At Directive No. 06 of February 15 on Urgent Tasks for Implementing Key Tasks after the 2024 Lunar New Year Holiday, Prime Minister requested the Ministry of Finance to lead and coordinate with the State Bank of Vietnam, the Ministry of Planning and Investment to promptly resolve obstacles in the areas under their responsibility to meet the criteria for upgrading the stock market from a frontier market to an emerging market by 2025, and report to the Prime Minister on the results before June 30, 2024. This demonstrates the Government’s determination to upgrade the stock market.

Billions of USD expected to flood the market after the upgrade

According to Vinacapital, the deployment of the new KRX trading system in the first quarter will help solve some technical issues and may help Vietnam upgrade to an emerging market from a frontier market by FTSE-Russell by the end of the year.

To increase the attractiveness of the market, the State Securities Commission, along with related agencies and securities companies, is making efforts to put the KRX trading system into operation soon and remove the requirement that institutional investors must pre-fund 100% of the shares before trading.

If the Vietnamese stock market is upgraded, VinaCapital estimates that Vietnamese stocks will account for about 0.7% to 1.2% in the new emerging market index baskets of MSCI and FTSE Russell, and foreign capital pouring into the Vietnamese stock market could reach $5-8 billion.

SSI Stocks estimates that FTSE Russell’s upgrade of the Vietnamese stock market to an emerging market could take place as early as September 2024 (optimistic scenario) or March 2025 (baseline scenario) and will take effect six months later. SSI said Vietnam could immediately attract about $1.7 – 2.5 billion when the upgrade decision takes effect.

Meanwhile, BSC Securities (BSC Research) expects foreign investment capital through open funds, ETFs – benchmarked to the MSCI and FTSE indices, is expected to flood into the Vietnamese stock market on a large scale.

According to BSC Research’s estimate, in case MSCI and FTSE upgrade Vietnam to a new emerging stock market, there will be about $3.5-4 billion in new purchases of Vietnamese stocks. The estimate is based on the assumption that the proportion of Vietnamese stocks purchased is about 0.7% – equivalent to the proportion of Philippine stock exchange stocks (rated as a primary emerging stock exchange by FTSE) in the current investment portfolios of the funds.

Since Vietnam is currently not on MSCI’s upgrade watchlist and is on FTSE’s watchlist, Vietnam’s stock market will officially be upgraded to a primary emerging exchange by FTSE in the near future. When FTSE Russell officially upgrades, an estimated $1.3-1.5 billion will flow into the market from open-end funds/ETFs benchmarked to FTSE’s criteria, of which ETFs are expected to purchase at least $700-800 million (equivalent to the current scale of the Philippine stock market).

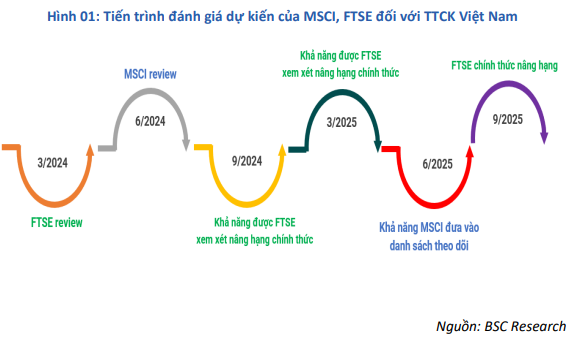

BSC believes that in the coming period, there are notable milestones and events to be monitored regarding the possibility of upgrading the Vietnamese stock market that investors need to pay attention to such as: (1) Periodic market classification evaluation reports of market-rating organizations – especially FTSE’s comments, (2) Actual progress in the implementation of the KRX system, (3) Actions by regulatory authorities in addressing outstanding issues – first and foremost the “pre-funding” criteria, (4) Developments of foreign capital and ETFs in the market – where the strong purchase of stocks that meet the criteria of foreign investors is a factor to be observed carefully, (5) The viewpoint of relevant Ministries and agencies on the coordination to promote the market upgrading process.

A series of stocks to note if the Vietnamese stock market is upgraded

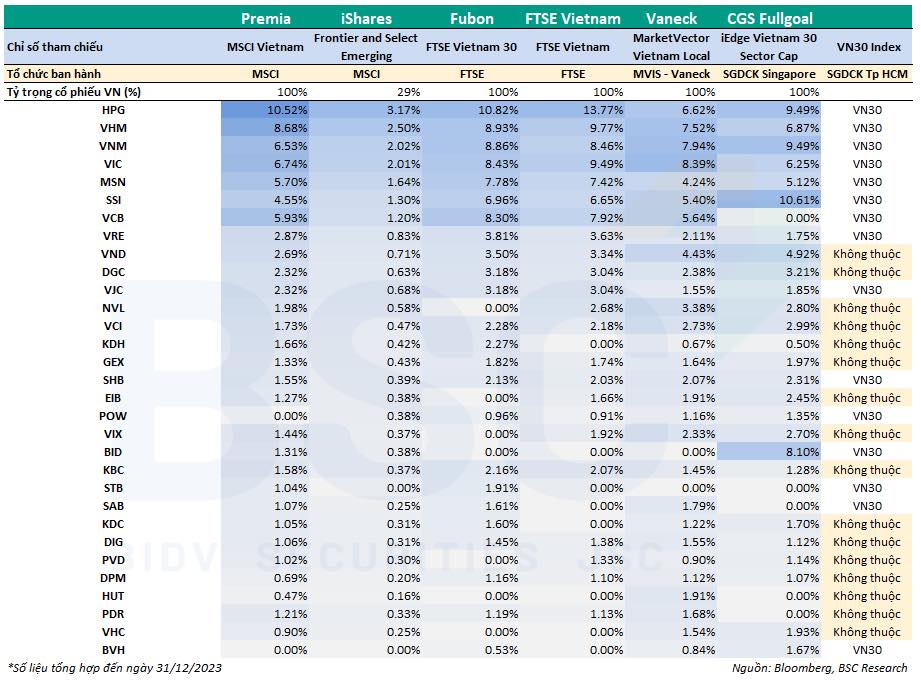

BSC Securities also provided an evaluation that, in addition to large-cap stocks listed in the VN30-Index issued by HoSE, other stocks that meet liquidity, market capitalization, foreign ownership ratios also need to be noted in case the Vietnamese stock market is upgraded by rating organizations.

BSC Research compiled 20 stocks with the largest weighting in foreign ETFs holding Vietnamese stocks, including a total of 31 stocks from 06 foreign ETFs that need to be noted, of which 15/30 VN30-Index stocks include: HPG, VHM, VNM, VIC, MSN, SSI, VCB, VRE, VJC, SHB, POW, BID, STB, SAB, BVH.

For stocks that have exceeded foreign ownership room, foreign investors can indirectly own them through investing in CCQ ETF VN-Diamond or NVDR products in the future.

Mirae Asset Securities also made a forecast of the stocks that will benefit if FTSE Russell’s upgrade is successful. Among them, many real estate stocks are projected to be positive such as VIC, VHM, VRE, KBC, DIG, DXG. Securities groups are also forecasted to be present such as SSI, VND, VCI, VIX,….. In addition, some stocks in banking, food, electricity, steel, oil and gas sectors are also forecasted to have positive effects after the stock market is upgraded.