Pin Con Thỏ is a product of Habaco Battery Corporation (Habaco, stock code: PHN), which was previously known as Vandi Battery Plant, a rare industrial plant established in 1960.

Despite its over 60 years of existence, what’s surprising is that Con Thỏ batteries have still maintained good business results, even reaching new records and standing strong in a competitive market.

Currently, the company operates primarily in the Northern provinces, Central and Central Highlands regions. In 2011, the company established a branch in Ho Chi Minh City to focus on consuming high-end products and expanding the market for its products in Southern provinces.

The company has stable export volumes to the markets of Laos and Cambodia, and through its strategic shareholder, the Singapore International Battery Company, it has been actively boosting exports to potential markets such as India, Eastern Europe, Central Asia, Africa, and South America.

The company has also renewed its contract with GPBI to become the sole distributor of GP brand batteries in the Vietnamese market since September 2019 after a period of interruption.

Record-breaking profits in 2023

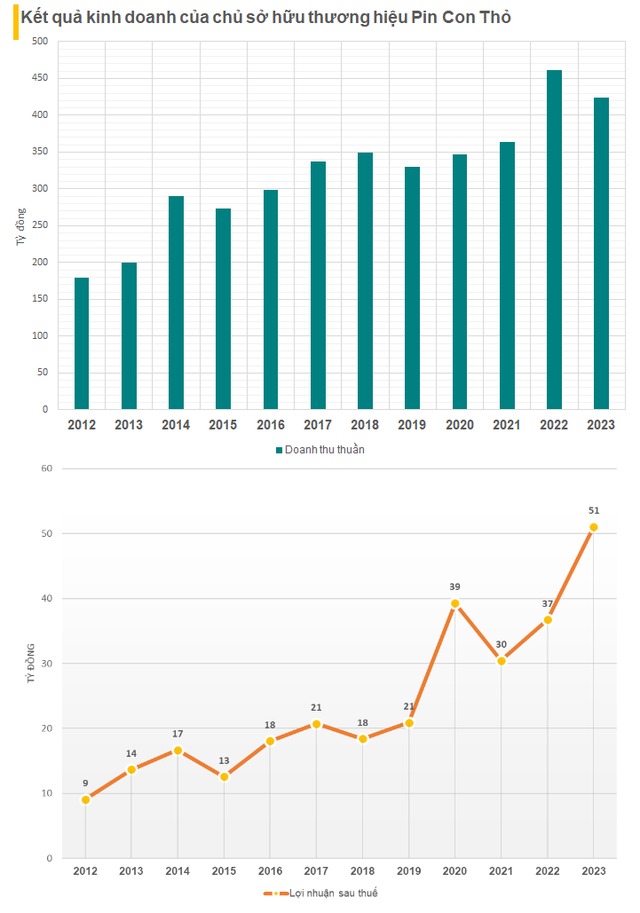

In general, Habaco’s revenue has shown stable growth over the years. In 2023, Habaco’s net revenue decreased by nearly 8% compared to the previous year, reaching VND 424 billion, but thanks to a significant decrease in the cost of goods sold, Habaco still had a gross profit of over VND 101 billion, an increase of 13% compared to the same period. On average, Habaco earned over VND 1.16 billion per month. Habaco’s gross profit margin improved from 17.9% to 23.8%.

As a result, Habaco’s after-tax profit exceeded VND 51 billion, an increase of 39% compared to the previous year, reaching the highest level ever recorded for the company.

Habaco stated that in Q4/2023, the prices of raw materials, especially Zinc, decreased by 10-20% compared to the same period. This is the main reason for the decrease in the proportion of the cost of goods sold to net revenue, increasing the profit during the period.

As of December 31, 2022, Habaco’s total assets increased by VND 26 billion compared to the beginning of the year, reaching over VND 173 billion. Short-term debt increased by VND 5 billion to nearly VND 27 billion, and the company does not use long-term debt. Furthermore, Habaco has no long-term debt.

In 2024, Habaco aims to produce and consume a total of 353.2 million batteries of all kinds. The battery consumption revenue is expected to be VND 438.7 billion, and the pre-tax profit is projected to reach VND 60.3 billion.

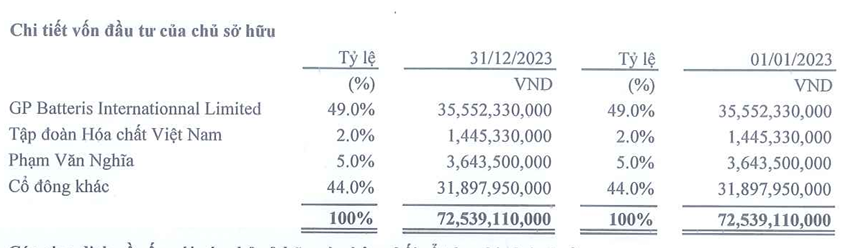

In terms of shareholders’ structure, GPBI is currently the largest shareholder of Habaco, holding 49% of the charter capital. Vietnam National Chemical Group holds 2%, Mr. Pham Van Nghia holds 5%, and the rest are other shareholders.

In the stock market, PHN shares are currently priced at VND 49,500 per share. From the beginning of 2023 until now, PHN shares have increased by over 25%. One notable point is that Habaco has consistently paid dividends. Since its listing in 2019, Habaco has never missed distributing dividends at a rate of around 30% – 40% per year.

The battery and accumulator market is expected to experience significant growth in the future.

According to a recent report by McKinsey Consulting, the global battery and accumulator market will experience rapid growth in the coming years: By 2030, the demand for batteries and accumulators (measured in electrical capacity) will increase from the current 700 GWh/year to 4,700 GWh/year, with an average annual growth rate of 30%.

Of this demand, the majority, which is 4,300 GWh, will be for transportation vehicles, while the remainder will be for applications such as energy storage batteries and batteries for electronic entertainment devices.

Therefore, according to this new research, the demand for batteries and accumulators will grow even faster than previously forecasted.

According to the analysis by Modor Intelligence, the Vietnamese battery market is expected to achieve a CAGR rate of over 7% during the period 2022-2027. Factors such as the decreasing price of lithium-ion batteries and the increasing demand for lead-acid batteries are expected to drive the Vietnamese battery market in the forecast period. The lead-acid battery segment is projected to dominate the market during the forecast period.