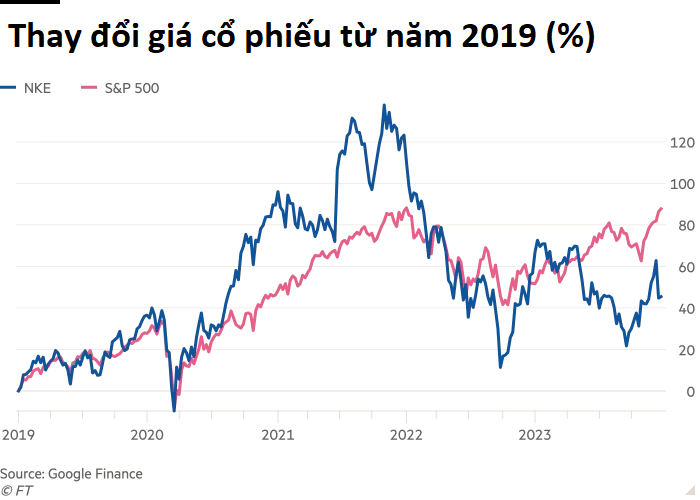

CNBC reported that world-renowned shoe brand Nike has had to lay off 2% of its global workforce to save $2 billion amid weak sales and fierce competition from competitors. This news has caused Nike’s stock price to drop by up to 4%.

Nike’s fiscal revenue for the fiscal year ending May 2023 increased by 10% compared to the same period last year, but profits decreased by 16%. Pre-tax profit (EBITDA) is at its lowest level in 10 years.

Since Q3 2023, Nike’s business performance has shown signs of weakness as for the first time, revenue was lower than expected. The brand only earned $12.94 billion, lower than the expected $12.98 billion. The company’s gross profit margin decreased by 0.1 percentage point to 44.2%.

Sales in North America, the brand’s largest market, decreased by 2%. Meanwhile, in China, although sales increased by 5% to $1.7 billion, it was still lower than the expected $1.8 billion.

In Q4 2023, the business situation continued to be concerning as revenue only reached $13.39 billion, lower than the estimated $13.43 billion.

In the past 6 quarters, Nike’s gross profit margin has continuously decreased compared to the same period last year, and the company’s retail intermediaries have an inventory turnover rate of up to 43%, leading to efforts to reduce prices and offer promotions to clear inventory.

However, according to a survey by Jefferies, Nike’s footwear retailers may face difficulties as 54% of Americans surveyed said they would reduce spending on fashion items and 46% said they would buy fewer shoes.

What is the reason?

Livemint speculates that Nike’s excessive focus on the secondary market of Jordan, while neglecting other innovations, has allowed Adidas and New Balance to surpass them with more attractive product lines in 2023. This is the main reason for the 2% reduction in workforce.

Despite facing difficulties in 2022, Adidas, Nike’s rival, quickly recovered with products like Samba, achieving operating profits of €286 million in 2023.

Although this figure is much lower than the €669 million in 2022, it is still higher than the previously predicted loss of €100 million.

Clearly, while Adidas is recovering from difficulties, Nike is asleep on its victory with the Jordan line and refuses to make any new improvements.

Data from the secondary business platform StockX shows that the Average Premium over The Retail Price for Nike Air Jordan 1 Retro High has decreased from 61% in 2020 to only 4% currently.

While Hoka and On compete fiercely in the running shoe segment, and Adidas and New Balance lead the trend in 2023 with their appealing product lines, Nike still relies too much on Jordan. Despite raising prices, it cannot compensate for the 10% decrease in sales volume in North America, which is the first time in over a year.

Although Nike Jordan products are the mainstay on secondary trading platforms like StockX, inflation and Americans saving on expenses have reduced the demand for expensive shoes.

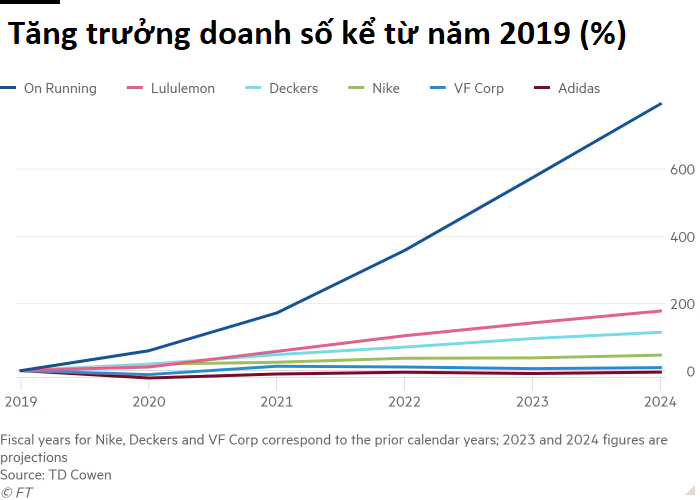

As of May 2023, Nike is still the world’s largest footwear and sportswear company with total revenue of $48.7 billion for the fiscal year. However, the brand’s sales growth is clearly slowing down.

It is worth mentioning that Hoka, Nike’s competitor in the running shoe segment, achieved sales of $1.4 billion for the fiscal year ending in March 2023, much higher than the $223 million in the same period in 2019, demonstrating the brand’s strong growth.

Similarly, On Holding also saw a 69% increase in sales compared to the same period last year, reaching $1.3 billion in fiscal year 2023.

“These competitors are eroding Nike’s market share,” responded expert Matt Powell to Livemint.

Slow to innovate

“Nike is very good at innovation, but they keep innovating the wrong products,” said Youtuber James Hesse about shoes to Livemint.

Four years ago, when CEO John Donahoe took office at Nike, the brand was doing well and showed no signs of difficulty.

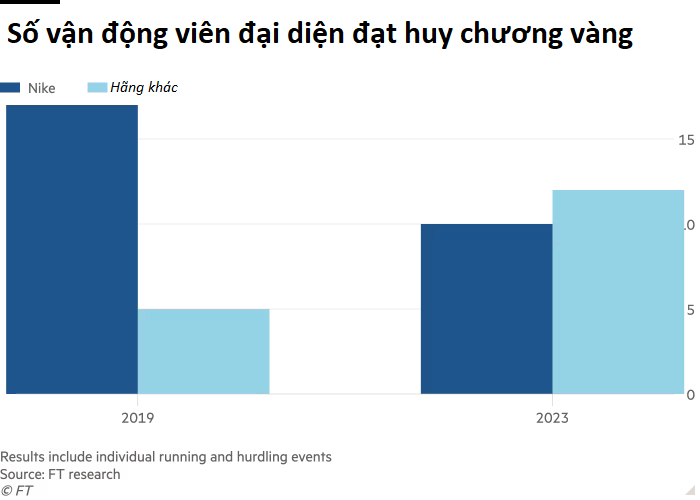

In that year’s world athletics championship, 17 Nike athletes won gold medals, much higher than the 5 representatives from other sports brands. Nike’s successful Vaporfly 4% technology shoes forced many rival brands to allow their athletes to use them but with covered logos during competitions.

This success led customers to accept paying over $200 for a pair of Nike sneakers.

However, four years later, Nike’s dominant position is no longer the same. The Vaporfly technology, which inserts carbon fiber into the sole of the shoe, has been learned by many rival brands. In the 2023 world athletic championships, Nike only had 10 medalists compared to 12 from rival brands.

The Financial Times (FT) reports that with the rapid technological learning in the footwear and sports fashion industry today, Nike’s competitors are no longer just Adidas but countless other young players.

Meanwhile, many famous Nike athletes who helped generate billions of dollars in revenue, such as Tiger Woods, are no longer at the peak of their careers.

“Nike is still a great company, but the sports shoe industry is facing many challenges and businesses need to try to survive and grow. The famous glory of the past is no longer a guarantee of success,” said John Kernan, director at TD Cowen.

Indeed, Nike’s performance during the Covid-19 pandemic and afterward depended heavily on previously famous product lines like Air Force 1, Air Jordan 1, or Dunk.

Although launching new products with new colors and designs pleases loyal fans, it makes the secondary shoe market uncomfortable as they cannot sell limited editions anymore.

Source: CNBC, Livemint

Bang Bang