Illustration

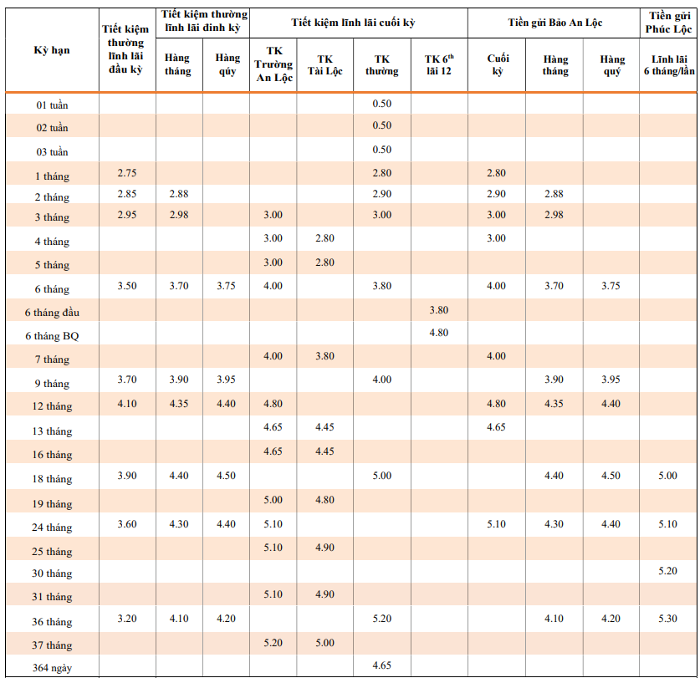

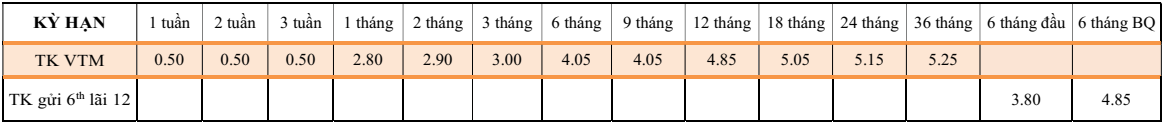

TPBank interest rates for individual customers in February 2024

According to the latest records, interest rates for individual customers at TPBank are listed in the range of 0.5 – 5.2% per year for the end-of-term interest savings method.

The interest rate of 0.5% per year is for deposits with a term of 1 – 3 weeks; 2.8% per year for a 1-month term, 2.9% per year for a 2-month term, and 3% per year for a 3-month term.

For 6-month and 9-month terms, the interest rates are 3.8% and 4% per year, respectively. Deposits with an 18-month term receive an interest rate of 5% per year.

The highest interest rate of 5.2% per year is applied to a 36-month deposit term.

In addition, TPBank still offers savings packages such as: Initial interest (approximately 2.75 – 4.1% per year); Monthly interest (approximately 2.88 – 4.4% per year); Quarterly interest (approximately 3.75 – 4.5% per year); Truong An Loc deposit (approximately 3% – 5.2% per year); Bao An Loc deposit (approximately 2.8% – 5.1% per year); Phuc Loc deposit (approximately 5% – 5.3% per year).

In case customers using savings products with a fixed term as regulated above have a demand for early termination, the lowest effective interest rate at the early termination date will be applied.

TPBank may also apply different interest rates than this interest rate schedule for certain customer groups, but not exceeding the interest rate cap regulated by the State Bank of Vietnam for each term.

TPBank deposit interest rates for individual customers at TPBank’s counter in February 2024

Source: TPBank

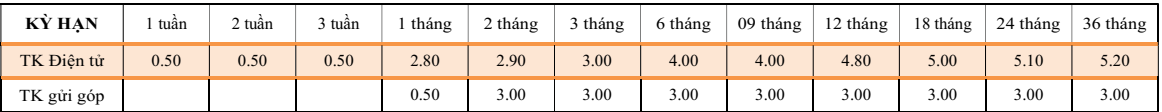

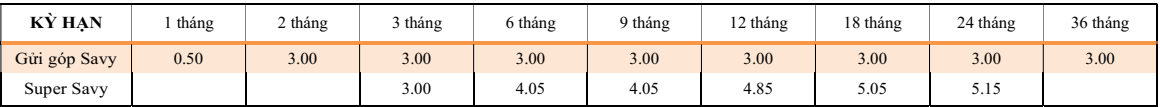

For online deposit methods, TPBank currently implements 3 methods: Electronic Savings, LiveBank, Savy. The highest preferential interest rate is 5.25% per year applies to deposits through LiveBank with a 36-month term.

Specifically, electronic savings on the TPBank banking app have interest rates ranging from 0.5% – 5.2% per year. In particular, the 5.2% per year interest rate is applied to a 36-month term.

Source: TPBank

Deposits made at TPBank’s LiveBank self-service banking have interest rates ranging from 0.5% – 5.25% per year. In particular, the highest interest rate is 5.25% per year applied to a 36-month term.

Source: TPBank

Super Savy deposit interest rates at TPBank range from 3% – 5.15% per year. In particular, the highest interest rate of 5.15% per year is applied to deposits with a 24-month term.

Source: TPBank

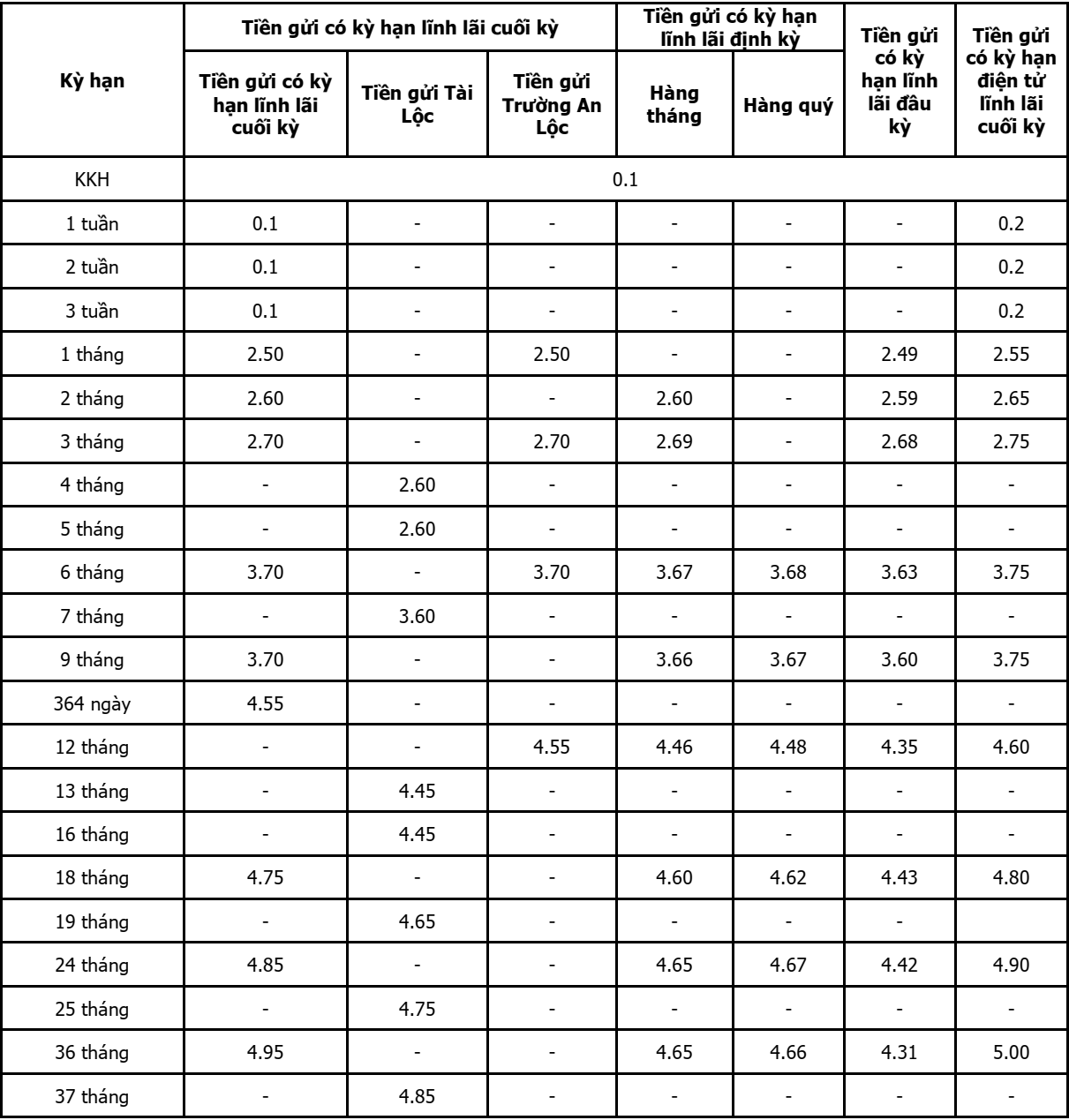

TPBank interest rates for corporate customers in February 2024

TPBank’s deposit interest rate survey in February 2024 for corporate customers with the end-of-term interest payment method ranges from 2.5% – 4.95% per year, depending on the term.

Specifically, TPBank sets the interest rate at 2.5% per year for a 1-month term. The 2-month term enjoys an interest rate of 2.6% per year, and the 3-month term is 2.7% per year.

Customers with terms ranging from 6 to 9 months are subject to a shared interest rate of 3.7% per year.

Deposits with a term of 364 days receive an interest rate of 4.55% per year.

For terms of 18 months and 24 months, the interest rates are 4.75% and 4.85% per year, respectively.

The most preferential interest rate for corporate customers depositing at TPBank is 4.95% per year, for a 36-month term.

Meanwhile, deposits with terms of less than 1 month are subject to an interest rate of 0.1% per year.

Corporate customers can also choose flexible savings methods such as: Monthly interest payout (about 2.6% – 4.65% per year); Quarterly interest payout (about 3.68% – 4.66% per year); Initial interest payout (about 2.49% – 4.43% per year); Electronic fixed-term deposit (about 2.55% – 5% per year).

TPBank deposit interest rate for corporate customers in February 2024

Source: TPBank