|

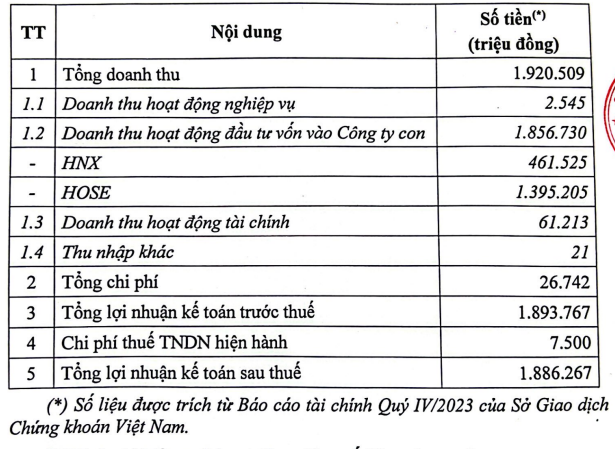

Financial results for VNX in 2023

Source: VNX

|

The majority of revenue comes from capital investment activities. Among them, Ho Chi Minh Stock Exchange (HOSE) generated over 1,395 billion VND and Hanoi Stock Exchange (HNX) contributed nearly 462 billion VND.

In addition, business operation revenue and financial operation revenue reached over 2.5 billion VND and 61 billion VND, respectively.

Notably, the total expenses of VNX in 2023 were approximately 27 billion VND.

In terms of operational performance, as of December 31, 2023, the return on equity (ROE) for VNX was 62.9% and the return on assets (ROA) was 55.7%.

Earlier, at the conference reviewing the work in 2023 and deploying tasks in 2024 on January 10, Mr. Nguyen Tien Dung – Deputy General Director of VNX announced that in 2023, VNX had successfully organized the safe, stable and smooth operation of the market; continued to improve regulations and procedures to create consistent synchronization in listing activities and trading registration; and conducted transactions.

In addition, VNX proactively reviewed related operational regulations to prepare for necessary modifications when the new trading system officially launched and when there were changes in legal regulations. Prepared necessary conditions to organize and operate the market for corporate bonds safely, effectively, and on schedule as directed by regulatory authorities.

Furthermore, VNX coordinated with the State Securities Commission (SSC) to submit proposals to the Ministry of Finance regarding the adjustment of the roadmap for stock market organization according to market practices. Along with that, the company conducted research, improved stock index systems, developed certain new products with certain results, contributed to diversifying investment products and improving product quality; the appraisal of registration documents for members was carried out rigorously and in accordance with legal regulations, especially the timely handling of documents to approve members in the corporate bond market.

VNX has implemented regular and serious member management, monitoring, and inspection, promptly detecting violations. Actively deployed and closely collaborated with SSC in supervising compliance, transaction monitoring, handling suspicious transactions, and handling violations. Actively directed investors and coordinated activities among beneficiary units to accelerate the progress of deploying information technology bidding packages and urged members to participate in testing the new trading system.

Moreover, becoming an official member of the World Economic Forum (WEF) is an important step in VNX’s integration process and its subsidiaries, contributing to promoting and enhancing the integration of stock exchanges. The organizational structure has been formed and initially completed, implementing the arrangement of subsidiary companies together with a gradual completion of leadership personnel. Financial management and investment assets ensure compliance with legal regulations. State capital invested in VNX and its subsidiaries is ensured and developed.

Finally, VNX has also made some proposals and recommendations to the Ministry of Finance and SSC regarding business operations and allowed to invest in infrastructure, supporting the construction of VNX’s salary mechanism in the coming period to meet the requirements of practice and the provisions of the Securities Law 2019.

|

The Vietnam Stock Exchange (VNX) officially commenced operations on August 6, 2021, based on the parent company – subsidiary model rearranging the Ho Chi Minh Stock Exchange and Hanoi Stock Exchange. The Exchange is the parent company organized as a single-member limited liability company with 100% charter capital held by the State. VNX has a charter capital of 3,000 billion VND, holding 100% of the charter capital of HOSE and HNX. |

Kha Nguyen