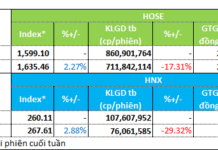

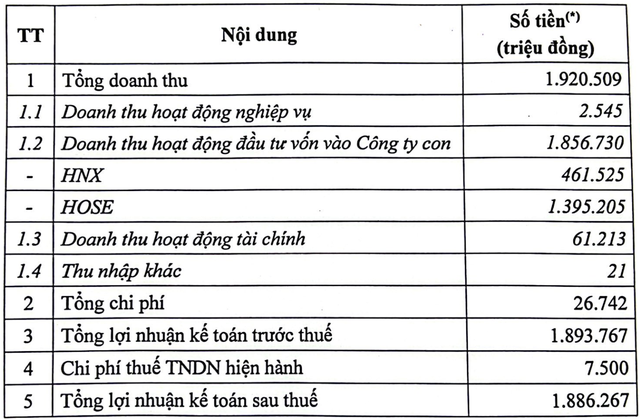

The Vietnam Stock Exchange (VNX) has announced its business performance plan for 2023, with a total revenue of 1,920 billion VND, a decrease of nearly 44% compared to 2022. 97% of the revenue comes from capital investment activities in subsidiary companies, in which the Ho Chi Minh City Stock Exchange (HoSE) contributes more than 1,395 billion VND and the Hanoi Stock Exchange (HNX) brings in 461.5 billion VND.

Notably, the total expenses for the year at VNX are very low, at only 26.7 billion VND, a decrease of over 96% compared to the previous year. This results in a nearly 10% decrease in VNX’s after-tax profit for the whole year 2023 compared to 2022, reaching 1,886 billion VND.

VNX was established in February 2021 under the Decision No. 37/2020/QD-TTg of the Prime Minister. VNX has a charter capital of 3,000 billion VND, organized as a limited liability company wholly owned by the State, operating under the parent-sub model based on the reorganization of HNX and HoSE. The main task of VNX is to unify the organizational model, mechanisms, policies, development thinking, and information technology infrastructure to serve the market.

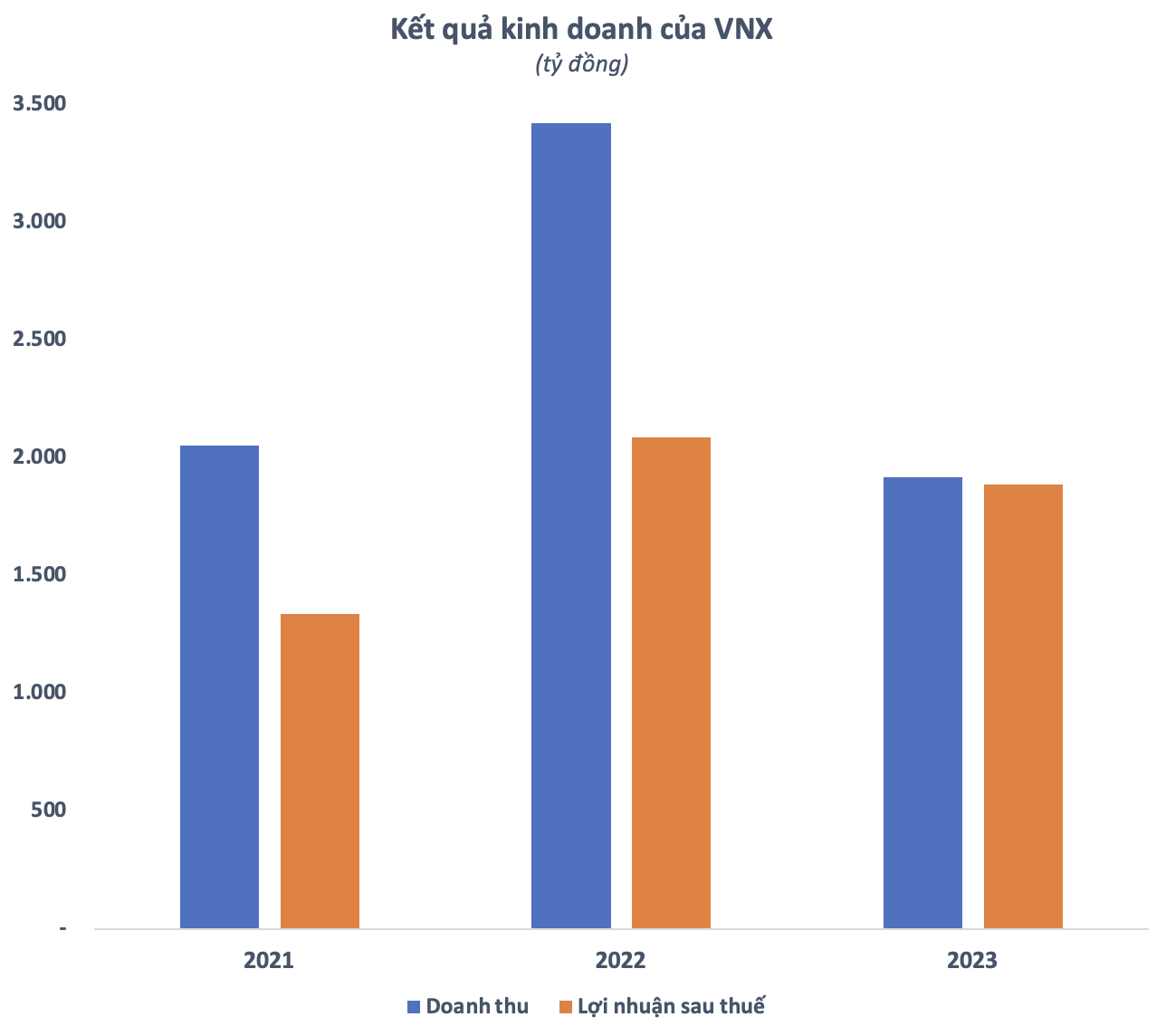

In its first year of operation in 2021, VNX achieved a revenue of 2,054 billion VND and an after-tax profit of 1,337 billion VND. In 2022, the stock market experienced significant fluctuations with particularly lively transactions in the early months of the year. Thanks to that, VNX’s revenue and profit also increased sharply, reaching 3,423 billion VND and 2,089 billion VND, respectively. All key business indicators have declined in the past year of 2023.

In 2023, VNX proactively reviewed related business regulations to prepare for necessary modifications when the new trading system is officially put into operation, and when there are changes in legal regulations; Preparing necessary conditions to organize and operate the market for individual corporate bonds safely, effectively, and on schedule according to the guidance of management authorities.

In addition, VNX has also carried out regular and serious management, supervision, and inspection of members, timely detection of violations; Actively implementing and closely coordinating with SSC in the task of monitoring compliance, monitoring transactions, handling suspicious transactions, handling violations;…

VNX has actively directed the Investor and coordinated activities between beneficiary units to accelerate the progress of implementing IT bidding packages and urged members to participate in testing the new trading system. Officially becoming a member of WEF is an important step in the integration process of VNX and subsidiaries, contributing to promoting integration of capital markets.

At the year-end conference of 2023 and the deployment of tasks for 2024, representatives of the Financial Banking Department – Ministry of Finance, Market Monitoring Department – SSC, HNX, HOSE, VSDC, proposed VNX to further coordinate closely in the next year 2024 to complete legal documents, promptly remove obstacles in institutions, policies, especially strengthening the supervision work (transaction monitoring, inter-market monitoring, member supervision,…), research and deployment of new products as well as coordination in building a new information technology system to meet the schedule set by management authorities.