According to a report by BSC Research, in the event that Vietnam is upgraded by FTSE and MSCI to an emerging market, the stock market and the Vietnamese economy as a whole could benefit in several aspects such as: (1) Enhancing global integration, elevating Vietnam’s stock market and national position, (2) Domestic businesses having more opportunities to access potential foreign investors, (3) Enhancing the attractiveness of Vietnam’s stock market for investors, and (4) Attracting significant capital inflows from investment funds worldwide.

If upgraded, foreign capital flows from ETF funds – referencing the MSCI and FTSE indices – will pour into the Vietnamese stock market on a large scale.

According to data as of November 30, 2023 from Bloomberg, there are currently 491 funds with a total scale of $956 billion, including 180 ETF funds ($421 billion) and 311 open funds with information ($533 billion) investing in emerging stock markets based on MSCI and FTSE rankings, with the proportion of funds referencing MSCI (87%) being higher than FTSE (13%).

BSC Research also notes that the Bloomberg open fund data does not fully cover the entire market/fund scale investing in the regions, so the actual value would be larger than the compiled data.

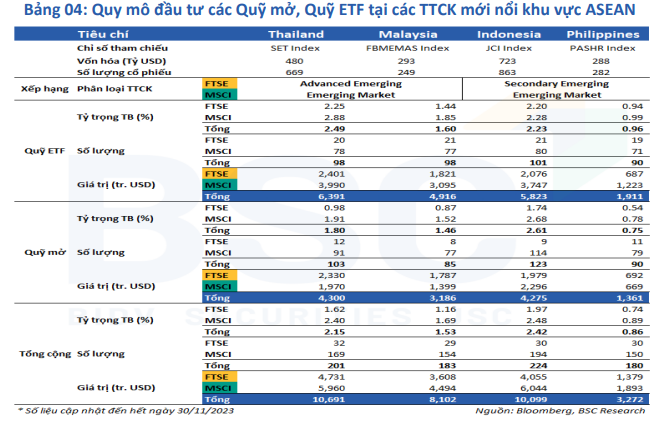

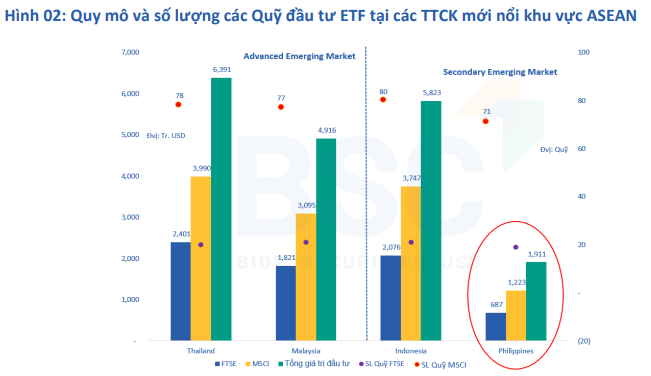

Looking specifically at the ASEAN5 region, for the 4 markets of Thailand, Malaysia, Indonesia, Philippines, there are a total of 240 funds with total assets of $859 billion, including 135 open funds ($490 billion – with total investment value of $13.12 billion) and 105 ETF funds ($369 billion – with total investment value of $19.04 billion) allocated to these 4 markets.

Specifically, referencing FTSE criteria, the Philippines currently has 30 funds investing with a total scale of $1.38 billion, and based on MSCI it has 150 funds with a total scale of $1.8 billion. Among them, ETF funds based on the FTSE index have 19 funds with a total investment value of $687 million.

Malaysia has a total investment scale of $8.1 billion, including 42 funds based on the FTSE criteria with a total scale of $3.6 billion and 154 MSCI funds with a scale of $4.5 billion.

As for Indonesia and Thailand, these are two markets with larger market capitalization. Although the Indonesian stock market is currently rated by FTSE as an emerging market at a primary level, foreign investment funds have poured $10.7 billion – equivalent to the scale of the Thai stock market (which has been rated by FTSE as an advanced emerging stock market).

Based on BSC Research’s estimation, if MSCI and FTSE upgrade Vietnam’s stock market to an emerging market, there will be about $3.5 – $4 billion of new purchases of Vietnamese stocks.

This estimation is based on the assumption that the proportion of new purchases of Vietnamese stocks will be around 0.7% – equivalent to the proportion of stocks in the Philippine stock market (rated by FTSE as a primary emerging stock market) in the current investment portfolios of the funds.