interest rates for a 1-month deposit include CBBank (4.1% per year), VietCapitalBank (3.6% per year), NCB, VietBank, and BaoVietBank with an interest rate of 3.4% per year for this term.

Most other banks apply interest rates from 2.5% per year to 3.2% per year for a 1-month term deposit. The lowest interest rate for this term is 1.7% per year, applied by Agribank and Vietcombank, while BIDV and VietinBank offer higher interest rates by 0.2% (1.9% per year).

For a 3-month term, NamABank continues to have the highest savings interest rate in February 2024 at 4.65% per year. CBBank applies an interest rate of 4.2% per year for a 3-month deposit.

In general, the savings interest rate for a 3-month term is higher than a 1-month term by 0.3% per year. Besides NamABank and CBBank, there are 4 other banks that apply savings interest rates for a 3-month term ranging from 3.6% per year to 3.7% per year, including BaoVietBank, NCB, VietBank, and VietCapitalBank. The lowest interest rate for a 3-month term is 2-2.2% per year, applied by AgriBank, BIDV, Vietcombank, and Vietinbank.

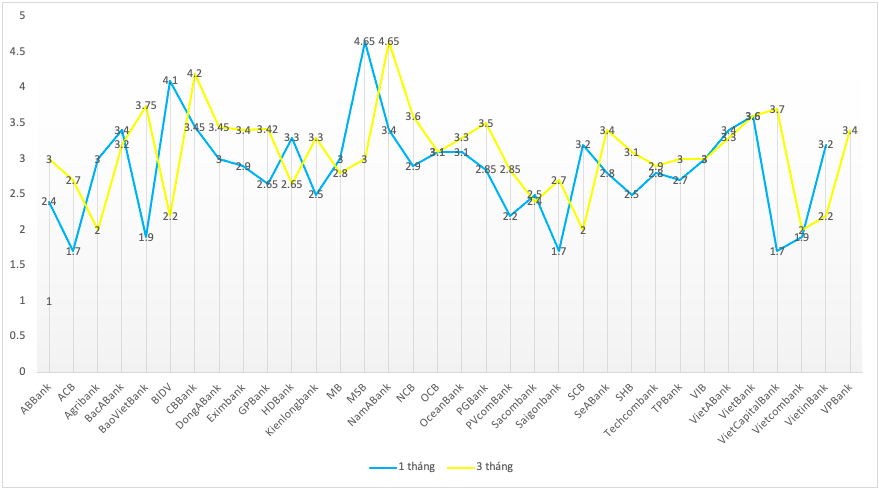

The highest savings interest rate for a 6-month term in February 2024 is 5% per year, applied by CBBank. In second place is VietBank (4.8% per year); NamABank, KienlongBank, and BaoVietBank have an interest rate of 4.7% per year for a 6-month term deposit.

The 9-month term deposit interest rate does not differ significantly from the 6-month term. Most banks only adjust the interest rate by 0.1 – 0.2% compared to the 6-month term. Accordingly, the highest savings interest rate for a 9-month term is 5.1% per year (CBBank), followed by NamABank at 5% per year. The lowest interest rate for this term is 3-3.2% per year, applied by Agribank, BIDV, Vietcombank, and Vietinbank.

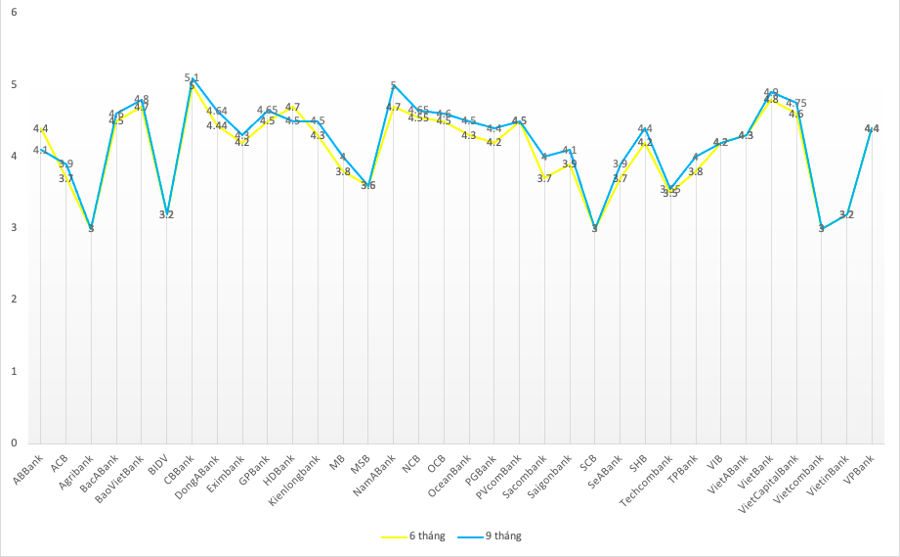

Notably, the highest savings interest rate for a 12-month term in February 2024 is 7% per year at NamABank. This is the highest deposit rate since October 2023. In addition, BaoVietBank and CBBank apply interest rates of 5.2% – 5.3% per year for this term. The remaining 30 banks apply interest rates below 5% per year for a 12-month term deposit.

For a 24-month term deposit, NamABank adjusts the interest rate sharply down to 5.9% per year, but this is still the highest interest rate in the system. Most banks apply interest rates from 4.7% – 5.5% per year for a 24-month term deposit.

If customers make online savings deposits, they can enjoy higher interest rates compared to deposits at the counter, ranging from 0.1% to 0.3% per year.

The above savings interest rates are for individual customers, with interest paid at the end of the term and subject to fluctuations. Banks have their own interest rate policies for different customer groups, depending on the deposit amount.

Furthermore, the actual savings interest rate may vary depending on the capital balance of each bank branch…