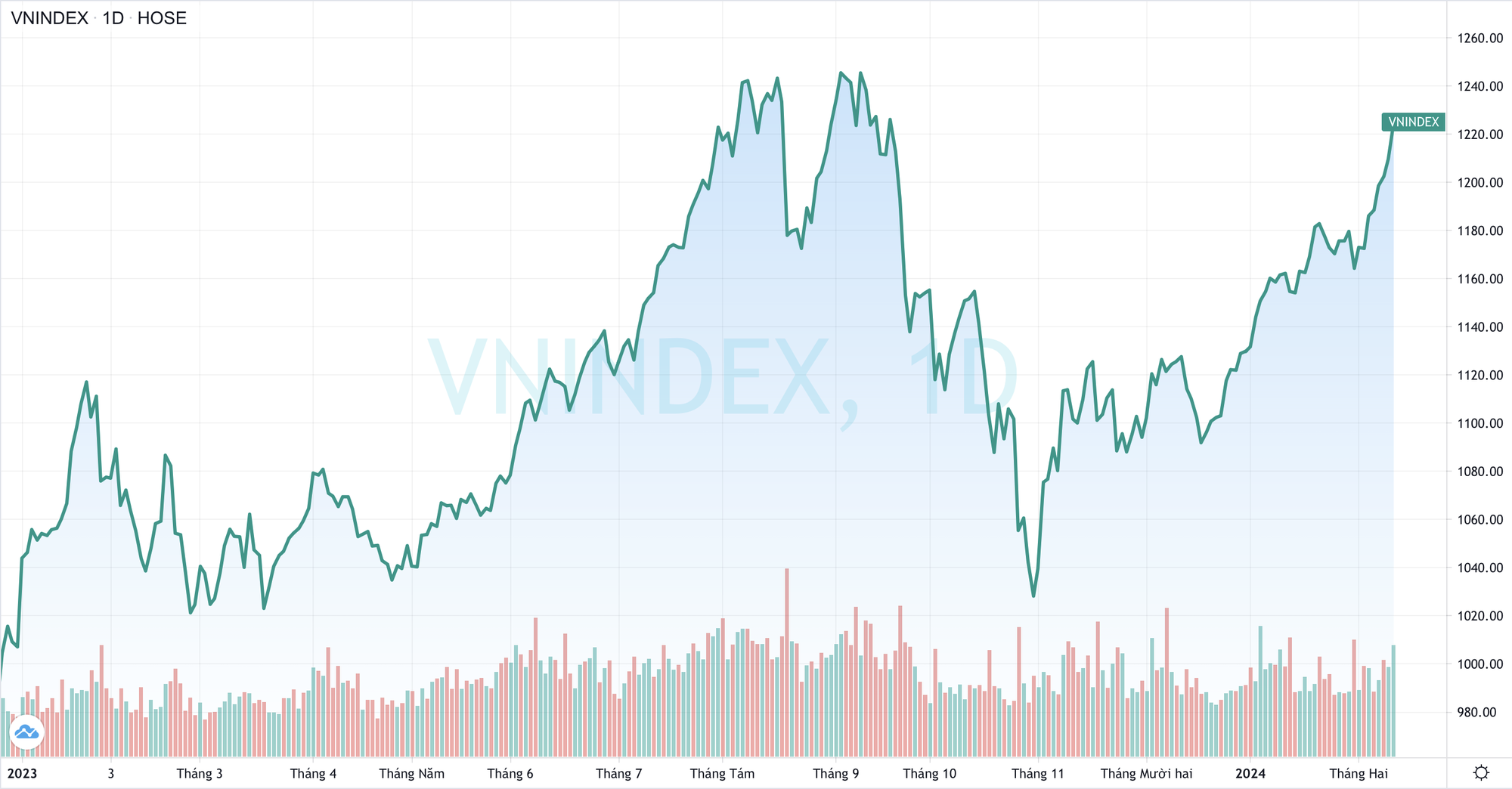

The Vietnam stock market has just extended its winning streak for 6 consecutive sessions, pushing the VN-Index to its highest level in 5 months. The actual upward trend started in mid-December 2023 and has almost been uninterrupted, except for a short break at the end of January.

In just 2 months, the VN-Index has increased by more than 130 points (+12%). The market capitalization of HoSE has also increased by about VND 550,000 billion (~ 23 billion USD), reaching nearly VND 5 million billion. Taking into account all 3 exchanges, the total market capitalization of the Vietnamese stock market has increased by about VND 660,000 billion (~ 27.5 billion USD) after 2 months of continuous growth.

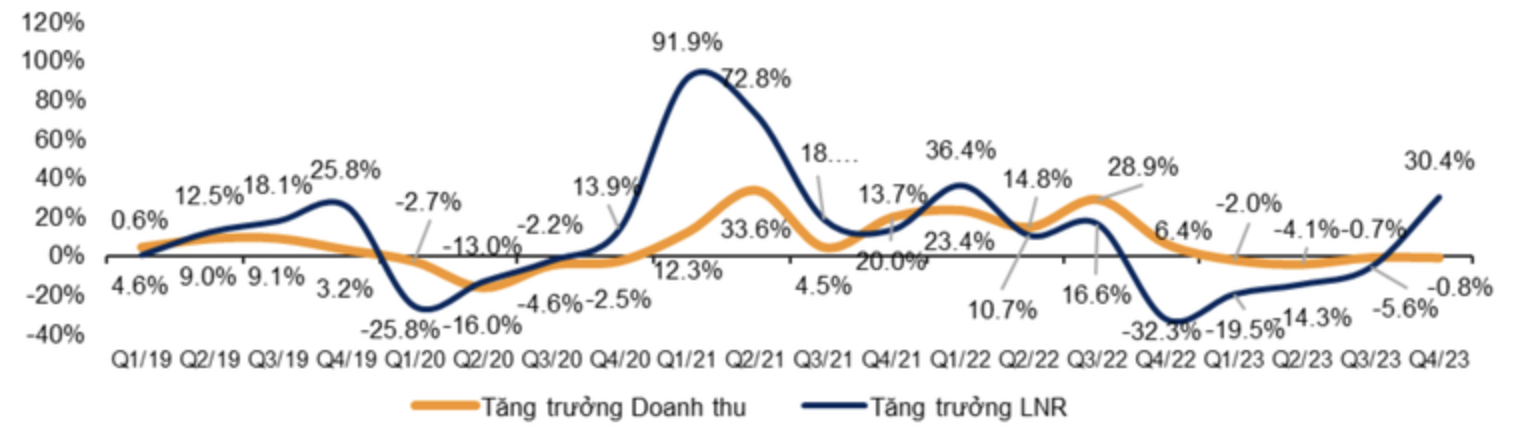

The recent market rally has been positively supported by the improved business performance of listed companies. According to VNDirect, the fourth-quarter net profit of 1,128 companies (which account for 96% of the market capitalization) is estimated to increase by 30% compared to the same period in 2022, thanks to the improved business operations of these companies and the low base effect of the fourth quarter of 2022.

The fourth-quarter net profit of the banking sector increased by 22.5% compared to the same period, thanks to accelerated credit growth, strong growth in non-interest income (fee income, foreign exchange activities), overall sector growth of 20%, and a 5% reduction in provisioning expenses. This is also the sector that has been leading the market recently.

In addition, the real estate sector is no longer so negative. The net profit in the fourth quarter of this sector decreased by 19.6% compared to the fourth quarter of 2022 and decreased by 24% compared to the third quarter of 2023. However, the decrease mainly comes from Vinhomes (VHM), while the actual figures seem to be better than the statistics. If VHM is excluded from the statistical basket, the fourth-quarter net profit of the real estate sector still grew by 132% compared to the fourth quarter of 2022.

In general, the positive developments in the business operations of the two largest sectors, banking and real estate, have helped the stock market make a smooth start in 2024. Many investors are expecting the stock market to perform better this year after a challenging year in 2023. In fact, major institutions also have high hopes for this prospect.

Is the stock market still the most attractive investment channel?

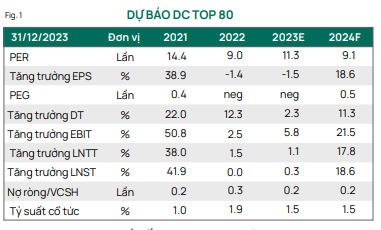

In 2024, Dragon Capital believes that the global picture still faces many challenges as global economic growth slows down, but there will be significant recovery domestically as low interest rates have sufficient time to penetrate the economy, stimulate consumer demand, and ignite the investment sentiment of businesses and investors.

In addition, the government’s commitment to continue to flexibly loosen monetary and fiscal policies is crucial to strengthen the confidence of private enterprises. The analyst team forecasts that the profit growth of the top 80 companies will be in the range of 16-18%, which is an important premise for the stock market to remain the most attractive investment channel in 2024.

In fact, individual investors account for more than 88% of the market, and there are not many investment channels outside of stocks. The 12-month deposit interest rate at banks is only about 4.7%, which is not attractive compared to the expected profit rate of 10.9% (based on the forecasted P/E ratio of 9.1 for 2024) from the stock market.

Moreover, other investment channels such as real estate have certain limitations, such as large capital scale, low liquidity, especially when investors are still cautious about the legal progress of projects. Therefore, large capital flows may turn to the stock market.

In addition, foreign capital flows may improve with any positive information from the market, such as the untangling of pre-funding or new developments in the process of upgrading to emerging markets. In general, Dragon Capital assesses that 2024 is an attractive time to participate in the stock market.

Similarly, the head of Pyn Elite Fund also showed optimism about the market outlook in the near future. The speed of Vietnam’s economic growth is showing signs of recovery, and there are positive profit prospects in the coming years. Currently, the stock market is still not reflecting the pace of corporate profit growth and the interest rate reduction story. If domestic interest rates decline, market liquidity will flourish and corporate profits are expected to grow strongly, thereby increasing the market’s profit.