Today is the Prosperous Day of Thanh Tai (February 19th, which is the 10th day of the Lunar New Year). This is an important festival, where besides preparing trays of offerings to pray for wealth, many people also buy gold with the hope that the new year will bring prosperity and abundance.

Contrary to the image of people queuing up at gold shops early in the morning to quickly buy gold for good luck, the stock price of PNJ, a jewelry company, dropped. At the end of the morning trading session today, the PNJ price of Phu Nhuan Jewelry Company decreased by VND 1,400/share (-1.55%) to VND 89,100/share.

Prior to that, in the first two trading sessions of the Year of the Wood Dragon 2024, the PNJ stock price continuously closed in the red. PNJ’s market capitalization has now dropped to around VND 29.7 trillion.

However, since the beginning of 2024, the PNJ stock price has still increased by about 3%, compared to the short-term bottom in late October 2023, which increased by nearly 24%. Compared to the peak reached in June 2022 (VND 93,970/share), the current PNJ stock price is still about 5% lower.

Extensive network system, efficient business operation, and expected strong growth

Despite strong gold consumption, companies operating in the gold, silver, and jewelry sector in Vietnam are relatively adrift. Among them, PNJ stands out with its scale and number one market share in the jewelry industry. This company has a different direction in the gold business story, no longer focusing on buying and selling gold bars but expanding into the segment of selling jewelry, gemstones, diamonds, or accessories to generate good profits.

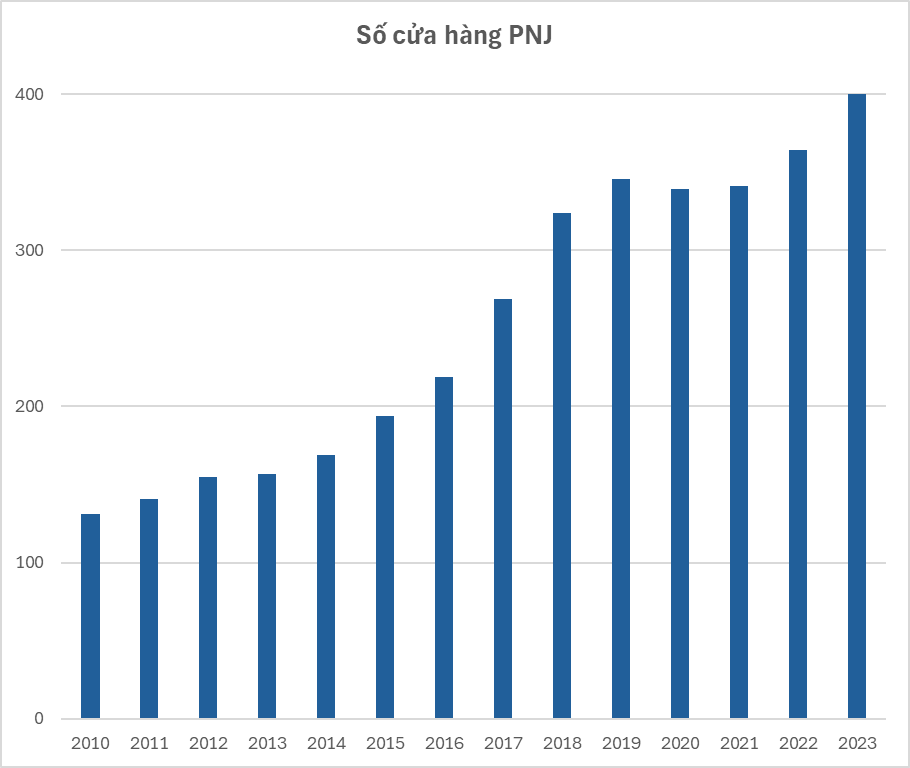

By the end of December 2023, PNJ had reached 400 stores in 55 out of 63 provinces and cities. In 2023 alone, PNJ opened 48 new stores to enhance coverage, converted the business model of 3 independent PNJ Watch stores and 2 PNJ Art stores to optimize cost efficiency.

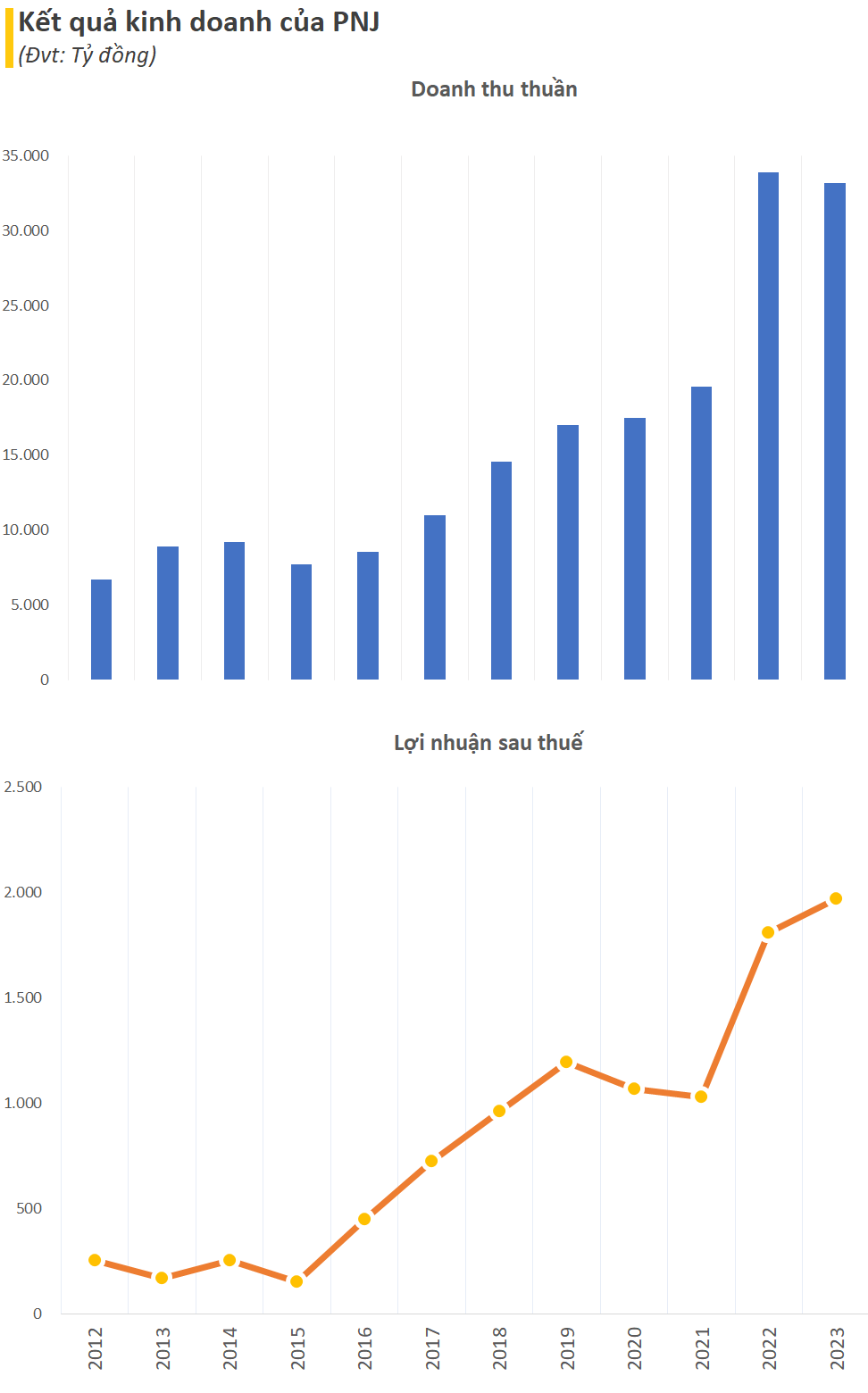

According to the financial statement, in Q4/2023, PNJ recorded a net revenue of VND 9.76 trillion (an increase of 18% compared to the same period) and a post-tax profit of VND 632 billion (an increase of 34% compared to the same period).

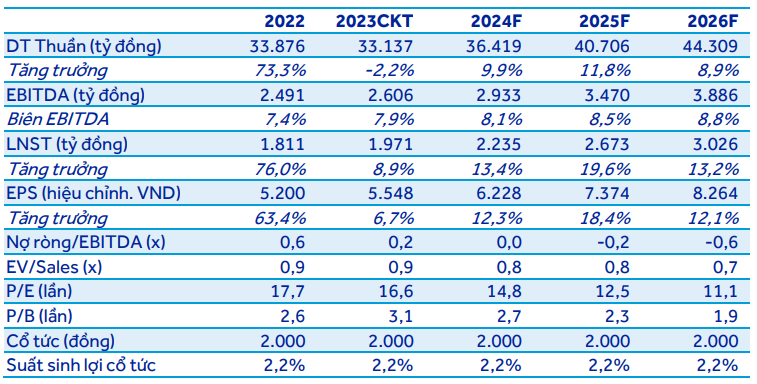

For the whole year of 2023, the net revenue reached VND 33.137 trillion (a decrease of 2%) and the post-tax profit reached VND 1.971 trillion (an increase of 9%), officially completing the profit plan for 2023. In which, the revenue from the jewelry segment accounted for 66.8% of the total revenue structure in 2023 (including 58.2% retail and 8.6% wholesale).

PNJ stated that through occupying more market share, increasing new customers, expanding the network, launching diverse products, and reaching customers through many marketing initiatives, the company has gained positive results.

In the latest report, ABCS Securities evaluated that PNJ has regained growth throughout the months of Q4/2023 thanks to special holidays/events in this quarter along with the more efficient implementation of many marketing programs. The application of technology and digitalization to analyze and exploit customer data better has led to effective marketing programs, achieving double-digit growth in the number of new customers and encouraging old customers to come back even though the invoice value decreased by about 20%.

The gross profit margin of the company increased to 18.3% in 2023 due to cost optimization and the exploitation of new customer groups. Although the new customer group tends to choose products with lower value, some of them have higher profit margins.

ACBS maintains positive expectations for PNJ’s prospects due to the improving purchasing power of consumers. ACBS forecasted that PNJ’s net revenue and post-tax profit in 2024 would reach VND 36.419 trillion (+10%) and VND 2.235 trillion (+13%) respectively.